France Diabetes Devices Market Analysis

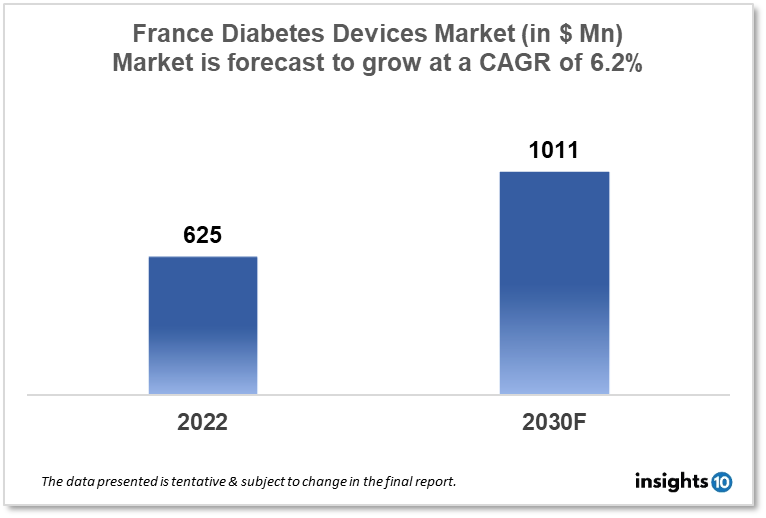

The France Diabetes Devices Market is expected to witness growth from $625 Mn in 2022 to $1011 Mn in 2030 with a CAGR of 6.20% for the forecasted year 2022-2030. In France, insulin pumps have become increasingly popular due to their ability to improve glycemic control and enhance the quality of life for diabetes patients in France. Manufacturers that offer insulin pumps with advanced features and better usability are likely to see growth in the market. The market is segmented by type and by the end user. Some key players in this market include Nanosonics France, SAMMEX Medical, Johnson & Johnson, Medtronic, Roche, Ascensia Diabetes Care and Dexcom.

Buy Now

France Diabetes Devices Healthcare Market Executive Analysis

The France Diabetes Devices Market is at around $625 Mn in 2022 and is projected to reach $1011 Mn in 2030, exhibiting a CAGR of 6.20% during the forecast period. 12.3% of France's GDP, or $5,370 per person, was spent on healthcare expenses. 0.36% more people are expected to live in France in 2023. Men can expect to live 79.53 years in France, compared to women who can expect 85.79. 3.56% less was spent on healthcare in France in 2022 ($5,370) than it was in 2020. 9.26% of all hospital spending in France is made up of out-of-pocket expenses.

In France, 3.3 million individuals have been diagnosed with diabetes as of 2021, which corresponds to a prevalence rate of about 5% of the country's population. In France, type 2 diabetes accounts for 90–95% of all cases, making it the most prevalent type of illness. The remaining instances of diabetes are Type 1 and other uncommon types. In line with worldwide trends, France has seen an increase in the prevalence of diabetes in recent years. The increase in diabetes cases is thought to be influenced by unhealthy diets, sedentary lifestyles, and rising obesity rates.

In France, diabetes devices are used to assist individuals with the condition in better managing it. They have many varied forms and are used for various things. Glucose meters, insulin pumps, continuous glucose monitoring (CGM) systems, and insulin pens are a few examples of popular diabetes devices. Accurate blood glucose readings from glucose meters are necessary for diabetics to track their blood sugar levels and adjust their insulin dosages. Diabetes management is made easier for diabetics by diabetes gadgets. For instance, CGM systems offer real-time blood glucose data to assist users in making treatment choices, and insulin pumps enable more precise insulin delivery. Diabetes devices make it easier and more discrete for people with diabetes to measure their blood sugar levels and administer insulin. By reducing the need for frequent injections or blood sugar checks, diabetes devices can help people with diabetes live more normally and concentrate on other parts of their lives. Diabetes devices can help control diabetes more effectively, lowering the risk of long-term complications like nerve, kidney, and eye damage.

Market Dynamics

Market Growth Drivers

In France, insulin pumps have become increasingly popular due to their ability to improve glycemic control and enhance the quality of life for diabetes patients in France. Manufacturers that offer insulin pumps with advanced features and better usability are likely to see growth in the market. Due to heightened awareness of the significance of glycemic control and the advantages of diabetes devices, managing diabetes has taken on greater importance in France. Market expansion is probable for suppliers who provide diabetes patients with informational materials and support. In France, where there are an approximated 4.7 million diabetics, the prevalence of the illness is rising. The demand for diabetes devices such as glucose meters, insulin pumps, and continuous glucose monitoring systems has grown as a result. With technological developments like the creation of non-invasive glucose monitoring devices and artificial pancreas systems, the market for diabetes devices is constantly changing. Manufacturers who make investments in R&D to produce cutting-edge and efficient diabetes products are likely to see market expansion.

Market Restraints

The French market for diabetes devices is extremely competitive, with a number of well-known companies providing a variety of goods. It might be difficult for new market entrants to compete with established companies and win market share. In France, diabetes devices are well-reimbursed, but some devices, like continuous glucose tracking systems, might not be entirely covered by insurance. This may restrict the use of these devices, and makers of devices with restricted reimbursement may experience slower market expansion.

Competitive Landscape

Key Players

- Nanosonics France (FR)

- SAMMEX Medical (FR)

- Johnson & Johnson

- Medtronic

- Roche

- Dexcom

- Ascensia Diabetes Care

Recent Notable Deals

June 2021: A significant distributor of diabetes supplies in France, B2M Medical, was acquired by Ascensia Diabetes Care in November 2021. Ascensia wanted to increase its distribution network and improve its position in the French diabetes market through the acquisition.

Healthcare Policies and Regulatory Landscape

The French National Agency for the Safety of Medicines and Health Products (ANSM), which is in charge of assuring the safety, effectiveness, and quality of medical products, including diabetes devices, regulates the French healthcare industry. Manufacturers must acquire a CE marking, which confirms that the product complies with European Union (EU) regulations for medical devices, in order to sell diabetes devices in France. Additionally, before a product can be sold in France, it might need to receive ANSM approval. Through the national health insurance program, the French government also pays for some diabetes equipment, including insulin pumps and continuous glucose monitors. This compensation is conditional on a number of factors, including the patient's age and the seriousness of their illness.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Diabetes Devices Market Segmentation

By Type (Revenue, USD Billion):

The market is divided into blood glucose monitoring systems, insulin delivery systems, and mobile applications for managing diabetes within the type segment. Due to its convenience, ease of use, and usefulness in providing patients and healthcare professionals with real-time insights regarding diabetic conditions for integrated diabetes management, the segment for diabetes management mobile applications is anticipated to grow at the highest rate during the forecast period. Bare-metal Stents

- Blood glucose monitoring systems

- Self-monitoring blood glucose monitoring systems

- Continuous glucose monitoring systems

- Test strips/Test papers

- Lancets/Lancing Devices

- Insulin delivery Devices

- Insulin pumps

- Insulin pens

- Insulin syringes and needles

- Diabetes management mobile applications

By End User (Revenue, USD Billion):

The diabetes market is divided into hospitals & specialty clinics and self & home care, based on the end user.

- Hospitals & Specialty Clinics

- Self & Home Care

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.