France Connected Healthcare Market Analysis

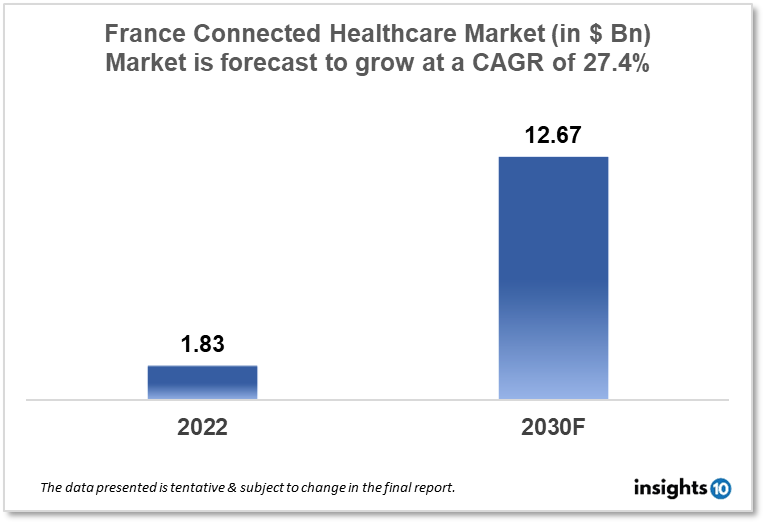

The France-connected healthcare market is projected to grow from $1.83 Bn in 2022 to $12.67 Bn by 2030, registering a CAGR of 27.4% during the forecast period of 2022 - 2030. The main factors driving the growth would be government support, health tech startups and the rising geriatric population. The market is segmented by type, function and by application. Some of the major players include Sanofi, Withings, Voluntis, Evolucare, Apple, Microsoft, Siemens Healthineers and Medtronic.

Buy Now

France Connected Healthcare Market Executive Summary

The France-connected healthcare market is projected to grow from $1.83 Bn in 2022 to $12.67 Bn by 2030, registering a CAGR of 27.4% during the forecast period of 2022 - 2030. French healthcare spending in 2020 was $227 Bn, or around $3,364 per person. In terms of health spending as a proportion of GDP and per person in the past, France has outperformed the EU average. Prior to 2020, the economy's growth rate and the rate of increase in health spending were roughly equal. But, in response to the COVID-19 epidemic, which resulted in an 8% decline in GDP, it expanded more quickly.

In recent years, the connected healthcare market in France has expanded quickly as more patients and healthcare professionals use digital health technology to enhance healthcare access and delivery. The use of digital technologies to link patients, healthcare practitioners, and other system stakeholders is referred to as "connected healthcare." The emergence of connected healthcare technology has accelerated the evolution of the French healthcare industry over the past several years. To increase access to healthcare services and save costs, the government has been supporting the use of telemedicine, e-prescriptions, and other digital health technologies.

Market Dynamics

Market Growth Drivers

The France-connected healthcare market is expected to be driven by factors such as:

- Government support- The French government has actively supported the growth of the connected healthcare industry through a number of laws and initiatives. This includes attempts to promote the use of telemedicine, electronic health records, and other digital health technology, as well as the national plan for e-health

- Healthtech startups- With a robust startup ecosystem, France is home to an increasing number of health-tech businesses that are creating ground-breaking remedies for healthcare problems. These start-ups are spurring innovation and helping the connected healthcare business expand

- Rising geriatric population- There are an increasing number of elderly patients in France who need medical treatment due to the country's ageing population. The desire for cutting-edge technology that can assist healthcare providers in managing chronic illnesses and delivering care remotely is being driven by this demographic transition

Market Restraints

The following factors are expected to limit the growth of the connected healthcare market in France:

- Resistance to change- The highly regulated and complex nature of the healthcare sector can make it challenging for innovative technology to become widely accepted in France. Some patients and healthcare professionals could be resistant to change and would rather continue with conventional healthcare delivery techniques

- Limited Funding- Although the connected healthcare sector in France is seeing an increase in interest and investment, there is still a lack of finance for start-ups and small businesses. This could restrict entrepreneurs' capacity to commercialise novel solutions and delay the market's expansion

Competitive Landscape

Key Players

- Sanofi (FRA)- Sanofi is a French pharmaceutical firm that develops a variety of medical products, including ones related to connected healthcare. Platforms for digital health and systems for remote patient monitoring are among its connected healthcare services

- Withings (FRA)- Withings is a French consumer electronics firm that provides connected healthcare gadgets, such as smart scales, blood pressure monitors, and sleep trackers

- Voluntis (FRA)- Voluntis is a French digital therapeutics firm that develops software to aid in the management of chronic diseases. Software for managing diabetic and oncology patients is among its products

- Evolucare (FRA)- Evolucare is an IT firm that develops software solutions for healthcare facilities such as electronic health records, imaging systems, and telemedicine platforms

- Apple- Apple is a multinational technology business that manufactures connected healthcare gadgets such as the Apple Watch and the Health app. Additionally, it offers healthcare software programmes like CareKit and HealthKit

- Microsoft- Microsoft is a multinational technology business that produces healthcare software products, such as the Microsoft HealthVault personal health record system and the Microsoft Teams telemedicine platform

- Siemens Healthineers- Siemens Healthineers is a multinational medical technology firm that manufactures a wide range of healthcare solutions, including those for connected healthcare. Its products and services include healthcare IT solutions, remote patient monitoring equipment, and medical imaging systems

- Medtronic- Medtronic is a global medical technology firm that manufactures connected healthcare products such as insulin pumps and pacemakers. The company also provides tools for managing healthcare data as well as remote patient monitoring services

Notable Deals

March 2022: Sanofi, a French pharmaceutical company, and DarioHealth, a digital health company, have agreed to a five-year, $30 Mn deal. As part of the agreement, Dario would have access to Sanofi's sales teams to promote the company's current products and incorporate Sanofi's products onto its platform.

February 2022: Withings has bought the health and fitness app 8fit in order to broaden its portfolio of tech-enabled consumer health products.

Healthcare Policies and Regulatory Landscape

The French National Agency for Pharmaceuticals and Health Products Safety (ANSM), the National Authority for Health (HAS), and the French Data Protection Authority (CNIL) are some of the organisations that oversee the regulatory environment for connected healthcare in France (CNIL). These organisations guarantee the security and privacy of connected healthcare solutions.

The French government passed legislation in 2018 to encourage the use of telemedicine, which allows healthcare providers to deliver remote medical consultations and prescriptions. The government has also put in place a national health data infrastructure that makes it possible to gather and share health data for research.

Reimbursement Scenario

The French healthcare system has a thorough reimbursement strategy that includes telemedicine and connected healthcare technologies as well as a wide spectrum of healthcare services. The government passed legislation in 2018 allowing the national health insurance system to reimburse doctors for teleconsultations. In other words, patients can access medical consultations remotely and get reimbursed for the consultation's expense.

The French National Authority for Health (HAS) oversees France's reimbursement regulations for connected healthcare systems. The HAS is in charge of assessing the therapeutic advantages and financial effects of medical technology and digital health solutions. The organisation evaluates these solutions' efficacy and safety to decide whether they qualify for payment.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Connected Healthcare Market Segmentation

By Type (Revenue, USD Billion):

Based on the Type the market is segmented into mHealth services, mHealth Devices, and E- Prescription

- MHealth services

- mHealth Devices

- E- Prescription

By FunctionType (Revenue, USD Billion):

- Remote patient monitoring

- Clinical monitoring

- Telemedicine

- Others (Assisted Living)

By Application Type (Revenue, USD Billion):

- Diagnosis and Treatment

- Monitoring Application

- Wellness and Prevention

- Healthcare management

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

The France-connected healthcare market is projected to grow from $1.83 Bn in 2022 to $12.67 Bn by 2030, registering a CAGR of 27.4% during the forecast period of 2022 - 2030.

The France-connected healthcare market is segmented by type (m-health services, m-health devices and e-prescription), by function (remote patient monitoring, clinical monitoring, telemedicine and others), and by application type (diagnosis and treatment, monitoring application, wellness and prevention, healthcare management and others).

Some of the major players in France's connected healthcare market are Sanofi, Withings, Voluntis, Evolucare, Apple, Microsoft, Siemens Healthineers and Medtronic.