France Congestive Heart Failure Therapeutics Market Analysis

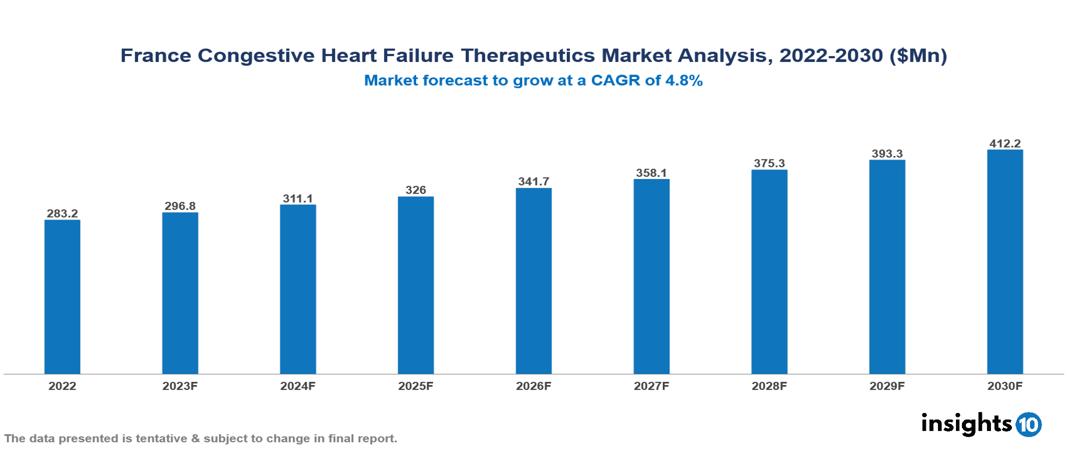

The France Congestive Heart Failure Therapeutics Market is anticipated to experience a growth from $283 Mn in 2022 to $412 Mn by 2030, with a CAGR of 4.8% during the forecast period of 2022-2030. The key drivers in France include the aging population, contributing to an increased demand for CHF treatments, ongoing advancements in pharmaceutical research leading to innovative therapies, and government initiatives and reimbursement policies supporting accessibility. The France Congestive Heart Failure Therapeutics Market encompasses various key players across different therapeutic segments, including Novartis, Boehringer Ingelheim, Eli Lilly, Bayer, Merck, Servier, Amgen, Otsuka Pharmaceuticals, Lexicon Pharmaceuticals, Tenex Therapeutics, etc, among various others.

Buy Now

France Congestive Heart Failure Therapeutics Market Analysis Executive Summary

The France Congestive Heart Failure Therapeutics Market is anticipated to experience a growth from $283 Mn in 2022 to $412 Mn by 2030, with a CAGR of 4.8% during the forecast period of 2022-2030.

Congestive Heart Failure (CHF) is a chronic medical illness in which the heart is unable to adequately pump blood, resulting in a buildup of fluid in the lungs and surrounding tissues. It is a progressive disorder caused by a variety of underlying conditions, including coronary artery disease, hypertension, and cardiomyopathy. CHF is often classified into two types: systolic heart failure, in which the heart's pumping ability is impaired. Another type is diastolic heart failure, in which the heart muscle has difficulties resting between heartbeats. Treatment for CHF usually consists of lifestyle changes, medicines, and, in extreme circumstances, surgical treatments. Diuretics are preferred to minimize fluid accumulation, ACE inhibitors can lower blood pressure, and beta-blockers can enhance heart function. Dietary modifications, exercise, and weight control are common areas of focus for lifestyle improvements. Technological improvements have had a profound influence on CHF management. Remote monitoring gadgets and wearable technology nowadays allow healthcare providers to monitor patients' vital signs and change treatment strategies remotely. Implantable devices, such as pacemakers and defibrillators, which can help control heart rhythm and improve overall cardiac function are also a treatment of choice in severe cases.

In France, the prevalence of heart failure is estimated to be 2.3% which is around 1.4 Mn individuals. The prevalence of heart failure was reported to be increasing with age, with more mortality among elders compared to the young.

The key drivers in France include the aging population, contributing to an increased demand for CHF treatments, ongoing advancements in pharmaceutical research leading to innovative therapies, and government initiatives and reimbursement policies supporting accessibility.

The market landscape in France holds major international players like Novartis, Boehringer Ingelheim, and Eli Lilly holding significant market share. Additionally, domestic players like Sanofi and Servier offer a variety of CHF medications and have a wide distribution network.

Market Dynamics

Market Growth Drivers

Socio-Demographic Trends: The aging population in France is a significant driver, as the prevalence of CHF is closely linked to age. As the population ages, there is an increased demand for CHF therapeutics, driving market growth. Additionally, the changing lifestyle with rapid urbanization is also a factor that adds to the risk factors for several cardiovascular diseases.

Advancements in Treatment Options: Ongoing research and development efforts in the pharmaceutical industry contribute to the introduction of new and more effective CHF therapies. Innovations such as novel drug formulations, targeted therapies, and personalized treatments enhance patient outcomes and drive market expansion.

Government Initiatives and Healthcare Policies: Government initiatives and reimbursement policies play a crucial role in shaping the market dynamics. Policies supporting favorable reimbursement for CHF medications encourage patient access and incentivize pharmaceutical companies to invest in the development of advanced and innovative therapies.

Market Restraints

Cost Constraints: High costs associated with CHF therapeutics can be a significant restraint, limiting patient access and potentially causing financial strain. Affordability challenges may impact the adoption of certain medications, especially for the population who has less insurance or no insurance coverage.

Regulatory Challenges: Delays in the regulatory approval process for new CHF therapeutics can hinder their timely availability in the market. Stringent regulatory requirements may pose challenges for pharmaceutical companies, leading to extended timelines for product launches.

Limited Healthcare Infrastructure: Insufficient healthcare infrastructure, including limited facilities and healthcare professionals with expertise in CHF management, can create barriers to timely diagnosis and optimal care, impacting the overall demand for CHF therapeutics.

Healthcare Policies and Regulatory Landscape

The French National Agency for the Safety of Medicines and Health Products (ANSM), operating under the Ministry of Health, plays a pivotal role in overseeing the safety and effectiveness of medicinal products and health-related items in France. ANSM is responsible for comprehensive evaluations throughout the life cycle of pharmaceuticals, medical devices, and other health products. It conducts rigorous assessments before granting marketing authorizations for new drugs and actively monitors their safety post-market. The agency also regulates clinical trials to uphold ethical standards and patient safety. ANSM is involved in ensuring the quality and safety of medical devices and actively participates in risk management and pharmacovigilance initiatives. Serving as a crucial entity in the French healthcare system, ANSM collaborates with European regulatory counterparts to standardize practices and maintain a unified approach to drug safety across borders.

Competitive Landscape

Key Players:

- Novartis

- Boehringer Ingelheim

- Eli Lilly

- Bayer

- Merck

- Servier

- Amgen

- Otsuka Pharmaceuticals

- Lexicon Pharmaceuticals

- Tenex Therapeutics

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

France Congestive Heart Failure Therapeutics Market Segmentation

By Stage of Heart Failure

- Acute Heart Failure

- Chronic Heart Failure

By Drug Class

- ACE Inhibitors

- Beta Blockers

- Angiotensin 2 Receptor Blockers

- Diuretics

- Aldosterone Antagonists

- Others

By Route of Administration

- Oral

- Parenteral

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By End User

- Hospitals

- Speciality Clinics

- Homecare

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.