France Chronic Obstructive Pulmonary Disease (COPD) Therapeutics Market Analysis

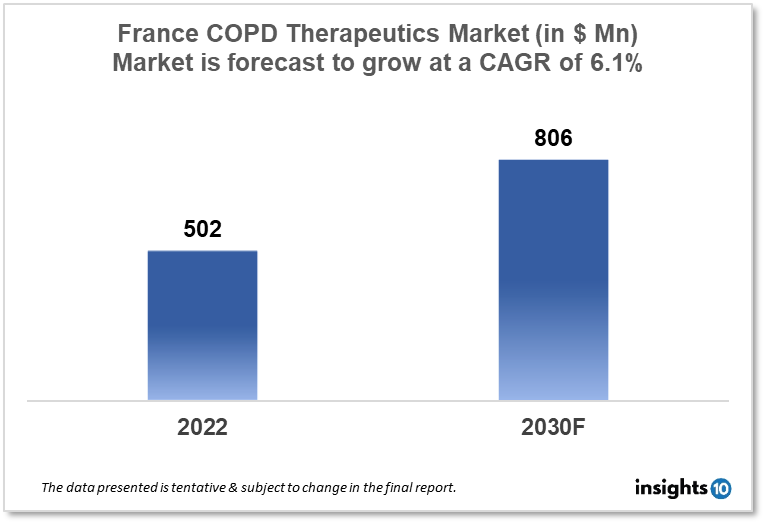

France's Chronic Obstructive Pulmonary Disease (COPD) therapeutics market was valued at $502 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 6.1% from 2022 to 2030 and will reach $806 Mn in 2030. One of the main reasons propelling the growth of this market is the increased prevalence rate of the aging population. The market is segmented by Drug class and By distribution channel. Some key players in this market are Salt Med, Adamis Pharmaceuticals Corporation, Almirall, Astellas Pharma, American Hospital of Paris, Boehringer Ingelheim Pharmaceuticals, Novartis, Pfizer, and others.

Buy Now

France Chronic Obstructive Pulmonary Disease (COPD) Therapeutics Market Executive Summary

France's Chronic Obstructive Pulmonary Disease (COPD) Therapeutics Market was valued at $502 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 6.1% from 2022 to 2030 and will reach $806 Mn in 2030. A widespread, preventable, and treatable chronic lung illness that affects both men and women worldwide is a chronic obstructive pulmonary disease (COPD). Airflow into and out of the lungs is restricted as a result of abnormalities in the tiny airways of the lungs. The airways narrow due to a number of factors. Parts of the lung may be destroyed, the airways may be obstructed by mucus, and the lining of the airways may become inflamed and swollen.

The COPD therapeutics market in France is expected to grow at a moderate pace in the coming years, driven by factors such as the increasing prevalence of COPD, growing awareness about the disease, and the launch of new drugs. Currently, bronchodilators and inhaled corticosteroids are the most commonly used medications for COPD treatment in France. Long-acting beta-agonists (LABAs) and long-acting muscarinic antagonists (LAMAs) are the most commonly prescribed bronchodilators, while inhaled corticosteroids are often used in combination with LAB.

Market Dynamics

Market Growth Drivers

COPD is a major public health concern in France, with an estimated 3.5 million people affected by the disease. According to a report, the prevalence of COPD in France is expected to increase from 4.9% in 2019 to 5.1% in 2028. This increasing prevalence is expected to drive demand for COPD treatments in the coming years. The COPD therapeutics market in France is expected to be driven by the launch of new drugs. Several major pharmaceutical companies, including GlaxoSmithKline, AstraZeneca, Boehringer Ingelheim, and Novartis, are investing heavily in the research and development of new drugs for COPD treatment. This drug is expected to generate significant revenue for the company in the coming years. There is a growing awareness of COPD in France, which is expected to drive demand for COPD treatments.

According to a recent survey by the French National Institute of Health and Medical Research (INSERM), 59% of French people are aware of COPD, compared to 46% in 2005. This increased awareness is expected to lead to earlier diagnosis and treatment of COPD, driving the market growth. The French government is taking steps to address the COPD epidemic, which is expected to drive market growth. For example, the government has launched public awareness campaigns, promoting smoking cessation programs, and providing funding for research on COPD prevention and treatment. In addition, the government has introduced regulations to limit smoking in public places, which is expected to reduce the prevalence of COPD in the long term.

Market Restraints

The French healthcare system is highly regulated, and the government sets prices for many drugs. This can create pricing pressures for pharmaceutical companies operating in the COPD therapeutics market in France. Additionally, the French government has been working to reduce healthcare costs, which may result in further pricing pressures on drugs used to treat COPD. Many of the drugs used to treat COPD are nearing the end of their patent protection. This means that pharmaceutical companies may face increased competition from generic versions of these drugs, which can lead to lower revenues.

The approval process for new drugs in France can be complex and lengthy, which can delay the launch of new drugs and increase development costs. This can be a challenge for pharmaceutical companies operating in the COPD therapeutics market in France. While the French healthcare system provides universal coverage, not all COPD treatments are fully reimbursed. This can limit patient access to some treatments and may impact the overall demand for COPD therapeutics in the country. While the French government has taken steps to reduce smoking rates, France still has a relatively high smoking rate compared to other European countries. This can contribute to the high prevalence of COPD in the country and may limit the effectiveness of public health campaigns to reduce COPD rates.

Competitive Landscape

Key Players

- Abbott Laboratories

- Salt Med

- Adamis Pharmaceuticals Corporation

- American Hospital of Paris

- Astellas Pharma

- AstraZeneca

- Boehringer Ingelheim Pharmaceuticals

- Novartis

- Pfizer

Healthcare Policies and Regulatory Landscape

France has a universal healthcare system known as the French Health Insurance (Assurance Maladie), which provides access to medical services and treatments to all residents, regardless of their income or health status. The system is financed through contributions from employers, employees, and the government, as well as through taxes. The French government is actively involved in healthcare policy in France and plays a major role in regulating the healthcare industry. The government sets prices for many drugs and also regulates the approval process for new drugs.

In terms of healthcare policy specific to the COPD therapeutics market, the French government has taken several initiatives to address the COPD epidemic. For example, the government has launched public awareness campaigns to increase knowledge and understanding of COPD and has introduced regulations to limit smoking in public places. Additionally, the government provides funding for research on COPD prevention and treatment. The French healthcare system also provides reimbursement for many COPD treatments, although not all treatments are fully reimbursed. The government regulates the prices of drugs used to treat COPD, which can create pricing pressures for pharmaceutical companies operating in the market.

Reimbursement Scenario

In France, the healthcare system provides reimbursement for many COPD treatments, although not all treatments are fully reimbursed. The level of reimbursement depends on several factors, including the type of treatment, the patient's medical condition, and the severity of the disease. The reimbursement process is regulated by the French National Health Insurance Fund (CNAM), which determines the reimbursement rate for each drug based on its therapeutic value and its price. The reimbursement rate can vary from 15% to 100% of the drug's cost, depending on its classification.

Drugs used to treat COPD are generally reimbursed, although the reimbursement rate may vary depending on the specific drug and the patient's condition. For example, bronchodilators, which are commonly used to treat COPD, are generally fully reimbursed, while some other treatments, such as pulmonary rehabilitation programs, may only be partially reimbursed.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

France Chronic Obstructive Pulmonary Disease (COPD) Therapeutics Market Segmentation

By Drug Class

Bronchodilators: Bronchodilators are medications that help to relax the muscles around the airways, making it easier to breathe. These can be further classified as short-acting or long-acting bronchodilators.

Corticosteroids: Corticosteroids are anti-inflammatory medications that can help reduce swelling and inflammation in the airways. These can be used alone or in combination with bronchodilators.

Combination Therapies: Combination therapies combine bronchodilators and corticosteroids in a single medication. These are often used for patients with more severe COPD.

Phosphodiesterase-4 Inhibitors: Phosphodiesterase-4 inhibitors are medications that help to reduce inflammation and improve airflow in the lungs.

Others: Other medications that may be used to treat COPD include mucolytics, oxygen therapy, and vaccines for influenza and pneumococcal disease.

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.