France Central Nervous System (CNS) Therapeutics Market Analysis

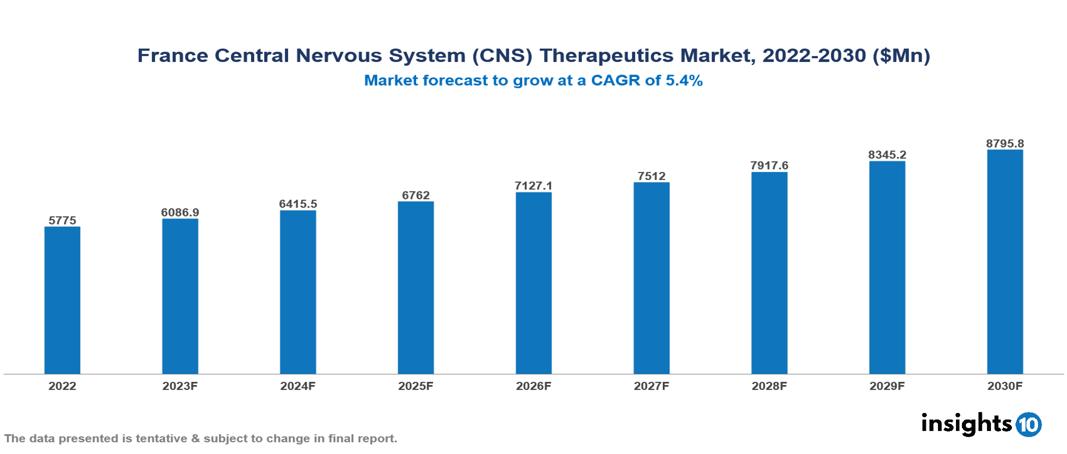

The France Central Nervous System (CNS) Therapeutics Market was valued at $5.775 Bn in 2022 and is predicted to grow at a CAGR of 5.4% from 2023 to 2030, to $8.796 Bn by 2030. The key drivers of this industry include the surge in the prevalence of CNS disorders, increasing public health programs, and increased R&D activities. The industry is primarily dominated by players such as Pfizer, Janssen, Camber, Allergan, Lundbeck, Teva, Cipla, and Merck among others.

Buy Now

France Central Nervous System (CNS) Therapeutics Market Executive Summary

The France Central Nervous System (CNS)Therapeutics Market is at around $5.775 Bn in 2022 and is projected to reach $8.796 Bn in 2030, exhibiting a CAGR of 5.4% during the forecast period.

Diseases affecting the Central Nervous System (CNS) encompass a broad spectrum of medical conditions that disrupt the normal functioning of the brain and spinal cord. These disorders are categorized into various types, including neurodegenerative conditions such as Alzheimer's and Parkinson's, psychiatric disorders like depression and schizophrenia, and neurological ailments such as epilepsy and multiple sclerosis. The causes of CNS disorders are multifaceted, involving genetic factors, environmental influences, infections, injuries, or autoimmune responses. Symptoms vary based on the specific disorder but commonly involve changes in cognitive function, motor skills, mood, or sensory perception. Current treatments for CNS conditions aim to alleviate symptoms, slow disease progression, or manage complications through options like medication, psychotherapy, and, in specific cases, surgery. Noteworthy pharmaceutical companies engaged in producing medications for CNS disorders include industry leaders such as Pfizer, Eli Lilly, and Johnson & Johnson. For example, Pfizer focuses on medications for Alzheimer's disease, while Eli Lilly is recognized for its contributions to psychiatric drugs.

France is experiencing an increased burden of mental health disorders affecting more than 12 Mn individuals. The market therefore is driven by crucial factors like the increasing prevalence of neurological diseases, increasing public health programs, and increased R&D activities in the therapeutics industry. However, a complex healthcare system, stringent regulatory environment, and disparities in the healthcare system limit the growth and potential of the market.

Market Dynamics

Market Growth Drivers

Surge in prevalence of CNS diseases: France is witnessing a steady increase in its elderly population, especially among individuals aged 65 years and above. This demographic change is associated with a higher occurrence of age-related neurodegenerative ailments such as Alzheimer's and Parkinson's diseases. The prevalence of mental health issues is significant in France, affecting an estimated 12 Mn individuals, with anxiety disorders (around 12%) and depression (about 10%) being the most prevalent. Various lifestyle factors, including increased stress levels, unhealthy dietary patterns, and insufficient physical activity, contribute to the surge in mental health disorders such as anxiety and depression in France.

Increased public health programs: France's National Mental Health and Strategy Plan directs investments toward mental health resources and research, while the National Alzheimer's Plan seeks to enhance both care and research efforts in this domain. Government initiatives and elevated healthcare spending specifically allocated to conditions affecting the central nervous system contribute to fostering a conducive environment for market expansion.

High R&D activities: France possesses a strong research and development (R&D) environment dedicated to CNS therapeutics, marked by substantial investments from government bodies, pharmaceutical firms, and academic establishments. Notable research institutions such as the Pasteur Institute and CEA contribute to France's robust R&D landscape, fostering synergistic partnerships between academia and industry that hasten the pace of innovation and discovery. French researchers are actively investigating personalized medicine approaches for CNS disorders, tailoring treatments based on the individual genetic and biological profiles of patients to enhance effectiveness and minimize side effects.

Market Restraints

Complex healthcare system: Navigating the healthcare system and securing reimbursement for medications can be intricate and time-intensive, given the multiple layers of the system and administrative protocols. The reimbursement procedures may prioritize traditional treatments over innovative and potentially more efficient alternatives, creating obstacles for patients seeking access to state-of-the-art options.

Stringent regulatory environment: Securing regulatory clearance for novel CNS drugs is often a long and costly process, dissuading potential investments and impeding timely patient access to innovative treatments. The complex regulations governing clinical trials, coupled with intricate ethical and legal prerequisites, contribute to the extended duration and financial burden of the approval process. These stringent requirements not only affect research and development initiatives but also lead to delays in the introduction of new treatments to the market.

Health system disparities: Despite having a universal healthcare system, France faces inequities in accessing specialized care for CNS diseases, especially affecting marginalized communities and rural regions. This disparity can result in delays in both diagnosis and the initiation of treatment, adversely affecting overall outcomes. Furthermore, even with insurance coverage, patients may encounter substantial co-payments and other out-of-pocket expenses for specific CNS medications, leading to non-adherence and discontinuation of treatment. The shortage of neurologists, psychiatrists, and other mental health professionals in France is a growing concern, particularly in underserved areas, diminishing the capacity to effectively address the increasing burden of CNS disorders.

Healthcare Policies and Regulatory Landscape

The National Agency for the Safety of Medicines and Health Products (ANSM) is France's regulating authority for therapeutics. The ANSM is in responsible for analyzing and monitoring pharmaceutical product safety, efficacy, and quality, as well as authorizing and supervising clinical studies in France.

The process of obtaining licensure for therapeutics in France involves submitting a comprehensive dossier to ANSM, detailing preclinical and clinical data, manufacturing processes, and quality control measures. If the therapeutic product meets the required standards, ANSM grants marketing authorization.

The regulatory environment in France is characterized by strict adherence to European Union regulations and international standards, ensuring that only safe and effective therapeutics are made available to the public. For new entrants, navigating this regulatory landscape requires thorough documentation, adherence to established standards, and collaboration with ANSM to ensure compliance with regulatory requirements, which may pose challenges but ensure the integrity and safety of the therapeutic market in France.

Competitive Landscape

Key Players

- Pfizer

- Janssen Pharmaceuticals

- Allergan

- Lundbeck

- Teva Pharmaceuticals

- Camber Pharmaceuticals

- Zhejiang Haisen Pharmaceuticals

- Jewim Pharmaceuticals

- Cipla

- Merck Sharp & Dohme Corp

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

France Central Nervous System (CNS)Therapeutics Market Segmentation

By Drug

- Biologics

- Non-Biologics

By Drug Class

- Antidepressants

- Analgesics

- Immunomodulators

- Interferons

- Decarboxylase Inhibitors

- Others

By Disease

- Neurovascular Disease

- Degenerative Disease

- Infectious Disease

- Mental Health

- CNS Cancer

- Others

By Distribution Channel

- Hospital based pharmacies

- Retail pharmacies

- Online pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.