France Brain Cancer Therapeutics Market

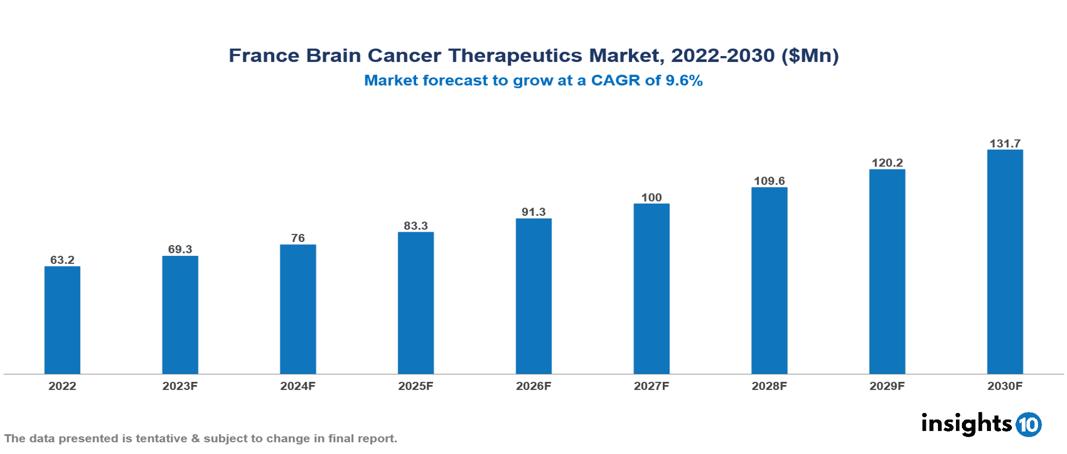

France Brain Cancer Therapeutics Market valued at $63 Mn in 2022, projected to reach $132 Mn by 2030 with a 9.6% CAGR. The anticipated increase in brain cancer cases, particularly glioblastoma multiforme, is expected to be a key factor propelling the demand for brain cancer therapeutics, shaping the overall market landscape. Prominent players in the pharmaceutical sector currently operating are Roche, Merck & Co., Bristol Myers Squibb, Novartis, Pfizer, AstraZeneca, Eli Lilly, Sanofi, Takeda Pharmaceutical, and AbbVie.

Buy Now

France Brain Cancer Therapeutics Market Executive Summary

France Brain Cancer Therapeutics Market valued at $63 Mn in 2022, projected to reach $132 Mn by 2030 with a 9.6% CAGR.

The irregular growth of brain cells acts as an indicator for brain cancer, with these cells displaying characteristics that can be either cancerous (malignant) or non-cancerous (benign). Despite the precise cause of brain cancer remaining elusive, identified risk factors encompass exposure to ionizing radiation and a family history of brain tumors. Typical symptoms linked to a brain tumor include headaches, gradual sensory deterioration, problems with balance, speech difficulties, and hearing challenges. The presentation of these symptoms varies based on factors like the size, location, and growth rate of the tumor. Treatment modalities for brain cancer are contingent on the type, location, and size of the tumor, with commonly employed approaches encompassing radiosurgery, chemotherapy, radiotherapy, surgery, and the application of carmustine implants.

In France, the estimated annual incidence of primary malignant brain tumors is around 5,000 cases, constituting approximately 70.9% of the overall prevalence of primary central nervous system (CNS) tumors, encompassing both benign and malignant forms. Gliomas are the most prevalent form, accounting for 42.8% of all CNS tumors, meningiomas, which are usually benign, make up a considerable portion of the tumors, contributing 24.1%. Every year, the nation reports about 5,400 new cases of brain tumors, which accounts for 1.3% of all new cancer cases. 1,800 of these cases are benign tumors, while 3,600 are malignant tumors. The median age at diagnosis for glioblastoma is 64 years old, and the yearly age-adjusted incidence ranges from 0.59 to 3.69 per 100,000 people.

Roche France has received permission for the NAVIFY test, a companion diagnostic tool intended to identify individuals with glioblastoma who may benefit from Venatum (onvansertib), their targeted medication. With a more focused approach to treatment and the possibility of better results for glioblastoma patients, this approval represents a major advancement in personalized medicine.

The Optune system, a tumour-treating field therapy, was approved by the European Commission in October 2023 for use with standard chemo-radiotherapy to treat newly diagnosed glioblastoma. Novocure, the company responsible for developing this technology, has established a presence in France.

Market Dynamics

Market Growth Drivers

Increasing Incidence of Brain Cancer: One major factor propelling the market's expansion is the increase in reported cases of brain cancer, including aggressive types like glioblastoma multiforme. In France, it is approximated that there are about 5,000 cases of primary malignant brain tumors reported annually. As the incidence rates increase, there is a greater demand for effective treatment options.

Advancements in Research and Technology: Brain cancer treatment options and customized medicines have been developed as a result of ongoing breakthroughs in medical research and technology. Vorasidenib, a recently developed targeted therapy medication, has demonstrated promising outcomes in slowing the advancement of glioma, a brain cancer known for its gradual growth yet severe consequences. New medications and treatment modalities are being introduced, which is helping the market expand.

Increasing Awareness and Advocacy: Public awareness of brain cancer is on the rise, thanks to media campaigns and advocacy initiatives. This heightened awareness contributes to early detection and a growing demand for diverse treatment options. Advocacy groups are actively striving to enhance treatment accessibility and tackle issues impacting both patients and their families.

Market Restraints

Pricing and Reimbursement: The healthcare system in France is strictly regulated and includes central negotiations for drug costs. This poses a challenge for companies seeking higher prices for groundbreaking drugs, particularly in the early stages of their introduction. The inability of the French national health insurance system to automatically reimburse all brain cancer medications prevents patients from accessing certain therapies, particularly those that are thought to be rare or costly.

Regulatory Challenges: Strict regulatory processes and the protracted approval processes for novel drugs may impede the timely release of novel brain cancer treatments into the market. Challenges in the regulatory process have the potential to delay the accessibility of advanced drugs, impacting patients' timely access to cutting-edge medications.

Ethical and Safety Concerns: Concerns about the ethical ramifications and safety of specific treatment methods, particularly those incorporating experimental or advanced therapies, could influence the acceptance of these approaches in the market.

Healthcare Policies and Regulatory Landscape

In France, healthcare policies and the regulatory framework for treatment drugs are overseen by institutions such as the Haute Autorité de Santé (HAS), which assesses the efficacy and cost-effectiveness of healthcare interventions, and the French National Agency for Medicines and Health Products Safety (ANSM), responsible for regulating and supervising the safety of medicines. The Pricing and Reimbursement Committee (CEPS) negotiates drug prices and ensures economic sustainability, while the Transparency Commission, under HAS, evaluates the therapeutic value of drugs and offers reimbursement recommendations. The French Social Security System plays a crucial role in funding healthcare, including drug reimbursement. Additionally, adherence to European standards is essential, requiring approval from the European Medicines Agency (EMA) for marketing authorization. This collective framework aims to uphold stringent standards for drug safety, efficacy, and affordability within the context of the French healthcare system.

Competitive Landscape

Key Players

- Roche

- Merck & Co.

- Bristol Myers Squibb

- Novartis

- Pfizer

- AstraZeneca

- Eli Lilly

- Sanofi

- Takeda Pharmaceutical

- AbbVie

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

France Brain Cancer Therapeutics Market Segmentation

By Type

- Gliomas

- Meningiomas

- Pituitary Adenomas

- Vestibular Schwannomas

- Neuroectodermal Tumours

By Treatment

- Chemotherapy

- Immunotherapy

- Targeted Drug Therapy

- Radiation Therapy

- Others

By End-Users

- Hospitals

- Oncology Specialty Clinics

- Oncology Treatment Centres

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.