France Atopic Dermatitis Therapeutics Market Analysis

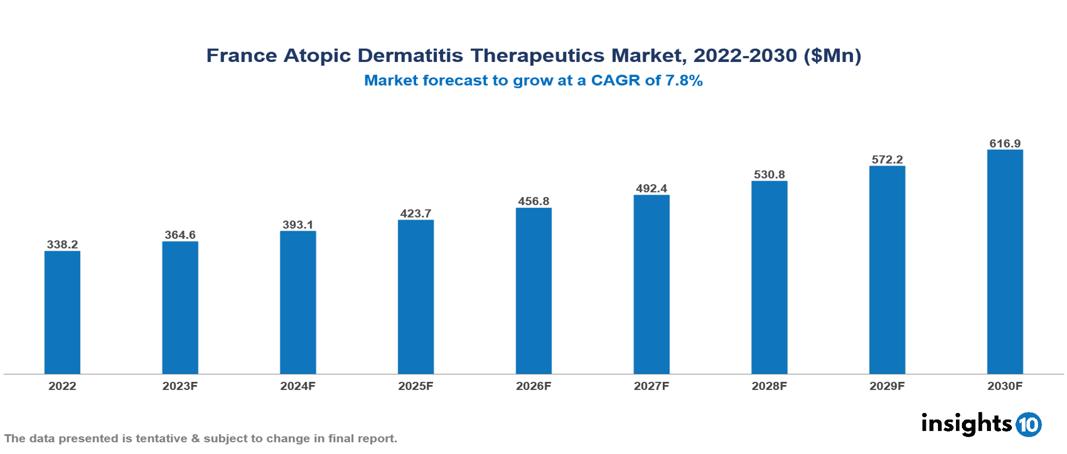

The France Atopic Dermatitis Therapeutics Market was valued at US $388 Mn in 2022, and is predicted to grow at (CAGR) of 7.80% from 2023 to 2030, to US $617 Mn by 2030. The key drivers of this industry include the upward trend in prevalence of Atopic Dermatitis (AD), emerging innovative therapeutics, and improved reimbursement policies. The industry is primarily dominated by players such as Sanofi, AbbVie, Viatris, Almirall, Leo Pharma, and Eli Lilly among others

Buy Now

France Atopic Dermatitis Therapeutics Market Analysis: Executive Summary

The France Atopic Dermatitis Therapeutics Market is at around US $388 Mn in 2022 and is projected to reach US $617 Mn in 2030, exhibiting a CAGR of 7.80% during the forecast period.

Atopic dermatitis (AD), commonly referred to as eczema, is a persistent inflammatory skin condition marked by redness, itching, and inflammation. It typically manifests in localized patches on various body areas and can be exacerbated by factors such as dry skin, stress, and exposure to specific irritants or allergens. Prominent symptoms include intense itching, redness, dryness, and the formation of small, fluid-filled blisters that may release fluid and form crusts. Emollients are frequently employed for skin moisturization, topical corticosteroids for inflammation reduction, and, in severe cases, systemic immunosuppressants. Various pharmaceutical companies produce remedies for atopic dermatitis, including Dupixent (Dupilumab) from Regeneron Pharmaceuticals and Sanofi, Eucrisa (Crisaborole) from Pfizer, and Elidel (Pimecrolimus) from Novartis.

The overall prevalence of AD is estimated to range between 10–15% for the French population and around 6%–9% for children in France. The market is being driven by significant factors such as the surge in the prevalence of AD, emerging novel therapeutics in the industry, and improvements in the reimbursement policies of the country. However, conditions such as increasing treatment costs, a complex regulatory environment, and others limit the growth and potential of the market.

Market Dynamics

Market Growth Drivers

Rising prevalence of AD: Atopic dermatitis is widely prevalent in France, with an estimated prevalence ranging between 6%-9% in children below 15 years and impacting around 10-15% of the French population. The substantial and expanding number of affected individuals in the country is driving the need for efficacious treatments. The rise in cases, particularly among children, is attributed to factors such as urbanization, pollution, and evolving lifestyles.

Emerging novel therapeutics: The introduction of novel drug classes, such as JAK inhibitors and topical PDE-4 inhibitors, provides enhanced and specifically targeted treatment alternatives. This not only improves patient outcomes but also stimulates the expansion of the market. Recent approvals and promising developments in the pipeline for innovative therapies, including biologics and targeted small molecules, further enhance the market's potential.

Improved reimbursement policies: The growth of the market is encouraged by the expansion of healthcare coverage and favourable reimbursement policies for innovative therapies, motivating healthcare professionals to recommend them. The French government's emphasis on enhancing access to treatments for chronic diseases, such as atopic dermatitis, creates opportunities for a broader market reach.

Market Restraints

Local competition:

The presence of generic alternatives for older medications can exert a downward influence on prices and market share for newer, branded drugs. Certain patients might choose alternative or complementary approaches such as moisturizers, probiotics, or dietary adjustments, potentially constraining the market for pharmaceutical interventions.

High cost of treatment: The cost of atopic dermatitis treatments, especially biologics, can be high. This may result in restricted patient accessibility and resistance from payers, such as insurance companies, posing a considerable challenge for patients, particularly those lacking sufficient insurance coverage.

Regulatory hurdles: The stringent approval processes of the French regulatory agency, ANSM, can prolong the timeline for the introduction of innovative treatments to the market. Given the continuously evolving treatment guidelines for atopic dermatitis, manufacturers must adjust their strategies to stay relevant in the market.

Healthcare Policies and Regulatory Landscape

France has a well-established and rigorous healthcare regulatory landscape overseen by various authorities. The main drug and pharmaceutical regulatory authority in the country is the Agence nationale de sécurité du médicament et des produits de santé (ANSM), which translates to the National Agency for the Safety of Medicines and Health Products. ANSM is responsible for evaluating and approving new drugs, monitoring their safety and efficacy, and ensuring compliance with regulatory standards. The agency plays a crucial role in safeguarding public health and maintaining the quality of pharmaceutical products in the French market.

Obtaining a license for new pharmaceuticals in France involves a thorough and systematic process guided by ANSM. Companies seeking approval must submit comprehensive documentation regarding the drug's safety, efficacy, and manufacturing processes. The regulatory environment emphasizes patient safety and public health, with a focus on ensuring that pharmaceuticals meet the highest standards of quality.

For new entrants, navigating the regulatory landscape can be challenging due to the stringent approval processes, but it also reflects the commitment to maintaining high standards in the healthcare sector. Companies entering the French pharmaceutical market must be prepared to adhere to the regulatory requirements set by ANSM to gain approval and establish a presence in this tightly regulated industry.

Competitive Landscape

Key Players

- Sanofi

- AbbVie

- Leo Pharma

- Galderma

- Pierre Fabre

- Viatris

- Novartis

- Almirall

- UCB

- Eli Lilly

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

France Atopic Dermatitis Therapeutics Market Segmentation

By Drug Class

- Corticosteroids

- Calcineurin Inhibitors

- Immunosuppressants

- Biologic Therapy

- PDE-4 Inhibitor

- Antibiotics

- Antihistamines

- Emollients

By Route of Administration

- Topic

- Oral

- Injectable

By Severity type

- Mild

- Moderate

- Severe

By Age Group

- 18 years and below

- 19 years and above

By Distribution channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Dermatology Clinics

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.