France Antibacterial (Antibiotics) Drugs Market Analysis

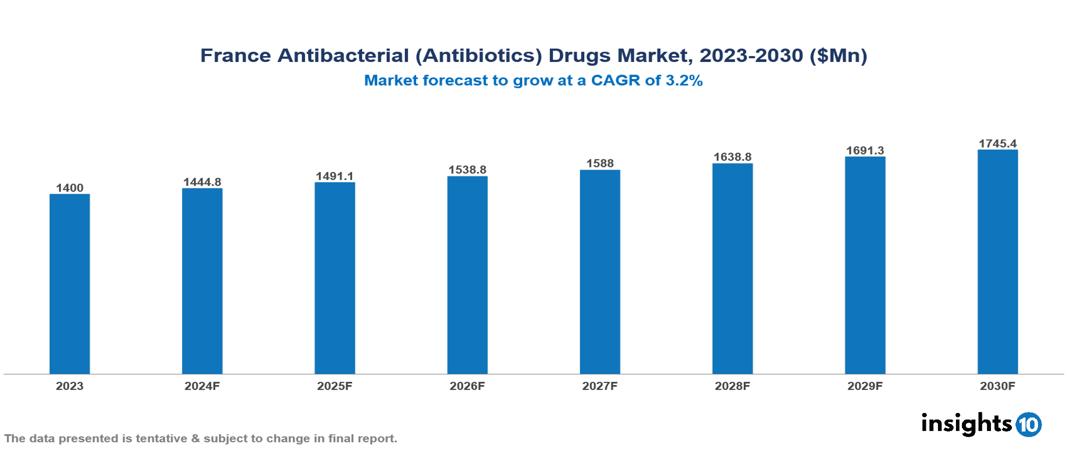

France Antibacterial (Antibiotics) Drugs Market is at around $1.4 Bn in 2023 and is projected to reach $1.75 Bn in 2030, exhibiting a CAGR of 3.2% during the forecast period. The market is expanding due to factors such as the prevalence of infectious diseases, improvements in healthcare infrastructure, and rising healthcare expenditures. The market is dominated by key players like Pfizer, AstraZeneca plc, GlaxoSmithKline plc, Johnson & Johnson, Merck & Co., Inc., Sanofi S.A., Abbott Laboratories, Novartis AG, Eli Lilly, and Bayer.

Buy Now

France Antibacterial (Antibiotics) Drugs Market Executive Summary

France Antibacterial (Antibiotics) Drugs Market is at around $1.4 Bn in 2023 and is projected to reach $1.75 Bn in 2030, exhibiting a CAGR of 3.2% during the forecast period.

The French pharmaceutical industry's manufacture, distribution, and use of antibiotics surround the country's antibiotic market. This includes variables including market size, growth forecasts, legal frameworks, and the competitive environment faced by major industry participants. To maintain efficient antibiotic stewardship and prevent antimicrobial resistance, stakeholders in pharmaceutical firms, lawmakers, healthcare professionals, and consumers must comprehend the dynamics of this market.

The prevalence of infectious diseases and rising healthcare costs are driving the steady growth of the French antibiotics market. Regulators' attempts to counteract antimicrobial resistance, however, provide obstacles for industry participants and spur new developments in antibiotics. With an emphasis on promoting safe antibiotic use, stakeholders are focusing on education and awareness initiatives to counter the emerging threat of antibiotic-resistant microorganisms.

In recent years, there has been a dramatic revolution in the antibiotic sector. The market saw $50.91 Bn in revenue in 2023 and is anticipated to expand further. This expansion is being driven by new products and an increase in infectious diseases. The demand for novel antimicrobial formulations, increased research and development, and the prescribing of antibiotics have all contributed to these advancements. Market expansion is impacted by new antibiotics and urbanization.

In the French healthcare industry, Sanofi is a significant participant and makes significant investments in the field. With 33 distinct locations around France, including 22 industrial facilities, the corporation employs about 25,000 people. With about $2.14 Bn invested in patient research annually, it is the largest private R&D investor in France.

Market Dynamics

Market Growth Drivers:

Growing Prevalence of Infectious Diseases: The prevalence of infectious diseases, particularly bacterial infections, is a major factor contributing to the rise in infectious disease incidence, hence fuelling the market's growth.

Improvements in Healthcare Infrastructure: France offers an advanced healthcare system that includes clinics, hospitals, and pharmacies. Investments in healthcare facilities and technologies have led to better detection and management of infectious diseases, consequently raising the demand for antibiotics.

Growing Healthcare Expenditure: As healthcare costs rise, people and governments are becoming more willing to spend money on efficient antibiotics to treat bacterial diseases. This trend helps the French market for antibiotics to expand.

Market Restraints:

Public Health Policies: Government initiatives aimed at cutting back on the overuse of antibiotics may affect market expansion. Campaigns by public health organizations encouraging the prudent use of antibiotics and other options, such as immunization, may lower demand.

Generic Competition: As a result of patent expirations and the availability of generic antibiotics, branded antibiotic manufacturers may see a decline in sales and a deterioration in price.

Alternative Treatments: Developments in non-antibiotic medicines, like phage therapy, immunotherapies, and probiotics, may offer substitutes for conventional antibiotics, hence lowering the demand of the market.

Healthcare Policies and Regulatory Landscape

The Agence nationale de sécurité du médicament and des produits de santé (ANSM) is a public institution that operates under the Ministry of Health's administration in France. It provides access to cutting-edge treatments and ensures the security of medical supplies on behalf of the French government. ANSM inspectors have the power to impose different enforcement actions and monitor compliance with pertinent rules and regulations through audits and inspections. The European Medicines Agency (EMA) partnership facilitates a more proficient centralized approvals process that requires adherence to both national and EU regulatory standards. The process of negotiating reimbursement following approval contributes to the total complexity of the French drug approval process.

Competitive Landscape

Key Players:

- Pfizer

- AstraZeneca plc

- GlaxoSmithKline plc

- Johnson & Johnson

- Merck & Co., Inc.

- Sanofi S.A.

- Abbott Laboratories

- Novartis AG

- Eli Lilly

- Bayer

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

France Antibacterial (Antibiotics) Drugs Market Segmentation

By Drug Class

- Cephalosporins

- Penicillin

- Fluoroquinolone

- Macrolides

- Carbapenems

- Aminoglycosides

- Sulfonamides

- 7-ACA

- Others

By Type

- Branded Antibiotics

- Generic Antibiotics

By Action Mechanism

- Cell Wall Synthesis Inhibitors

- Protein Synthesis Inhibitors

- DNA Synthesis Inhibitors

- RNA Synthesis Inhibitors

- Mycolic Acid Inhibitors

- Others

By Spectrum

- Broad-spectrum Antibiotic

- Narrow-spectrum Antibiotic

By Administration

- Oral

- Intravenous

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.