France Anti-Venom Market Analysis

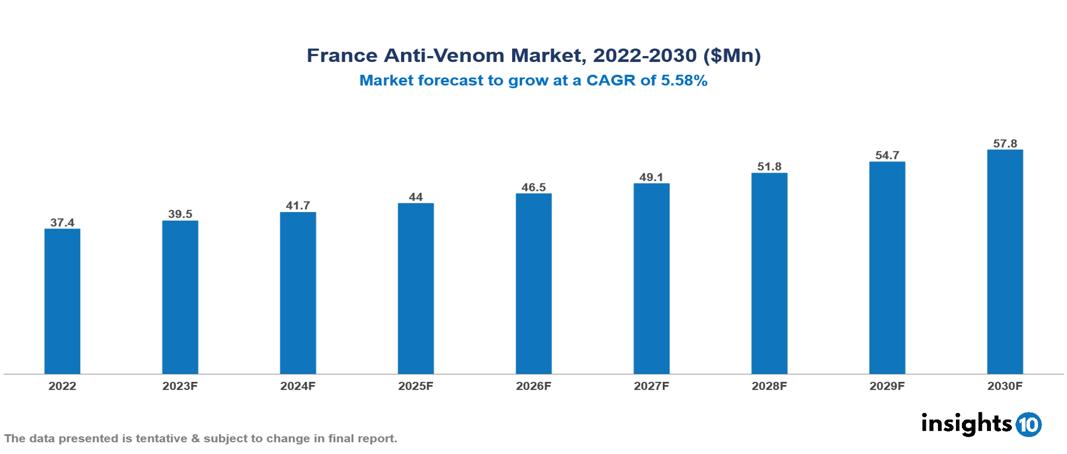

France Anti-Venom Market is projected to grow from $xx Mn in 2022 to $xx Mn by 2030, registering a CAGR of xx% during the forecast period of 2022 - 2030. Purified antibodies are used to prevent snake venom from attaching to tissues and causing severe allergic reactions, blood clotting, muscular injury, or nervous system difficulties. The anti-venom market is being driven by the rising global incidence of snakebites, which is fueling demand for effective snakebite treatment options such as anti-venom products. Anti-venom awareness and education efforts have been critical in emphasising the necessity of anti-venom in snakebite management. Manufacturing and delivery techniques advancements have enhanced the safety, efficacy, and accessibility of anti-venom medications. However, market obstacles include restricted access in rural places, high manufacturing costs, a lack of specificity and efficacy in particular formulations, and safety concerns about potential adverse responses and difficulties during therapy.Some global players in the anti-venom market include CSL Limited, BTG plc, Merck & Co., Inc., Pfizer Inc., Sanofi Pasteur SA, Haffkine Bio-Pharmaceutical Corporation Ltd., Rare Disease Therapeutics, Inc., Instituto Bioclon, S.A. de C.V., and Bharat Serums and Vaccines Limited.

Buy Now

France Anti-Venom Market Analysis Summary

France Anti-Venom Market is valued at around $886.5 Mn in 2022 and is projected to reach $1619.1 Mn by 2030, exhibiting a CAGR of 7.82% during the forecast period 2023-2030.

Purified antibodies are used to prevent snake venom from attaching to tissues and causing severe allergic reactions, blood clotting, muscular injury, or nervous system difficulties. They can prevent or reverse snakebite envenomation, reducing death and morbidity. They are collected using various technologies from various animal species such as snakes, funnel web spiders, stonefish, redback spiders, and box jellyfish. The anti-venom market is being driven by the rising global incidence of snakebites, which is fueling demand for effective snakebite treatment options such as anti-venom products. Anti-venom awareness and education efforts have been critical in emphasising the necessity of anti-venom in snakebite management. Manufacturing and delivery techniques advancements have enhanced the safety, efficacy, and accessibility of anti-venom medications. However, market obstacles include restricted access in rural places, high manufacturing costs, a lack of specificity and efficacy in particular formulations, and safety concerns about potential adverse responses and difficulties during therapy. Addressing these issues is critical to ensuring the availability, affordability, and safety of anti-venom for successful snakebite management worldwide. Some global players in the anti-venom market include CSL Limited, BTG plc, Merck & Co., Inc., Pfizer Inc., Sanofi Pasteur SA, Haffkine Bio-Pharmaceutical Corporation Ltd., Rare Disease Therapeutics, Inc., Instituto Bioclon, S.A. de C.V., and Bharat Serums and Vaccines Limited.

Market Dynamics

Market Growth Drivers

- Rising Snakebite Incidence: The rising number of snakebite cases worldwide is a crucial driver for the anti-venom business. Snakebites are a major public health concern, particularly in areas where snakebites are common. The need for anti-venom products is driven by the need for appropriate treatment alternatives

- Increased Awareness and Education: Increased awareness campaigns and instructional initiatives concerning snakebite prevention and treatment have resulted in a deeper understanding of the significance of timely and effective therapy. Because of this understanding, there is a greater demand for anti-venom as a critical component of snakebite therapy

- Innovations in Anti-Venom Production, Purification Techniques, and Delivery Systems: Advances in anti-venom production, purification techniques, and delivery systems have enhanced the safety, efficacy, and accessibility of anti-venom products. These developments have contributed to expanded therapy availability and improved treatment outcomes

Market Restraints

- Access to anti-venom is frequently restricted in distant and underdeveloped areas, where snakebite incidences are more common. Transportation, storage, and distribution infrastructure challenges impede the timely supply of anti-venom, limiting effective snakebite management. Anti-venom manufacture involves sophisticated processes such as venom extraction, purification, and quality control, all of which contribute to high manufacturing costs. The cost and availability of anti-venom can be substantial barriers, particularly in low-income areas. Not all anti-venom products are effective against all venomous snake species. Certain anti-venom compositions' poor specificity can diminish their overall efficacy. It is still difficult to develop comprehensive and region-specific anti-venom remedies. Adverse effects to anti-venom therapy are possible. The risk of hypersensitivity reactions, side effects, and potential complications raises safety concerns and necessitates careful administration and monitoring during treatment

Competitive Landscape

Key Players

- CSL Limited

- BTG plc

- Merck & Co., Inc.

- Pfizer Inc.

- Sanofi Pasteur SA

- Haffkine Bio-Pharmaceutical Corporation Ltd.

- Rare Disease Therapeutics, Inc.

- Instituto Bioclon

- S.A. de C.V.

- Bharat Serums and Vaccines Limited.?

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

France Anti-Venom Market Segmentation

By Species

- Snake

- Scorpion

- Spider

- Other

By Anti-venom Type

- Polyvalent

- Monovalent

- Other

By Distribution Channel

- Hospital

- Pharmacy

- Clinics

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.