France Alzheimer’s Disease Drugs Market Analysis

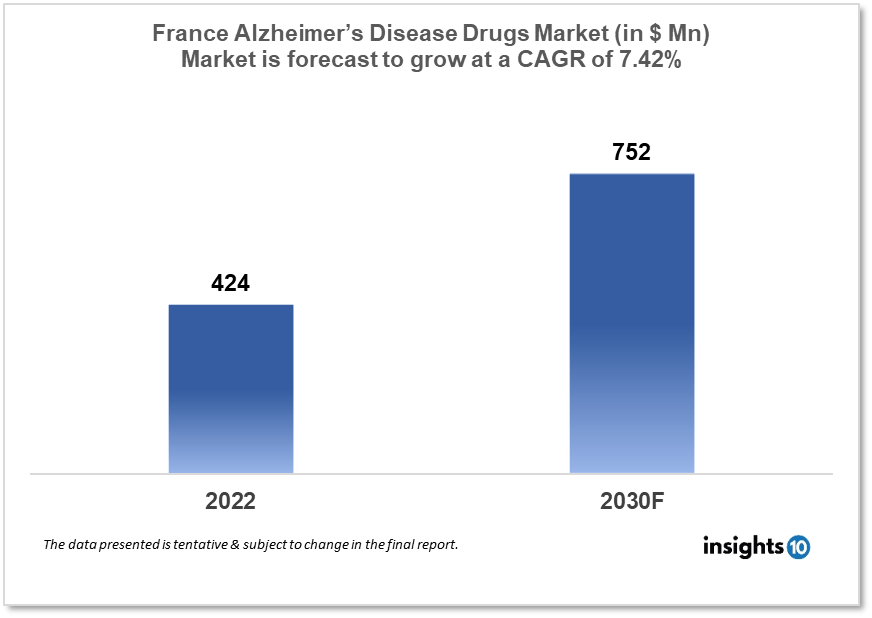

The France Alzheimer’s Disease Drugs market was valued at $424 Mn in 2022 and is estimated to expand at a CAGR of 7.42% from 2022-30 and will reach $752 Mn in 2030. One of the main reasons propelling the growth of this market is government support, and the aging population. The market is segmented by drug classes and by Distribution Channels. Some key players in this market are Alexion Pharma, Takeda Pharmaceuticals, Biogen, Daiichi Sankyo Company, Eisai Co., Eli Lilly and Company, Johnson and Johnson, H. Lundbeck A/S, F. Hoffmann-La Roche AG, Merck & Co., Novartis AG, Ono Pharmaceutical Co., Pfizer, and Teva Pharmaceutical among others.

Buy Now

France Alzheimer’s Disease Drugs Market Executive Summary

The France Alzheimer’s Disease Drugs market was valued at $424 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 7.42% from 2022 to 2030 and will reach $752 Mn in 2030. A brain illness that worsens over time is Alzheimer's disease. Changes in the brain that result in protein deposits are what define it. The brain shrinks as a result of Alzheimer's disease, and eventually, brain cells pass away. The most frequent cause of dementia, which is characterized by a slow loss of memory, thinking, behavior, and social abilities, is Alzheimer's disease. The ability to function is impacted by these modifications.

In France, more than 1,175,000 people have Alzheimer's disease, and each year, more than 200,000 more people receive a dementia diagnosis. In France, more than 400 000 patients received Alzheimer's disease treatment in 2019. The bulk of Alzheimer's patients, who numbered around 404 thousand, were 75 years of age or older. Yet, only 35,000 of those receiving treatment for Alzheimer's disease in that year were 65 to 74 years old.

Market Dynamics

Market Growth Drivers

The rising number of people with Alzheimer's disease in France is driving demand for drugs to treat the condition. The introduction of new and innovative drugs to treat Alzheimer's disease is contributing to market growth. These drugs are often more effective and have fewer side effects than older medications. The French government is taking steps to promote research and development in the healthcare sector. This includes funding for clinical trials and research into new drugs for Alzheimer's disease. France has a strong healthcare system, and reimbursement policies for Alzheimer's drugs are relatively favorable. This means that patients can access the drugs they need, even if they are expensive. France had a population of 21.7% over the age of 65 in 2022. France's population of 65 and over increased at an average yearly rate of 1.01% from 13.3% in 1973 to 21.7% in 2022. As the population of France continues to age, the number of people with Alzheimer's disease is likely to increase. This is expected to drive demand for drugs to treat the condition.

Market Restraints

There are a number of medications available to treat Alzheimer's disease, but none of them can reverse the illness. This indicates that there is a sizable unmet need for better therapies. Side effects from several Alzheimer's medications include nausea, diarrhea, and vomiting. This might prevent some patients from using them. The market for Alzheimer's medications in France is extremely competitive, with numerous businesses contending for market dominance. Because of this, it could be challenging for newcomers to get established. Drugs for Alzheimer's must pass stringent testing and receive regulatory approval before being sold to patients. There is no assurance that a medicine will be approved, and this procedure can be expensive and time-consuming.

Competitive Landscape

Key Players

- Alexion Pharma

- Takeda Pharmaceuticals

- Biogen

- Daiichi Sankyo Company

- Eisai Co.

- Eli Lilly and Company

- H. Lundbeck A/S

- Johnson and Johnson

- Merck & Co.

- Novartis AG

- Pfizer

Healthcare Policies and Regulatory Landscape

The French government has implemented policies to ensure that patients with Alzheimer's disease have access to the drugs they need to manage their condition. These policies are designed to ensure that patients have access to safe and effective drugs, while also controlling healthcare costs and promoting innovation in the healthcare sector.

One key aspect of the Alzheimer's drugs policy in France is the process of obtaining regulatory approval and reimbursement. In general, drugs must be approved by the European Medicines Agency (EMA) or the French regulatory agency, the National Agency for the Safety of Medicines and Health Products (ANSM), before they can be marketed in France. Once a drug has been approved, it may be eligible for reimbursement by the French National Authority for Health (HAS).

Reimbursement Scenario

In France, the healthcare system is largely funded by the government, with healthcare expenditures accounting for approximately 11% of the country's GDP. Reimbursement for drugs is provided through the national health insurance system, which covers a significant portion of the cost of drugs for patients. For Alzheimer's drugs, reimbursement is typically provided through the French National Authority for Health (HAS). HAS is responsible for evaluating new drugs and determining whether they are eligible for reimbursement by the national health insurance system. Also, the European Medicines Agency (EMA) or the French regulatory agency, the National Agency for the Safety of Medicines and Health Products (ANSM). Reimbursement is typically provided for a limited period of time and may be subject to certain conditions, such as prescribing guidelines or monitoring requirements.

In general, drugs are reimbursed based on their therapeutic value and cost-effectiveness. This means that drugs that are considered to provide significant clinical benefits to patients are more likely to be reimbursed.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Alzheimer's Disease Drugs Market Segmentation

By Drug Class (Revenue, USD Billion)

- Cholinesterase Inhibitors (Donepezil, Rivastigmine, Galantamine)

- N-Methyl-D-Aspartate (NMDA) Receptor Antagonists (Memantine)

- Combination Drugs

- Others (Lecanemab, Aducanumab)

Drug segmentation is the process of dividing a set of drugs into different categories or classes based on their pharmacological properties, therapeutic uses, and other characteristics. Here, Alzheimer’s Disease Drugs Market is segmented into Cholinesterase Inhibitors, N-Methyl-D-Aspartate (NMDA) Receptor Antagonists, Combination Drugs, and others like (Lecanemab, Aducanumab).

By Distribution Channel (Revenue, USD Billion)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By route of Administration

- Oral

- Transdermal

- Intravenous

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.