France Addiction Therapeutics Market Analysis

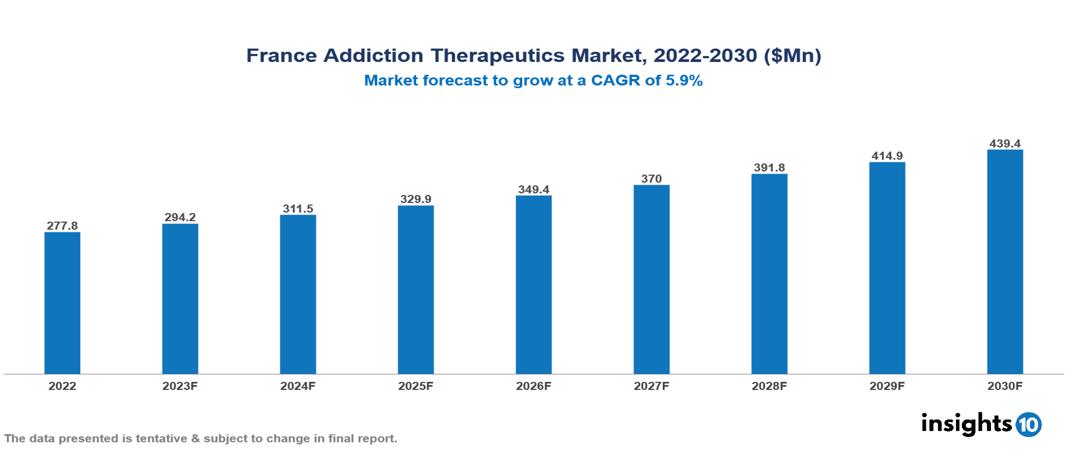

France addiction therapeutics market was valued at $278 Mn in 2022 and is estimated to reach $438 Mn in 2030, exhibiting a CAGR of 5.9% during the forecast period. The market for addiction treatments is being driven primarily by the growing recognition and understanding of substance use disorders as a serious public health issue. Major players in the market includes Indivior, Reckitt Benckiser Pharmaceuticals, Sanofi, Ethypharm, Mundipharma, Bioprojet Pharma, GlaxoSmithKline, Pfizer, Novartis and Merck KGaA

Buy Now

France Addiction Therapeutics Market Executive Summary

France addiction therapeutics market was valued at $278 Mn in 2022 and is estimated to reach $438 Mn in 2030, exhibiting a CAGR of 5.9% during the forecast period.

Addiction therapy uses a variety of techniques, interventions, and approaches to treat and prevent addiction. Its main goal is to reduce or eliminate the use of substances, especially drugs and alcohol, and to support those struggling with co-morbidities and addiction. Effective addiction treatment usually requires a customized, comprehensive strategy that takes into account each patient's unique situation, drug use history, comorbidities, and social networks. Two commonly prescribed medications used in the ongoing treatment of opioid use disorder addiction are methadone and buprenorphine. Other medications that are approved for the treatment of substance use disorders include naltrexone, acamprosate, and disulfiram; however, these may not be initiated until after detox.

As of January 1, 2022, 77.5% of prisoners in France were convicted of crime, with 13.5% of these convictions having a connection to drug-related offenses. Cannabis is still the most commonly used illegal substance among those aged 18 to 64, making up 46% of users and an estimated 18 million of them having tried it. 11.3% of adults had used cannabis in the previous year. For recent users aged 18–64, a high risk of problematic cannabis use was at 25%, which is 2.3% of the French population in 2017. Additionally, 1.3% of adults aged 18–64 use synthetic cannabinoids, which are comparable to heroin or amphetamines. Despite the stabilization of cannabis consumption between 2017 and 2020 in different age groups, the trend continues at a consistently high level, indicating a dynamic landscape due to the different sources of supply in France, including local cannabis cultivation and the emerging resin market. The consumption of substances has increased significantly and rapidly across Europe. About 3.5 Mn people have been identified as regular users, 600,000 of whom are in France. This figure represents a significant increase compared to the 400,000 registered users in 2010, which means that France is one of the countries most affected by this growing trend of drug use.

Research conducted at the INSERM (French National Institute of Health and Medical Research) is investigating the possibility of treating opioid addiction with a combined strategy that combines buprenorphine with mindfulness and meditation. Also, researchers at the University of Bordeaux are looking at how well the antioxidant N-acetylcysteine works to treat cocaine addiction. Preliminary research suggests that it may lessen cravings and improve relapse prevention in cocaine addiction sufferers.

Market Dynamics

Market Growth Drivers

Rising Substance Use Rates: Increasing rates of substance use, including cannabis and other illegal drugs, increase the need for addiction treatment in a larger population. Substance use disorders increase the need for effective treatments and accelerate the growth of the addiction treatment market.

Awareness and Education Initiatives: The addiction treatment market is growing as a result of ongoing campaigns, educational programs, and governmental and non-governmental initiatives aimed at reducing stigma, supporting early intervention, and encouraging help-seeking behavior.

Government Initiatives and Support: Support from government agencies through policies, initiatives, and strategic plans aimed at combating drugs and addiction significantly influences the growth of the addiction therapeutics market. The Centres de Soins d'Accueil et de Prévention en Addictologie (CSAPA), or "Care, Support, and Prevention Centres in Addiction," are a well-established network run by the French government. Growing investments in addiction treatment programs and healthcare infrastructure are driving the expansion of the addiction treatment market.

Market Restraints

Cost of Treatment: Affordability and reimbursement issues related to addiction treatment can impede access. High care costs combined with inadequate insurance coverage can limit an individual’s ability to obtain necessary drugs or treatments, which will affect market growth.

Treatment Adherence and Compliance: Inadequate patient compliance with recommended dosage schedules or unfinished treatment programs can reduce the efficacy of medications used to treat addiction, which may have an adverse effect on the market's potential for growth.

Stigma and Perception: Stigma and societal attitudes toward addiction can prevent people from seeking treatment. Misconceptions or societal prejudices about addiction can prevent affected individuals from acknowledging their illness or seeking appropriate treatment options. This stigma associated with substance abuse restricts the market's potential for expansion.

Healthcare Policies and Regulatory Landscape

The French National Agency for Medicines and Health (ANSM - Agence Nationale de Securité du Médicament et des Produits de Santé) controls the approval, licensing, and supervision of drugs used in the treatment of addiction and strictly monitors safety, quality, and effectiveness before entering the market. It regulates the entire life cycle of these medicines and ensures the fulfilment of strict criteria. Specific guidelines dictate the prescribing, dispensing, and administration of addiction medications and often require special training or certification for health care professionals who administer controlled substances for addiction treatment. These measures aim to ensure the appropriate use of these drugs by reducing the risk of abuse or misuse in the health system. The French National Agency for the Safety of Medicines and Health Products (ANSM) has a complex and stringent licensing and approval process for addiction drugs. It entails thorough documentation that includes safety profiles, clinical trial data, manufacturing specifics, and pharmacological qualities. It is essential to abide by the changing regulatory criteria set forth by ANSM for drug research, production, and quality control. Before approving a medicine, ANSM does extensive studies and expert assessments that frequently necessitate several reviews in order to guarantee the drug's quality, safety, and efficacy. It is necessary to conduct continuous post-market surveillance for safety and efficacy, which necessitates continuous compliance and prompt reporting of any new problems. In order to achieve the high safety and efficacy requirements established by ANSM, navigating this process requires a significant investment of time, money, and compliance with stringent regulatory criteria.

Competitive Landscape

Key Players

- Indivior

- Reckitt Benckiser Pharmaceuticals

- Sanofi

- Ethypharm

- Mundipharma

- Bioprojet Pharma

- GlaxoSmithKline

- Pfizer

- Novartis

- Merck KGaA

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

France Addiction Therapeutics Market Segmentation

By Treatment Type

- Opioid Addiction Treatment

- Alcohol Addiction Treatment

- Nicotine Addiction Treatment

- Other Substance Addiction Treatment

By Drug Type

- Buprenorphine

- Naltrexone

- Bupropion

- Disulfiram

- Nicotine Replacement Products

- Varenicline

- Others

By Treatment Centre

- Inpatient Treatment Centre

- Residential Treatment Centre

- Outpatient Treatment Centre

By Distribution Channel

- Hospital Pharmacies

- Medical stores

- Online Pharmacies

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.