France Acute Lymphocytic Leukemia (ALL) Therapeutics Market Analysis

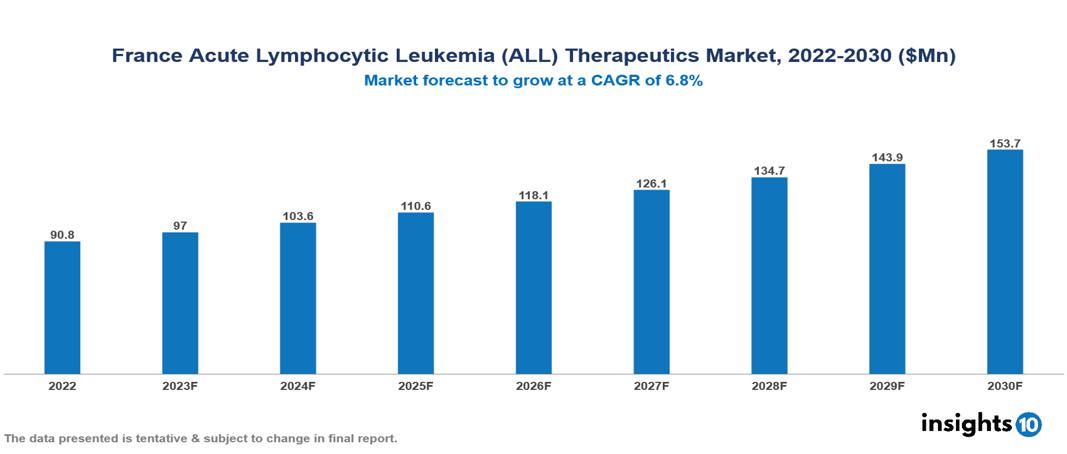

The France Acute Lymphocytic Leukemia (ALL) Therapeutics Market was valued at US $91 Mn in 2022, and is predicted to grow at (CAGR) of 6.8% from 2023 to 2030, to US $154 Mn by 2030. The key drivers of this industry include a surge in the incidence of acute lymphocytic Leukemia cases, rising awareness and diagnosis, increased government funding initiatives and other factors. The industry is primarily dominated by players such as Bristol Myers Squibb, Novartis, Sanofi, Pfizer Inc, among other players

Buy Now

France Acute Lymphocytic Leukemia (ALL) Therapeutics Market Analysis: Executive Summary

The France Acute Lymphocytic Leukemia (ALL) Therapeutics Market is at around US $91 Mn in 2022 and is projected to reach US $154 Mn in 2030, exhibiting a CAGR of 6.8% during the forecast period.

Acute Lymphocytic Leukemia (ALL) is a blood cancer marked by the rapid proliferation of immature white blood cells, known as lymphoblasts, within the bone marrow. Typically arising from a genetic mutation affecting developing lymphocytes, it results in an accumulation of undifferentiated lymphoid cells. Symptoms encompass frequent infections, swollen lymph nodes, weight loss, bone pain, and other signs. Managing ALL is an extensive process, lasting months or even years, involving diverse therapies like chemotherapy, targeted treatments, CAR-T cell immunotherapy, and, in severe cases, stem cell transplantation. These advances in treatment have substantially heightened the likelihood of a cure, with success rates reaching 80% in adults and young children.

In France, the overall highest incidence of ALL is reported to be in children under the age of 5 years. The incidence rate varies between 1.6/1,000,000 males and 1.1/1,000,000 females. Adults account for approximately 60% of newly diagnosed cases of ALL. The market is therefore driven by major factors like the surge in incidence of ALL cases, rising awareness and diagnosis, allowing prompt treatment, and increased government funding in the therapeutics industry. However, conditions such as high costs of treatment and limited accessibility to advanced treatments, among other factors, hinder the growth and potential of the market.

One of the notable players in the market is Amgen, which has obtained approval for the drug BLINCYTO® (blinatumomab), a treatment for adult and paediatric patients with B-cell ALL, from the European Medicines Agency (EMA).

Market Dynamics

Market Growth Drivers

Increased incidence of ALL: In France, the incidence of ALL varies from 1.6/1,00,000 males to 1.1/1,00,000 females. Approximately 60% of newly diagnosed cases of ALL occur in adults, even though the highest incidence rate is observed in children below the age of 5 years, creating a pool of patients requiring treatment.

Rising awareness and diagnosis: Enhanced public awareness initiatives and upgraded healthcare facilities result in earlier detection and prompt treatment. France has implemented nationwide screening initiatives for childhood cALL, aiding in the early detection process. This factor propels the industry toward growth.

Increased government funding:France possesses a robust healthcare system that provides universal health coverage, guaranteeing widespread access to high-quality treatment for ALL. The government prioritizes cancer care and dedicates resources toward researching and developing new therapies for ALL. National cancer control strategies such as the Plan National Santé 2018-2022 focus on facilitating access to innovative treatments for diverse cancers, including ALL.

Technological advancement and collaborations: France actively engages in global clinical trials aimed at assessing novel therapies for ALL, contributing to advancements in the global landscape of the field. Collaborations between research institutions, pharmaceutical firms, and healthcare providers promote innovation and expedite access to potentially beneficial treatments.

Market Restraints

High costs and limited access: Advanced treatments such as CAR-T cell therapy and more recent targeted medications are often expensive, potentially surpassing the financial means of many patients and the limits of their healthcare coverage. Socioeconomic inequalities and regional differences in healthcare resources can lead to unequal access to specialized ALL treatment, especially in rural areas.

Notable updates

March 2023, The European Medicines Agency (EMA) granted approval for blinatumomab in B-cell ALL for minimal residual disease (MRD) marking a recent milestone in this regard.

October 2022, The European Commission approved Kymriah for marketing and it was subsequently made accessible in France toward the end of the 2022.

Healthcare Policies and Regulatory Landscape

France's healthcare policy and regulatory framework involve multiple crucial authorities and agencies. The primary regulatory body for healthcare products, such as pharmaceuticals, is the French National Agency for Medicines and Health Products Safety (ANSM). ANSM holds responsibility for regulating, supervising, and authorizing health-related products, encompassing all therapeutics.

The healthcare system in France comprises both public and private healthcare provisions. The public healthcare sector is overseen by the Ministry of Social Affairs, Health, and Women's Rights, which is responsible for establishing the national health strategy. This ministry defines and executes government policies concerning public health, along with organizing and funding healthcare services.

Compliance with ANSM requirements is a prerequisite for obtaining a license in France. Before commercializing therapeutics, companies are required to get registration and marketing license from ANSM. Technical and scientific data proving the product's efficacy, safety, and quality must be submitted as part of the registration process.

France has a strong regulatory framework and a resilient healthcare system, creating an advantageous setting for businesses to function effectively. The healthcare industry in the nation offers diverse opportunities for companies involved in both public and private healthcare sectors.

Competitive Landscape

Key Players

- Bristol Myers Squibb

- Boehringer Ingelheim

- CureVac

- Sanofi

- Pfizer Inc.

- AstraZeneca PLC

- Roche

- Novartis

- Seattle Genetics

- Merck Co & Inc

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

France Acute Lymphocytic Leukemia (ALL) Therapeutics Market Segmentation

By Type

- Paediatrics

- Adults

By Drug

- Hyper CVAD regimen

- Linker Regimen

- Nucleoside Metabolic Inhibitors

- Targeted drugs and Immunotherapy

- CALGB 811 Regimen

By Cell

- B Cell ALL

- T Cell ALL

- Philadelphia Chromosome

By Therapy

- Chemotherapy

- Targeted therapy

- Radiation therapy

- Stem Cell Transplantation

By Distribution channel

- Hospital Pharmacy

- Retail Pharmacy

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.