France Actinic Keratosis Therapeutic Market Analysis

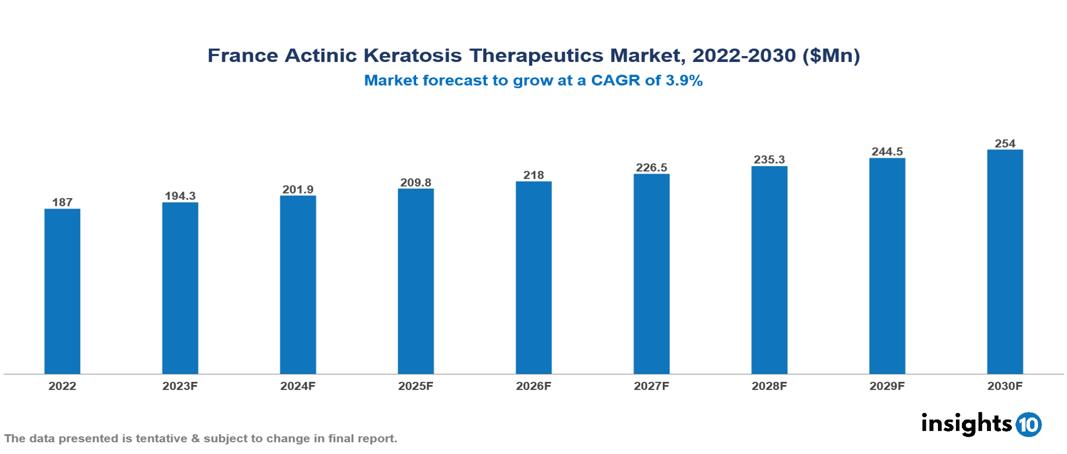

The France Actinic Keratosis Therapeutic Market is projected to grow at a CAGR of 3.9%, increasing from $187 Mn in 2022 to reach $254 Mn by the year 2030. Actinic Keratosis is becoming more common, and there are a number of reasons for this, such as more awareness and changing lifestyles, improved diagnostic tools, prolonged exposure and aging populations, and increased focus on skin health. The key players in the French market include Galderma, Almirall, Sun Pharma, Novartis, Pierre Fabre Laboratories, LFB Biotechnologies etc.

Buy Now

France Actinic Keratosis Therapeutic Market Executive Summary

The France Actinic Keratosis Therapeutic Market is at around US $187 Mn in 2022 and is projected to reach US $254 Mn in 2030, exhibiting a CAGR of 3.9% during the forecast period

Actinic Keratosis (AK) is an aberrant cell growth brought on by chronic UV exposure. Another name for it is solar keratosis. The cheeks, lips, ears, forearms, scalp, neck, or back of the hands are frequently affected by the illness. People with pale skin, light-coloured eyes, and a history of substantial sun exposure or sunburn are more likely to develop actinic keratoses. If treatment is not received, they are regarded as precancerous and may progress to squamous cell carcinoma. Minimizing sun exposure and shielding the skin from UV damage are examples of preventive strategies. The formation of AK has a complicated pathophysiology that involves prolonged and excessive sun exposure, which causes pathological alterations in the skin and promotes the growth of dysplastic keratinocytes, the progenitors of AK

It is well recognized that AK is brought on by prolonged or severe sun exposure and that those with pale skin, light-coloured eyes, and a history of extensive sun exposure or sunburn are more prone to acquire the condition. Therefore, the incidence of AK in France may be influenced by such variables. Given that AK is more frequent among older people, the aging of the French population may potentially increase the prevalence. The France Actinic Keratosis Therapeutic Market is booming and there are several reasons for this, such as more awareness and changing lifestyles, improved diagnostic tools, prolonged exposure and aging populations, and increased focus on skin health

Galderma, Almirall, Sun Pharma, Novartis, Pierre Fabre Laboratories, LFB Biotechnologies, and other major players are present in the France Actinic Keratosis Therapeutic Market

Market Dynamics

Market Growth Drivers

There are a number of factors that help drive the market size in the France Actinic Keratosis Therapeutic Market. Some of the factors, including enhanced public awareness initiatives and improved diagnostic methods, contribute to the early identification and treatment of AK. This results in a broader patient base actively seeking treatment, thereby fostering market growth

The introduction of novel and efficacious treatment modalities, such as topical creams, photodynamic therapy, and cryotherapy, is attracting an increasing number of patients seeking medical intervention. Furthermore, progress in minimally invasive procedures enhances the convenience and appeal of treatment options

Market Growth Restraints

Apart from the driving forces, the market is also determined by restraints, such as the reimbursement issue. The reimbursement limitations imposed by the French healthcare system exert pressure on manufacturers to maintain competitive pricing, restricting their capacity to invest substantially in the research and development of new treatments. This financial constraint has the potential to impede market growth by limiting innovation in the field. Also, the presence of generic alternatives, particularly for older topical treatments like imiquimod, poses a significant threat to the market share of newer, more costly branded drugs. The competition from generics not only tightens profit margins for manufacturers but also acts as a deterrent to continued innovation within the industry

Despite the growing public awareness of AK, some healthcare professionals, particularly those in primary care settings, may not be fully informed about the latest treatment options and the critical importance of early intervention. This lack of awareness among professionals can contribute to underdiagnosis and undertreatment, presenting a hurdle to market expansion

Certain treatments, such as topical creams, require daily application over an extended period of time. This regimen may prove inconvenient for patients, leading to low adherence rates and impacting the overall success of treatment. Additionally, potential side effects associated with treatments like photodynamic therapy, such as pain and swelling, can dissuade some patients from pursuing treatment, limiting the market's reach.

Healthcare Policies and Regulatory Landscape

The healthcare policies and regulatory landscape in France are characterized by a statutory health insurance (SHI) system that provides universal coverage for residents. The system is financed through employee and employer contributions, as well as earmarked taxes on a broad range of revenues. The French government sets the national health strategy, allocates budgeted expenditures to regional health agencies, and is responsible for defining the national health strategy, public health policy, and the organization and financing of healthcare. The oversight of the French healthcare system is mostly centralized, with the French National Agency for Medicines and Health Products Safety (ANSM) serving as the central administrative enforcement authority for medicines and medical devices. The ANSM is supported in its task by the regional health agencies (ARS), which are responsible for the implementation and enforcement of many regional health policies. France has also made efforts to move towards prevention, health promotion, and patient empowerment, breaking from the previous more paternalistic system that focused on curative care.

Competitive Landscape

Key Players

- Galderma

- Almirall

- Sun Pharma

- Novartis

- Pierre Fabre Laboratories

- LFB Biotechnologies

- Cipher Pharma

- Merck & Co

- 3M Canada

- Lumenis Corporation

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

France Actinic Keratosis Market Segmentation

By Treatment Type

- Topical Treatment

- Procedural Modality

- Photodynamic Therapy

- Others

By Drug Class

- Nucleoside Metabolic Inhibitor

- Immune Response Modifiers

- NSAIDs

- Photo enhancer

- Other Drug Classes

By Distribution Channel

- Hospital Pharmacies

- Drug Stores & Retail Pharmacies

- Online Providers

By Disease Type

- Clinical AK

- Subclinical AK

By End User

- Hospitals

- Private Dermatology Clinics

- Laser Therapy Centres

- Cancer Treatment Centres

- Spas and Rejuvenation Centres

- Homecare

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.