France Acne Therapeutics Market Analysis

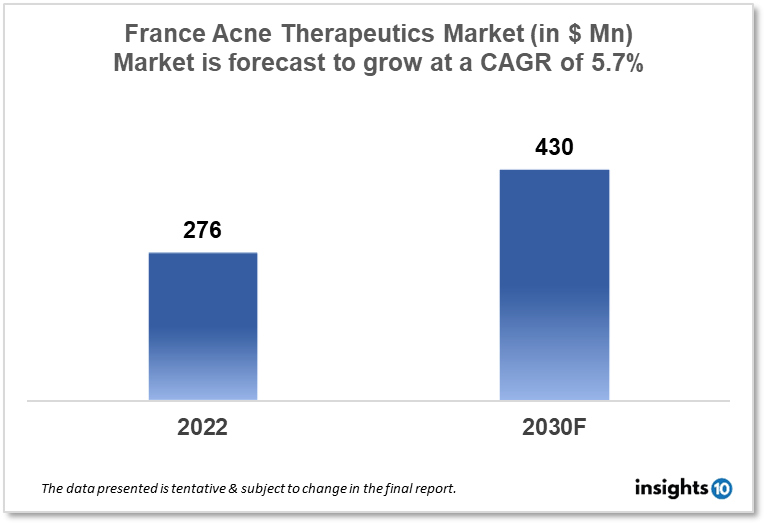

France's acne therapeutics market is expected to witness growth from $276 Mn in 2022 to $430 Mn in 2030 with a CAGR of 5.7% for the forecast year 2022-2030. The rising demand for acne medications for the acne increasing incidence of acne in France is the major market driver for the market. The France acne therapeutics market is segmented by treatment, route of administration, age group, and distribution channel. Some of the key competitors in the market are Pierre Fabre, Ceva Santé Animale, and Teva Pharmaceuticals.

Buy Now

France Acne Therapeutics Market Executive Analysis

France's acne therapeutics market size is at around $276 Mn in 2022 and is projected to reach $430 Mn in 2030, exhibiting a CAGR of 5.7% during the forecast period. Equal access to healthcare is a fundamental tenant of both French democracy and the country's healthcare infrastructure. Access to coherent, transparent, and plain information is a requirement for this. The French government put the national health insurance budget at 2.7 % of GDP, an increase of $4.85 Bn from the previous year. The funds will be used to modernize the healthcare system, which will enhance local healthcare delivery and the standard of care given by public hospitals. The social security scheme that finances the French healthcare system had a deficit of 1.7% of GDP in 2020. This imbalance is projected to be greater than $15.81 Bn in 2024. Modern medications enable patients to "live with" some illnesses that were previously thought to be incurable. Although many of these medications are costly, their introduction to the market raises questions about the French government's capacity to control prices while ensuring entry for all patients.

Acne is a long-term inflammatory condition that affects the pilosebaceous layer. Hyperseborrhea, abnormal follicular keratinization, and Propionibacterium acnes growth in the pilosebaceous unit are a few of its pathophysiologic features. One of the major causes of dermatological consultations is acne. Particularly for mild to moderate juvenile facial acne, where topical treatments are used for mild cases and topical treatments combined with systemic antibiotics are used for intermediate cases, management may appear standardized. When determining a regimen for the treatment of acne, specific patient variables must be considered. Current medical conditions, disease states, the severity of lesions, endocrine history, and the patient's chosen course of treatment are a few of these variables.

Based on the nature and severity of acne, topical therapy is used. Topical retinoids (i.e., tretinoin, adapalene, and tazarotene) are frequently used to treat mild cases of acne, along with other therapies like azelaic acid, salicylic acid, and benzoyl peroxide. Topical retinoids can be used as a maintenance regimen, in conjunction with more severe types of acne, or as a monotherapy for inflammatory acne. They typically regulate the development of micro-comedones, lessen the occurrence of lesions and existing comedones, reduce sebum production, and restore epithelium desquamation. They prevent comedone development by concentrating on micro-comedones. Furthermore, they might have anti-inflammatory qualities.

Market Dynamics

Market Growth Drivers

Around 80% of French citizens experience acne at some time in their lives, according to the French Society of Dermatology. The demand for acne therapeutics is anticipated to rise as acne's incidence rises. The France acne therapeutics market is expanding as a result of the large number of people seeking medical guidance for acne and their willingness to pay for efficient treatments. Technology developments have resulted in the creation of novel acne treatments, such as topical retinoids, oral medications, and light therapy. The effectiveness of treating acne should improve as a result of these novel treatments, propelling the France acne therapeutics market's expansion.

Market Restraints

Treatment for acne can be costly, especially for those who require more extensive care. Because of this, many patients might not be able to pay for the required care, which would restrict the France acne therapeutics market's expansion. The adverse effects of some acne treatments, such as oral antibiotics, may deter patients from pursuing further therapy. This may result in a decline in the market's desire for acne treatment products.

Competitive Landscape

Key Players

- Servier (FRA)

- bioMérieux (FRA)

- Ipsen Pharma (FRA)

- Pierre Fabre (FRA)

- Ceva Santé Animale (FRA)

- Teva Pharmaceuticals

- L'Oréal

- Sun Pharmaceuticals

- Johnson & Johnson

- Abbvie

Healthcare Policies and Regulatory Landscape

The Agence nationale de sécurité du médicament et des produits de santé (ANSM) is a public organization overseen by the Ministry of Health. On behalf of the French government, it promotes access to therapeutic innovation and guarantees the security of medical products. It collaborates with medical professionals to provide care for patients after consulting with the individuals who represent them and are involved in each Agency body. The ANSM guarantees the safety, efficacy, accessibility, and correct use of the medical products offered in France through assessment, expertise, and monitoring policy. The ANSM is actively engaged in both European and global activity. Its operations are closely aligned with those of the European Union as a whole, and its efforts are coordinated with those of the European Medicines Agency, the European Commission, and other state agencies. Furthermore, it works with global health organizations. Its goals are to monitor all health products throughout their lifespan, approve novel medications and biologics, and research the effects of their use.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Acne Therapeutics Market Segmentation

By Treatment (Revenue, USD Billion):

- Therapeutics

- Retinoid

- Antibiotics

- Hormonal Agents

- Anti-Inflammatory

- Other Agents

- Other Treatments

By Route of Administration (Revenue, USD Billion):

- Oral

- Topical

- Injectable

By Age Group (Revenue, USD Billion):

- 10 to 17

- 18 to 44

- 45 to 64

- 65 and above

By Distribution Channel (Revenue, USD Billion):

- Hospital Pharmacies

- Retail and Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.