Europe Telemedicine Market Analysis

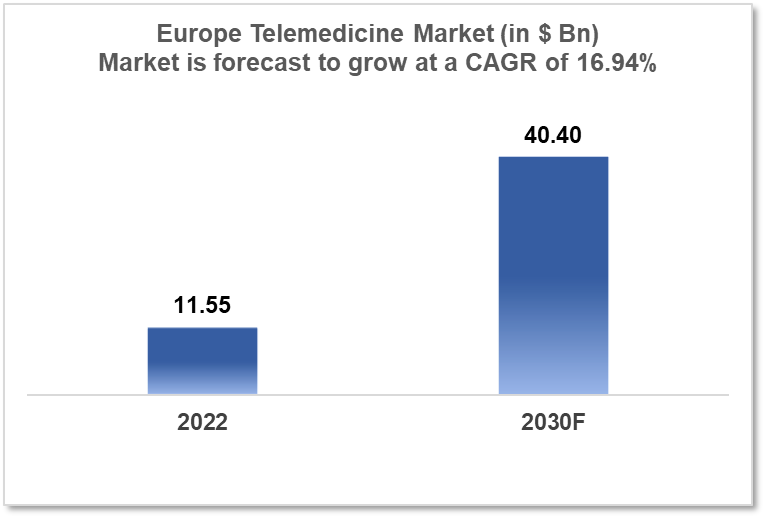

The telemedicine market in Europe is growing rapidly. The market is expected to reach from $11.55 Bn in 2022 to a value of $40.4 Bn by 2030, at a CAGR of 16.94% during the forecast period 2022-30. This growth is driven by several factors, including the healthcare mobile app development is one of the fastest-growing areas in Europe with a tremendous 30.5% CAGR in 2022-2023. The report by Insights10 draws attention to the market segmented by component, modality, application, delivery mode, facility, and end-user.

Buy Now

Europe Telemedicine Market Executive Summary

Europe's telemedicine market size is at around $11.55 Bn in 2022 and is projected to reach $40.4 Bn in 2030, exhibiting a CAGR of 16.94% during the forecast period 2022-2030. The collective economy of the European Union's member states makes up the EU's economy. After the US and China, it has the third-largest nominal economy in the world, and after China and the US in terms of Purchasing Power Parity (PPP). The nominal GDP of the European Union cumulative of all member states was $16.6 Tn in 2022 or almost a sixth of the world economy. Healthcare costs made up 9.9% of GDP on average in the EU in 2018. The EU Member States with the highest percentages were Germany (11.5% of GDP), France (11.3%), and Sweden (10.9%), in that order. According to population size, Denmark ($5,260 per person), Luxembourg ($5,220 per person), and Sweden ($5,040 per person) spent the most on healthcare in 2018 among EU member states.

High literacy rate, rise in population of elderly patients, better socio-economic conditions, increase in the rate of chronic diseases, increase in adoption of IT solutions in healthcare, rise in demand for primary care services, the emergence of favorable policies, and advancements in telecommunications are a few of the key factors promoting the telemedicine market in the European region. High literacy rates, a rise in the number of elderly patients, and better socio-economic conditions are some of the key factors promoting the telemedicine market in the European region. The emergence of home care devices and social platforms has improved communication between consumers and professionals for transferring information and physiological data. Developments and enhancements in immersive environments like nanotechnology, virtual reality, and haptic feedback are expected to boost the growth opportunities of the Europe telemedicine market during the forecast period.

Healthcare mobile app development is one of the fastest-growing areas globally with a tremendous 32.5% CAGR (2022-2030). Almost 1 in 3 mobile health apps are dedicated to mental health. Mental health relates to mental and psychological well-being. The available solutions are very diverse. Examples include breathing exercises for stress management (Breathe2Relax); alert notifications to specific contacts for teenagers struggling with depression or bullying (Code Blue); and Cognitive Behavioural Therapy (CBT) techniques with advice from real experts (Lantern). Diabetes and heart/circulatory diseases are the next most treated diseases by mobile health applications.

Market Dynamics

Market Growth Drivers

There are several factors that are driving the market for telemedicine market in Europe. Some of them include advancements in user-friendly AI-backed mobile health applications where these health apps benefit the consumer end by empowering them with access to health services with technological devices. The rise in IoT and Health monitoring wearables and predictive analysis combined with advancements in health Big Data Analytics, and better prediction of health outcomes with consumer-fed data first hand has revolutionized access to telemedicine since the inception years. Europe has an aging population expected to reach 80 Mn by 2030 in the age group of 65-85 and limited mobility is overcome with the advent of telemedicine as an anytime-anywhere solution.

Market Restraints

A dependable internet connection is necessary for telemedicine, however, access to high-speed internet may be restricted in some rural or underprivileged areas. Some healthcare providers could be reluctant to use telemedicine technologies because they don't understand them or they are worried about how it will affect their business model. Some patients might be reluctant to adopt telemedicine because they prefer in-person care or have privacy concerns. Telemedicine services may not be covered by insurance in some nations, which might be a deterrent to use.

Competitive Landscape

Key Players

- Teladoc Health

- MedExpress

- Doctolib

- Livi

- Babylon

Notable Recent Deals

October 2021 - The Zur Rose Group and Roche have announced a partnership to provide cutting-edge health journeys for diabetics. The Zur Rose Group, a provider of a European digital healthcare ecosystem, and Roche, a global leader in integrated personalized diabetes treatment, announce their collaboration to enhance daily therapy management and better meet the requirements of the 60 Mn individuals living with diabetes in Europe.

June 2021 - Babylon, a pioneering, value-based, digital health company, has announced plans to merge with Alkuri Global Acquisition Corp. for $4.2 Bn in order to go public. A global leader in value-based care, Babylon serves 24 Mn customers across four continents. The deal means that Babylon will have an equity value of $4.2 Bn, including approximately $575 Mn in gross proceeds.

Healthcare Policies and Regulatory Landscape

Regulation fragmentation (different telemedicine regulations in different countries) and social security plan limitations when it comes to patient proposals are factors that affect companies' ability to enter markets in other EU nations or outside the EU. An important issue with telemedicine products and solutions is their compatibility. The European Commission is working to improve the interoperability of telehealth systems between member states, thus the Digital Single Market policy has been developed which enables cross-border use of telemedicine solutions through its eHealth Action Plan 2012-2020.

Reimbursement Scenario

L'Assurance Maladie (AM), the French national insurance fund, has decided to cover all teleconsultations through the end of April. This ruling was subsequently extended to 2020. Between March and April 2020, France paid for around 5.5 Mn teleconsultations, up from a few thousand just a week earlier and about 1 Mn every week at the start of the pandemic.

In a similar vein, Belgium's state health insurance approved telemedicine reimbursement in March 2020. In addition to offering continuity of care to patients with chronic diseases who are unable to travel in person, doctors are compensated for triaging and supporting patients who are likely to be infected with COVID-19. The Europe member countries have varied telemedicine reimbursement policies.

1. Executive Summary

1.1 Digital Health Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Digital Health Policy in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Telemedicine Market Segmentation

Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

Modality

The industry is driven by three concepts, which include real-time (synchronous), store and forward (asynchronous), and others comprising remote patient monitoring, etc.

- Store and forward

- Real-time

- Others

Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call centers

Facility

- Tele-hospital

- Tele-home

End-user

- Providers

- Payers

- Patients

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.