Europe Dental Care Market Analysis

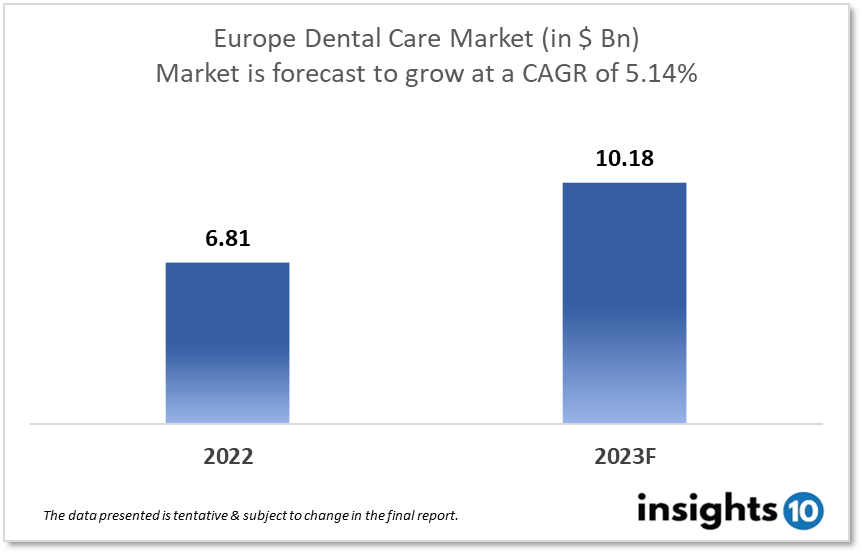

Europe's dental care market size is at around $6.81 Bn in 2022 and is projected to reach $10.18 Bn in 2030, exhibiting a CAGR of 5.14% during the forecast period. Post Brexit, the UK essentially relies on NHS for dental care services and other European Union states have a mixture of public and private healthcare providers to contribute to this endeavour. Driven by the needs of the aging population in Europe and the increased rate of migration from the Middle East due to the acceptance of refugees, dental care needs are reported to shift drastically over the next years. Major players include – Smysecret, Tandartspraktijk Praktijk Noord, Dental Clinic Denmark, Irish Dental Care, and Dentales. This report is segmented by treatment type, age group, clinical setup, and by demography and provides in-depth insights into opportunities for strategic placement of ventures in the region of Europe.

Buy Now

Europe Dental Care Market Executive Summary

The economy of Europe countries varies widely. Some countries, such as Germany and the Netherlands, have highly developed and industrialized economies, while others, such as Greece and Bulgaria, have lower levels of economic development. Most Europe countries have stable economies, with low unemployment and a high standard of living, but there are disparities in wealth and economic opportunity between countries and regions. Expenditure on healthcare in Europe also varies widely by country. According to data from the Organization for Economic Co-operation and Development (OECD), the average expenditure on healthcare as a percentage of GDP across European countries is around 9%. However, some countries spend significantly more, such as Switzerland at 12.2% or France at 11.2%, while others spend less, such as Turkey at 4.1%. In general, expenditure on healthcare as a percentage of GDP tends to be higher in countries with higher GDP per capita, as well as in countries with older populations and higher rates of chronic disease.

Healthcare systems in Europe also vary by country, but generally, they are government-funded and provide universal coverage to citizens and legal residents. Many countries have a mix of public and private healthcare providers, with the option for private insurance to supplement coverage. Services are generally easily accessible, although wait times for non-emergency procedures can vary. Some countries have nationalized healthcare systems, where all healthcare is provided and financed by the government, while others have a multi-payer system, where healthcare is financed by a mix of private insurance companies and government funds. Overall, the healthcare systems in Europe are generally considered to be high-quality and accessible, but there are some variations in terms of accessibility and wait times depending on the country.

Dental services in Europe are generally included in the coverage provided by national healthcare systems, but the specifics can vary by country. In some countries, dental care is fully covered, while in others it may be partially covered or require additional private insurance. In general, the utilization of dental services across Europe is relatively high, but there are some variations between countries.

Factors that can affect utilization include the cost of services, the availability of dental providers, and cultural attitudes toward dental care. However, the utilization rate may vary depending on the country, with some with more access to dental care than others. Europe's dental care market size is at around $6.81 Bn in 2022 and is projected to reach $10.18 Bn in 2030, exhibiting a CAGR of 5.14% during the forecast period of 2022-2030. In some countries, dental care is fully covered and the utilization is high, while in others it may be partially covered or require additional private insurance and the utilization is lower.

Market Dynamics

Market Growth Drivers

The Union is concerned about Europe's aging population because elderly edentulous patients (8.9% of the population) may increase demand for dental care, particularly dentures and implants, as the population's median age rises. Periodontal disease, which affects 20.5% of the population and may raise inflammatory markers and be a risk factor for a variety of cardiac diseases and the onset of labor in pregnant women, is recognized as a serious oral health concern. Europe is a popular travel destination, and dentistry tourism, as well as travelers from the United States, Canada, and the United Kingdom, are now taking advantage of the region's aesthetic splendour. Due to flexible appointment scheduling and high-quality services, the market is responding positively to this. Because Europe has a robust economy and a high standard of living, there may be a higher demand for dental services because people have more money to spend on dental treatments. Technology advancements in the dentistry sector may result in the availability of new treatments and procedures, which may increase demand for dental services. Demand for dental services may increase as more people seek regular check-ups and preventative care as they become more aware of the importance of oral health. Dental clinic and practitioner rivalry can also have an impact on market trends, since clinics and practitioners may introduce new treatments or lower prices.

Market Restraints

Low-cost dental clinics might put pressure on established dental offices to reduce their costs. Dental procedures are expensive, which can be a barrier for some patients. Dental experts are scarce in some locations, notably in rural areas. Portugal may affect the ability of dental clinics to expand, as a weak economy led to a decrease in consumer spending on non-essential items such as dental care. There may be a high level of competition among dental clinics in Europe which makes it difficult for new clinics to establish themselves in the market. Dental clinics may face financial constraints like high operational costs and personnel’s wages that limit their ability to grow, such as lack of funding or access to credit. The lack of qualified dentists has also limited the growth of dental clinics, as it is difficult to find enough experienced professionals to staff new clinics. The dental care or oral hygiene industry is being hampered by intensifying price rivalry and a lack of client understanding of technological improvements. Regional disparities in oral health and total healthcare costs, particularly for the elderly, are examples. It appears that the technical development of a new tele-dental system that can be used in rural and isolated areas that do not have easy access to dental professionals to receive diagnostic and preventive care is an unaddressed problem, particularly for the aging population.

Competitive Landscape

Key Players

- Dentego (FRA)

- DentiFree (FRA)

- Dentix (ESP)

- Smysecret (ESP)

- Tandartspraktijk Praktijk Noord (NLD)

- Tandartspraktijk Middenmeer (NLD)

- Dental Clinic Denmark

- Irish Dental Care

- Suomen Hammaslääkäriasema

- Dentales

- Dr. Fatori & Partner

Notable Recent Deals

December 2022: Biotech Dental is a rapidly growing producer of clinical software, oral surgery, and orthodontic devices based in Salon-de-Provence, France. The two companies have agreed that Henry Schein will acquire majority ownership of Biotech Dental, while the current majority owner, Upperside Capital Partners Group, will keep management of the remaining minority portion.

October 20, 2022: Advent-owned Clinica Dental Cuevas Queipo de Llano, a dental clinic operator in Spain, formed a consortium with Vitaldent, Moonz clinics, and Smysecret.

January 2021: Colosseum Dental Group (CDG), the largest pan-European network of high-quality dental care, and Otium Capital have agreed to buy a controlling stake in Dentelia, an emerging high-quality dental care provider in France. The acquisition strengthens CDG's position as the pan-European leader in dental care, with over 300 dental facilities in nine countries.

Healthcare Policies and Regulatory Landscape

In France, 99% of General Dentists are bound by the "Convention," a national agreement reached by elected dental trade unions, the National Health Insurance (NHI), and Complementary (private) Health Insurers (CHI). The Swiss healthcare system is unique in that every dentist in the country owns his or her own practice. The Swiss Dental Association (Schweizerische Zahnärzte-Gesellschaft - SSO) is the national organization for dentists. A dentist who belongs to the Consejo Dentista de Colegios de Odontólogos y Estomatólogos in Madrid (Spanish General Council of Colleges of Dentistry and Stomatology or General Dental Council). Over 34,000 licensed dentists and over 25,000 dental clinics are listed in the Consejo Dentista database. The National Chamber of Dentists (NCD), a professional organization that supervises dental practice in Denmark, is the dental regulating authority.

Reimbursement Scenario

Dental services coverage in Europe is reliant on the health finance mechanism's coverage of specific dental treatments. In Belgium, services provided by private providers are not covered by government healthcare insurance. However, many people have private health insurance that covers some or all of the expenses of dental services. The insurance company's policy's coverage and reimbursement policies differ. Some private health insurance policies in Belgium include dental care as a standard, while others offer it as an add-on. The level of coverage can also vary, with some insurance only covering routine check-ups and cleanings, whereas others may cover more expensive services such as orthodontics or cosmetic dentistry. It is critical to emphasize that in Europe, private health insurance is separate from government health insurance. Individuals are frequently required to pay a monthly membership fee for private insurance, as well as deductibles or co-payments for procedures.

Dental care in Europe is subsidized by the government to the tune of 48-75% of the treatment costs. Unless you are under the age of 15 or require emergency treatment, the Spanish healthcare system does not cover dental care in Spain. Unless you have private health insurance, you will have to pay for dental treatment. Dentists in Spain generally ask for payment in advance. Individual dental insurance can also be purchased separately. If you are a low-income Spanish resident with a child aged 6 to 15, you are eligible for assistance. Typically, this includes twice-yearly check-ups, protective treatments, milk teeth extractions, and permanent dental fillings, though services provided and eligibility age differ by area. All Finns are granted a Kela Card to show their eligibility for social security and National Health Insurance in Finland. The Kela Card also provides discounts on pharmaceutical purchases. It is, however, only available to anyone migrating to Finland on a permanent basis. Finland is a member of the European Union, therefore inhabitants of the EU, Iceland, Liechtenstein, Norway, and Switzerland have access to public healthcare with the presentation of a European Health Insurance Card (EHIC).

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Europe Dental Care Market Segmentation

By Product (Revenue, USD Billion):

In terms of product category, the toothbrush had the highest revenue share (26% in 2020). The rising incidence of cavities, sensitivity, and gingivitis has increased toothpaste usage significantly in both emerging and wealthy countries. As a result, toothpaste is now an essential part of good dental health. In the oral care sector, toothpaste thus commands the biggest market share.

- Toothbrush

- Toothpaste

- Mouthwash

- Dental Floss

- Denture Care

By Age Group (Revenue, USD Billion):

Adults lead the oral care market over the projection period based on age group. The overall expansion of the oral care industry is being driven by adults' increasing consumer knowledge of mouth cleanliness and care. Adult oral care products come in a variety on the market.

- Children

- Adults

- Geriatric

By Sales Channel (Revenue, USD Billion):

The specialty stores dominate the oral care market over the projection period based on the sales channel. Specialty shops carry a broad selection of goods. The employees of specialty businesses provide customers with precise product information. With the aid of specialty shops, customers can also find all types of dental care items under one roof.

- Hypermarkets/Supermarkets

- Specialty Stores

- Drug Stores &Pharmacies

- Convenience Stores

- Online Sales Channel

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.