Europe Anti-Depressants Drugs Market Analysis

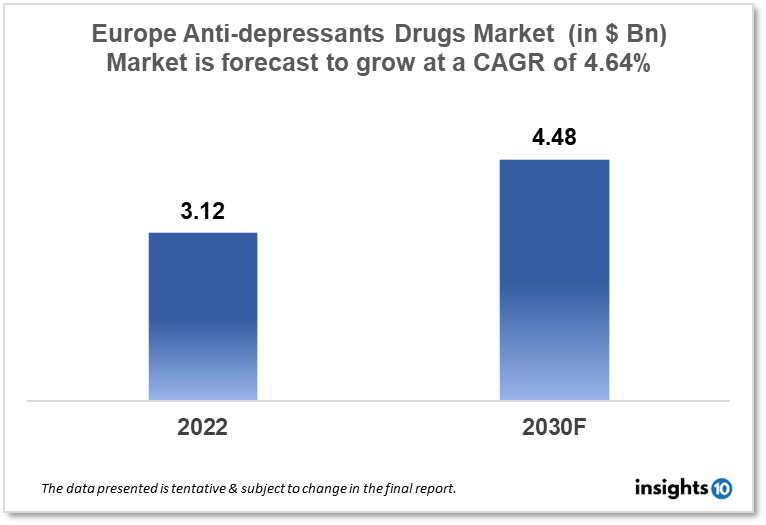

Europe's Anti-Depressants drugs market size was valued at $3.12 Bn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 4.64% from 2022 to 2030 and will reach $4.48 Bn in 2030. The market is segmented by drug class, indication, route of administration, end-user, distribution channel, and geography. The Europe Anti-Depressants drug market will grow because of the development of novel antidepressant drugs and the expansion of the product portfolio of pharmaceutical companies. The key market players are GlaxoSmithKline plc (GBR), AstraZeneca (GBR), Mallinckrodt (GBR), Novartis AG and others.

Buy Now

Europe Anti-Depressants Drugs Market Executive Summary

Europe's Anti-Depressants drugs market size was valued at $3.12 Bn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 4.64% from 2022 to 2030 and will reach $4.48 Bn in 2030. Mental health expenditure in Europe varies across different countries and depends on several factors, including healthcare systems, government policies, and cultural attitudes toward mental health. According to a report by the European Commission, mental health expenditure in the European Union (EU) was estimated to be around $84.75 Bn, accounting for approximately 6.7% of total healthcare expenditure in the region. The highest mental health expenditure per capita was reported in Denmark (€428), followed by the Netherlands ($414.22) and Austria ($365.49). In contrast, some countries reported much lower mental health expenditure per capita, such as Bulgaria ($20.13), Romania ($30.72), and Latvia ($36.02).

Depression disorder is a significant public health issue in Europe, affecting millions of people every year. According to the World Health Organization, the prevalence of depression in Europe is around 6.6%, with higher rates among women and young adults. It is estimated that around 30 mn people in Europe will experience depressive episodes each year. The prevalence varies across different European countries, with some countries reporting higher rates than others. For example, the prevalence of depression in Germany was around 8.2%, while in the United Kingdom, it was around 6.9%. In Italy, the prevalence was lower, at around 4.8%. Another study published in the European

Depression can have a significant impact on an individual's quality of life, as well as their ability to work and socialize. It can also have a negative impact on physical health, increasing the risk of other health problems such as cardiovascular disease and diabetes. The economic burden of depression in Europe is also substantial, with estimates suggesting that it costs the European Union around $180 billion annually in healthcare costs and lost productivity.

Several factors may contribute to the prevalence and incidence of depression in Europe, including genetics, lifestyle factors, and social and economic factors. In recent years, there has been a growing awareness of the importance of mental health and the need for better access to treatment and support for those with depression and other mental health conditions in Europe. The high prevalence of depression in Europe has a significant impact on the anti-depressant drugs market in the region. Anti-depressants are commonly used to treat depression, and the high demand for these drugs in Europe is driven by the large number of people with the condition.

In addition to the high prevalence of depression, other factors that contribute to the growth of the anti-depressant drugs market in Europe include the aging population and the increasing use of generic drugs. However, the market is also impacted by factors such as drug pricing regulations and the availability of alternative treatments, such as psychotherapy. Overall, the high prevalence of depression in Europe continues to drive demand for anti-depressant drugs and is expected to contribute to the growth of the market in the coming years.

Market Dynamics

Market Growth Drivers Analysis

The antidepressant drugs market in Europe is primarily driven by the increasing prevalence of depression and related mental health disorders. According to the World Health Organization (WHO), depression affects an estimated 25 million people in the European Union, making it the leading cause of disability and morbidity in the region. Additionally, the growing awareness and acceptance of mental health disorders and the increasing demand for effective treatment options are also driving market growth.

Market Restraints

There are several factors that could potentially restrain the growth of the antidepressant drugs market in Europe. One of the key factors is the stringent regulatory framework for drug approvals and the high cost of drug development. The increasing prevalence of side effects associated with these drugs is another factor that could limit market growth. Additionally, the emergence of alternative therapies such as psychotherapy and cognitive-behavioural therapy, which are considered to be safer and more effective in certain cases, could also pose a challenge to the growth of the antidepressant drugs market in Europe.

Competitive Landscape

Key Players

- GlaxoSmithKline plc (GBR)

- AstraZeneca (GBR)

- Mallinckrodt (GBR.)

- Novartis AG (CHE)

- Endo Pharmaceuticals plc (GBR)

- Johnson & Johnson

- Allergan (now part of AbbVie Inc.)

- Apotex Inc.

- Bausch Health Companies Inc.

- Lundbeck

- Purdue Pharma

- Takeda Pharmaceutical Company Limited

- Merck & Co., Inc.

- AbbVie Inc.

- Mylan N.V.

- Novartis AG

Healthcare Policies and Regulatory Landscape

In Europe, the regulation of antidepressant drugs falls under the authority of the European Medicines Agency (EMA). The EMA is responsible for evaluating the safety and efficacy of antidepressant drugs before they are approved for use in the European Union. Before a new antidepressant drug can be approved for use in the EU, it must undergo a rigorous evaluation process that includes clinical trials to test its safety and effectiveness. The EMA reviews all of the data from these trials and considers factors such as the drug's side effects, dosing information, and contraindications.

Once a new antidepressant drug is approved, it is subject to ongoing monitoring by the EMA to ensure its safety and effectiveness over the long term. This includes monitoring for any new safety concerns that may arise and conducting additional studies as needed. In addition to the regulation of new antidepressant drugs, the EMA also oversees the regulation of generic versions of these drugs. Generic versions must demonstrate that they are bioequivalent to the original drug and meet the same safety and efficacy standards.

In Europe, the reimbursement of antidepressant drugs is determined at the national level by each country's healthcare system. The reimbursement policies may vary from country to country depending on factors such as the type of healthcare system in place, the availability of funds, and the government's priorities. In general, most European countries have some form of reimbursement policy in place for prescription drugs, including antidepressants. These policies typically cover a portion of the cost of the drug, with patients responsible for paying the remaining portion out of pocket. The exact amount of reimbursement can vary depending on the country and the specific antidepressant drug being prescribed.

Some countries may have a fixed co-pay amount for all prescription drugs, while others may use a tiered system based on the cost of the drug or the patient's income level. In some cases, certain types of antidepressant drugs may be fully covered under the reimbursement policy, while others may only be partially covered or not covered at all. This can be due to factors such as the drug's cost, its effectiveness, or the availability of alternative treatments.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Anti-Depressants Drugs Market Segmentation

Drug Class

The market is divided into monoamine oxidase inhibitors, atypical antidepressants, tricyclic, serotonin, and norepinephrine reuptake inhibitors, selective serotonin reuptake inhibitors, and others based on pharmacological class. In 2021, the selective serotonin reuptake inhibitors (SSRIs) market segment held the biggest market share. The strength of the pipeline of top players to assess new potential candidates in this drug class, combined with the clinical advantage of SSRIs over conventional medications in the management and treatment of depression, is anticipated to accelerate the segment's growth.

- Tricyclic Antidepressants (TCAs) - Amitriptyline (Elavil), Amoxapine (Asendin), Desipramine (Norpramin), Doxepin (Silenor), Imipramine (Tofranil), Nortriptyline (Pamelor), Protriptyline (Vivactil), Trimipramine (Surmontil)

- Selective Serotonin Reuptake Inhibitors (SSRIs) - Citalopram (Cipramil), Dapoxetine (Priligy), Escitalopram (Cipralex), Fluoxetine (Prozac or Oxactin), Fluvoxamine (Faverin), Paroxetine (Seroxat), Sertraline (Lustral), Vortioxetine (Brintellix)

- Serotonin-Norepinephrine Reuptake Inhibitors (SNRIs) - Desvenlafaxine (Pristiq), Duloxetine (Cymbalta), Levomilnacipran (Fetzima), Venlafaxine (Effexor XR)

- Monoamine Oxidase Inhibitors (MAOIs) - Socarboxazid (Marplan), Phenelzine (Nardil), Selegiline (Emsam), Tranylcypromine (Parnate)

- Serotonin Antagonist and Reuptake Inhibitors (SARI) - Etoperidone (Axiomin, Etonin), Lorpiprazole (Normarex), Mepiprazole (Psigodal), Nefazodone (Serzone, Nefadar), Trazodone (Desyrel)

- Others

Indication

By Indication, the major depressive disorder segment was the major contributor in 2021 and is expected to maintain its lead during the forecast period, owing to an increase in the prevalence of major depressive disorder and initiatives taken by governments and private organizations about the development of drugs. However, the obsessive-compulsive disorder segment is expected to witness considerable growth during the forecast period, owing to an increase in the prevalence of mental disorders and an increase in the number of approval for anxiety drugs.

- Major Depressive Disorder

- Anxiety Disorders

- Attention Deficit Hyperactivity Disorder

- Others

Route of Administration

Based on the route of administration the market is segmented into:

- Oral

- Injectable

- Others

End-Users

Based on end users the market is segmented into:

- Hospitals

- Homecare

- Speciality Centres

- Others

Distribution Channel

Hospital pharmacies, retail pharmacies, and online pharmacies are the three types of pharmacies that make up the market based on the distribution channel. In 2019, the hospital pharmacies segment dominated the world market. Nonetheless, the expansion of the retail pharmacy market might be attributed to patients' increasing demand for these establishments. Due to the growing prevalence of online pharmacies in emerging countries, the segment of online pharmacies is estimated to see a profitable CAGR over the forecast timeframe.

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.