Egypt Telemedicine Market Analysis

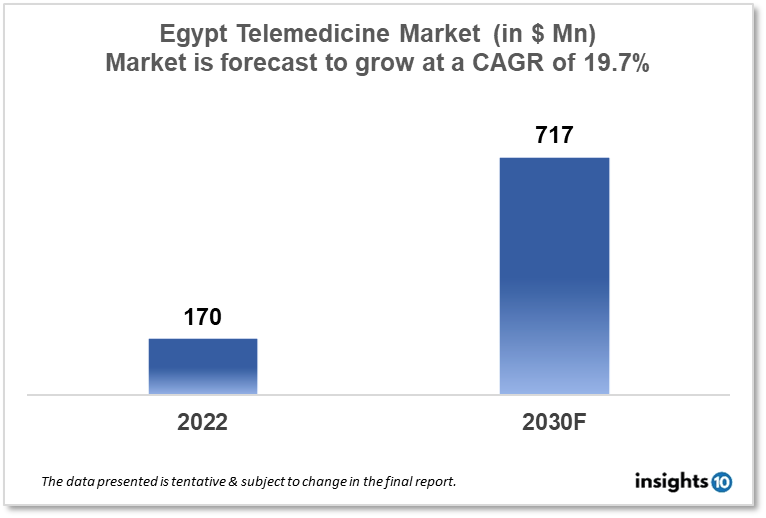

The Egypt telemedicine market size is at around $170 Mn in 2022 and is projected to reach $717 Mn in 2030, exhibiting a CAGR of 19.7% during the forecast period. The driving factors for potential growth in the Egyptian market are the prevalence of chronic diseases, the increasing cost of healthcare, the 5G network, and so on. The telemedicine industry is segmented by component, modality, application, and delivery mode. It also shows the competitive firms like Vezeeta, Clinido, Estshara, Schneider Electric, Siemens AG, and many more.

Buy Now

Egypt Telemedicine Market Executive Summary

The Egypt telemedicine market size is at around $170 Mn in 2022 and is projected to reach $717 Mn in 2030, exhibiting a CAGR of 19.7% during the forecast period 2022-2030. By providing a supportive legal and regulatory environment, an adequate Information and Communications Technology (ICT) infrastructure, and a Ministry of Information and Communications Technology (ITI), Egypt has made significant progress toward creating the Information Society (IS). There have been several initiatives to promote the use of telemedicine in Egypt, including the establishment of telemedicine centers and the development of telemedicine training programs for healthcare providers.

Egypt's government spent an average of 5.2% of its total budget, or 1.5% of GDP, on healthcare services from fiscal years 2016 to 2021. In comparison to the $ 0.97 Bn that was allocated for FY 2021-2022, public investments in healthcare are set at $1.26 Bn in FY 2022-2023, an almost 30% increase.

Market Dynamics

Market Growth Drivers Analysis

The prevalence of chronic diseases is increasing, and the cost of healthcare is rising, which is also speeding up market growth. Due to a shortage of qualified personnel and the necessary infrastructure for delivering healthcare in remote areas, the Egypt Telehealth Market is growing. The virtual healthcare platform's ability to provide affordable and practical remote consultations, particularly for the geriatric population, has contributed to the expansion of the telehealth market in Egypt. Aspects of healthcare could be completely transformed and improved thanks to 5G networks, which are now accessible in various parts of Egypt.

Market Restraints

Lack of patient awareness and acceptance of receiving medical services via telemedicine networks and applications is one factor that may restrain the market growth of telemedicine in Egypt. The project's inability to continue its operations due to a lack of funding and legal frameworks is another issue. Both professional standards and programs to build capacity are lacking.

Competitive Landscape

Key Players

- Vezeeta (EGY)

- Clinido (EGY)

- Estshara (EGY)

- Schneider Electric (EGY)

- Siemens AG (EGY)

- Nabda Care (EGY)

Notable Recent Deals

December 2022: Exits MENA signs a takeover deal in the Egyptian health tech industry, with CheckMe acquiring a majority stake in DoctorOnline, a doctor appointment booking app. A press release states that the transaction increases the market value of the health tech platform CheckMe, which is based in Egypt, to $20 Mn. This acquisition shows how health tech in the area is still expanding, particularly in telemedicine, e-pharmacy, and e-diagnostics, which have all seen significant growth since the COVID-19 outbreak.

August 2022: To serve the Bedouin communities of South Sinai and ensure the needs of the governorate's residents were met, Egypt's General Authority for Health Care made the decision to establish a mobile clinic networked with a virtual hospital.

Healthcare Policies and Regulatory Landscape

In Egypt a supportive legal and regulatory environment is being created by signing agreements on intellectual property rights, establishing the National Telecommunications Regulatory Authority (NTRA), adopting progressive legal measures to encourage the growth of ICT, and passing communications laws to liberalize Egyptian communications industry.

Reimbursement Scenario

In Egypt, virtual clinic consultations were typically not covered by insurance. But later in April 2020, AXA Egypt began offering a number of healthcare services to its customers including home healthcare services, medical consultations through its mobile application, medicine delivery, screening, testing, and analysis of health issue services for its customers. The Public Health Care Authority launched a telemedicine services application in August 2020, according to a statement from the Egyptian Ministry of Health, and it will offer online medical services through the country's national health insurance program.

1. Executive Summary

1.1 Digital Health Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Digital Health Policy in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Telemedicine Market Segmentation

Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

Modality

The industry is driven by three concepts, which include real-time (synchronous), store and forward (asynchronous), and others comprising remote patient monitoring, etc.

- Store and forward

- Real-time

- Others

Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call centers

Facility

- Tele-hospital

- Tele-home

End-user

- Providers

- Payers

- Patients

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.