Egypt Lipid Disorder Therapeutics Market Analysis

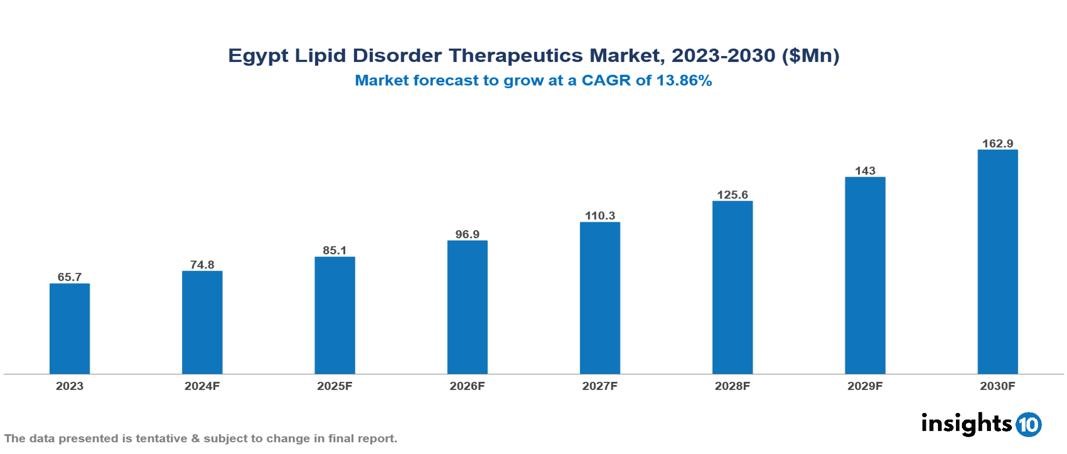

The Egypt Lipid Disorder Therapeutics Market was valued at $65.7 Mn in 2023 and is predicted to grow at a CAGR of 13.86% from 2023 to 2030, to $162.9 Mn by 2030. Egypt's Lipid Disorder Therapeutics Market is growing due to the Rising Prevalence of Non-Communicable Diseases, Growing Awareness and Focus on Chronic Disease Management, and Rising Demand for Digitalized Healthcare Services. The industry is primarily dominated by players such as Sanofi, Sun Pharmaceutical Industries Ltd., Pfizer, Inc., GlaxoSmithKline plc, Novartis AG, Merck & Co., Inc., Takeda Pharmaceutical Company Limited, AbbVie Inc., Viatris, AstraZeneca PLC, and Dr. Reddys Laboratories Ltd.

Buy Now

Egypt Lipid Disorder Therapeutics Market Executive Summary

Egypt's Lipid Disorder Therapeutics Market is at around $65.7 Mn in 2023 and is projected to reach $162.9 Mn in 2030, exhibiting a CAGR of 13.86% during the forecast period.

The several kinds of fats found in blood are called lipids, or lipoproteins. Lipid diseases are a broad category of metabolic ailments that affect blood lipid levels. The heightened blood levels of lipoproteins, triglycerides, and/or cholesterol that they share are associated with an increased risk of cardiovascular disease, if it occurs at all. Low-density lipoproteins (LDLs) can be lowered by following several easy steps, including cutting back on foods high in saturated fat, cholesterol, and calories; exercising; maintaining a healthy weight; and quitting smoking. Statins are the drugs that are most frequently prescribed to address lipids.

In Egypt, the prevalence rate of lipid disorders, including high cholesterol and triglycerides, is significant, with a rising trend due to lifestyle changes. Demographic factors such as urbanization, sedentary lifestyles, and dietary habits contribute to this health concern. Healthcare expenses related to lipid disorder treatment are substantial, encompassing medication costs, diagnostic tests, and physician consultations. The burden is exacerbated by limited access to healthcare services, particularly in rural areas. The market therefore is driven by significant factors like Rising Prevalence of Non-Communicable Diseases, Growing Awareness and Focus on Chronic Disease Management, and Rising Demand for Digitalized Healthcare Services. However, Alternative Treatments, Side effects, and High Costs of New Therapies restrict the growth and potential of the market.

Sun Pharma launches a first-in-class oral drug, Bempedoic Acid for reducing LDL cholesterol under the brand name Brillo.

Market Dynamics

Market Growth Drivers

Rising Prevalence of Non-Communicable Diseases: Egypt, like many developing countries, faces a growing burden of NCDs like heart disease, stroke, and diabetes. These conditions are often linked to high cholesterol and unhealthy lipid profiles, increasing the demand for lipid-lowering medications.

Growing Awareness and Focus on Chronic Disease Management: Public health initiatives and increased access to medical information are raising awareness about lipid disorders and their long-term health risks. This, in turn, encourages Egyptians to seek diagnosis and treatment, propelling the market for lipid disorder therapeutics.

Rising Demand for Digitalized Healthcare Services: With the rising prevalence of chronic diseases among the residents, the demand for specialized medical care clinics & hospitals has significantly increased to get advanced & cost-competitive treatment. Owing to the rising demand, the country witnessed a considerable surge in investments & innovations in healthcare facilities by leveraging artificial intelligence, machine learning, and the Internet of Things (IoT) to provide advanced medical treatment to residents. For instance, in 2022, CMR Surgical launched Versius, a robotic surgical system in Egypt.

Market Restraints

Alternative Treatments: Lifestyle changes and alternative therapies are another source of competition for the industry. Some people can effectively treat their lipid problems with non-pharmacological therapy including diet and exercise. New therapeutic techniques and drug classes are also always being developed, which could mean fewer people needing to take conventional lipid-lowering drugs. Patients' adherence to traditional lipid disease treatments may be diverted by this competition, which could affect market demand.

Side effects: The side effects of cholesterol-lowering drugs are one of the main obstacles facing the lipid disease therapeutics market. Common medications like statins can cause side effects like elevated blood sugar, liver damage, and muscle soreness, which can discourage patients and restrict market growth. Because of these side effects, patients must be closely monitored and managed, which raises healthcare expenses and complicates treatment regimens.

High Costs of New Therapies: The introduction of novel therapies, such as gene therapies, comes with high development and production costs. These costs are often passed on to patients and healthcare systems, making these treatments less accessible to a broader population. Gaining regulatory approval for new lipid-lowering medications in Germany can be a lengthy and expensive process. Rigorous clinical trials and data analysis are mandatory, which can delay market entry and inflate development costs for pharmaceutical companies.

Regulatory Landscape and Reimbursement Scenario

Egyptian Drug Authority (EDA) under the Ministry of Health is responsible for protecting public health by ensuring the safety, efficacy, and security of drugs. It has three key arms: The Central Administration for Pharmaceutical Affairs (CAPA) handles medicine registration, pricing, and facility inspections. The National Organization for Drug Control and Research (NODCR) ensures quality control of various products, including pharmaceuticals and cosmetics. Finally, the National Organization for Research & Control of Biologicals (NORCB) tackles marketing authorization and licensing.

Egypt's healthcare reimbursement landscape is complex. The public Universal Health Insurance System (UHIS) managed by the Egyptian HealthCare Authority (EHA) offers some coverage, but it may not cover all medications or treatments. Private insurance penetration is low, leaving many Egyptians reliant on out-of-pocket payments. This creates a burden, particularly for expensive lipid-lowering medications, potentially hindering access to proper treatment.

Competitive Landscape

Key Players

Here are some of the major key players in the Egypt Lipid Disorder Therapeutics Market:

- Sanofi

- Sun Pharmaceutical Industries Ltd.

- Pfizer, Inc.

- GlaxoSmithKline plc

- Novartis AG

- Merck & Co., Inc.

- Amgen Inc.

- Takeda Pharmaceutical Company Limited

- AbbVie, Inc.

- Amgen Inc.

- Viatris

- AstraZeneca PLC

- Dr. Reddy’s Laboratories Ltd.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Egypt Lipid Disorder Therapeutics Market Segmentation

By drug class

- Statins

- PCSK9 Inhibitors

- Nicotinic Acid

- Bile Acid Sequestrants

By Indication

- Hypercholesterolemia

- Dysbetalipoproteinemia

- Familial Combined Hyperlipidemia

- Others

By Product Type

- Atorvastatin

- Simvastatin

- Pravastatin

- Rosuvastatin

- Lovastatin

- Others

By Distribution Channel

- Hospital & Clinics

- Retail Pharmacies

- Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.