Egypt Herbal Supplements Market Report

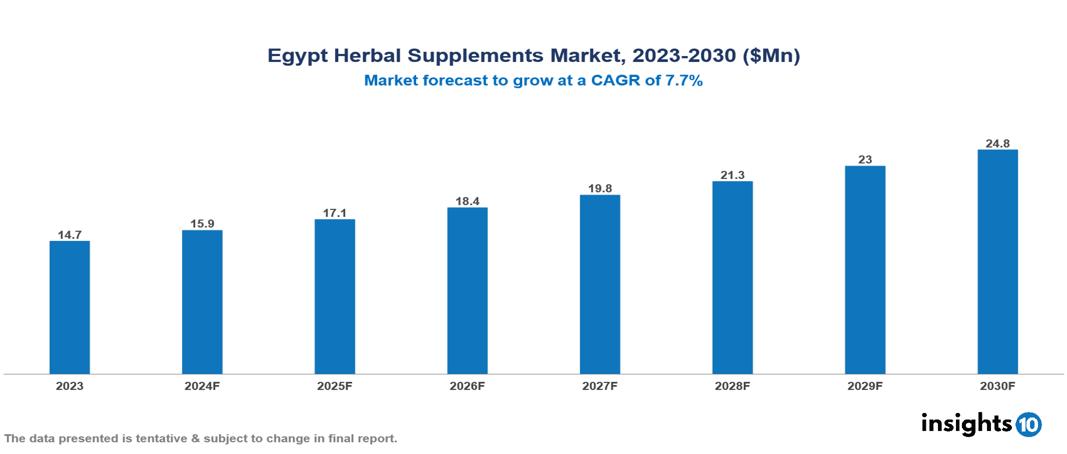

The Egypt Herbal Supplements Market was valued at $14.73 Mn in 2023 and is predicted to grow at a CAGR of 7.7% from 2023 to 2030, to $24.75 Mn by 2030. The key drivers of this industry include rising obesity rates, growing health awareness, and distribution channels. The industry is primarily dominated by players such as Himalaya Wellness, NOW Foods, Botanic Supplements, and Dabur among others.

Buy Now

Egypt Herbal Supplements Market Executive Summary

The Egypt Herbal Supplements Market was valued at $14.73 Mn in 2023 and is predicted to grow at a CAGR of 7.7% from 2023 to 2030, to $24.75 Mn by 2030.

Herbal supplements, also known as botanicals, are dietary supplements that contain one or more herbs. These products, which include herbal, botanical, or phytomedicines, are derived from plants or botanicals to promote health or treat illnesses. Herbal supplements are intended specifically for internal use and are commonly available in solid forms such as capsules, pills, tablets, and lozenges, but can also be found in liquid or powder forms. Some popular herbal supplements include Echinacea, Garlic, Ginkgo, Ginseng, St. John's Wort, Saw Palmetto, and Valerian.

It is found that 70.7% of university students in Egypt engage in self-medication with herbal products. Egypt also has one of the highest obesity rates globally, especially among women, with approximately 50% of men and 65-80% of women being overweight or obese. The market is driven by significant factors like rising obesity rates, growing health awareness, and distribution channels. However, lack of scientific evidence, economic constraints, and consumer skepticism restrict the growth and potential of the market.

Prominent players in this field include Himalaya Wellness, NOW Foods, Botanic Supplements, and Dabur among others.

Market Dynamics

Market Growth Drivers

Rising Obesity Rates: Egypt has one of the highest obesity rates globally, especially among women, with approximately 50% of men and 65-80% of women being overweight or obese. This drives demand for herbal supplements targeted at weight management and associated health concerns, thereby boosting the herbal supplement market in Egypt.

Growing Health Awareness: Growing health and wellness awareness among the population promotes the use of natural and herbal products for both prevention and treatment. This trend drives the herbal supplement market in Egypt by increasing consumer demand for these products.

Distribution Channel: The growth of retail channels, such as pharmacies, health stores, and online platforms, has improved the availability and convenience of purchasing herbal supplements throughout Egypt. This expansion drives the market by making these products more accessible to consumers.

Market Restraints

Lack of Scientific Evidence: The lack of extensive clinical research and scientific validation for many herbal supplements can result in skepticism among healthcare professionals and consumers regarding their efficacy and safety. This skepticism acts as a market restraint in Egypt by limiting the acceptance and use of herbal supplements.

Economic Constraints: Economic instability and lower disposable incomes can decrease consumer spending on non-essential health products, such as herbal supplements. This acts as a market restraint in Egypt by limiting the financial ability of consumers to purchase these products.

Consumer Skepticism: Consumer skepticism about the effectiveness and safety of herbal supplements compared to conventional pharmaceuticals can impact adoption rates. This restraint limits the growth of the herbal supplement market in Egypt as potential users may prefer established pharmaceutical options.

Regulatory Landscape and Reimbursement Scenario

Herbal medicines in Egypt are regulated by the Central Administration of Pharmaceutical Products (CAPP) under the Egyptian Drug Authority (EDA). All locally produced, imported, and exported herbal medicinal products must undergo registration with CAPP, involving an application and evaluation procedure. The Egyptian government aims to ensure that medications, including self-care items like herbal supplements, are affordable and accessible to the public. However, out-of-pocket expenses for self-care products remain a significant concern for patients.

Competitive Landscape

Key Players

Here are some of the major key players in the Egypt Herbal Supplement Market:

- Himalaya Wellness

- NOW Foods

- Botanic Supplements

- Dabur

- Harraz

- Imtenan

- Al Rehab Herbs

- Bright Star Herbs

- iHerbal Egypt

- Hishimo Pharmaceuticals Pvt. Ltd

1. Executive Summary

1.1 Product Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Government Regulation in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel and Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

6. Methodology and Scope

Egypt Herbal Supplements Market Segmentation

By Product Form

- Tablet

- Capsule

- Powder

- Others

By Application

- Immunity

- General Wellness

- Specific Health Condition

By Distribution Channel

- Pharmacies

- Supermarket/Hypermarket

- Online

- Specialty Stores

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.