Egypt Gram-Negative Infection Therapeutics Market Analysis

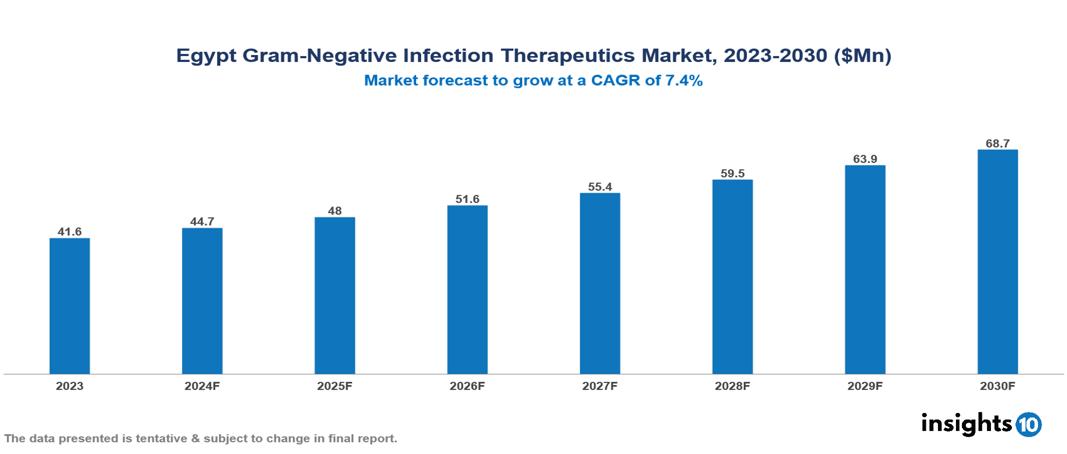

The Egypt Gram-Negative Infection Therapeutics Market was valued at $41.6 Mn in 2023 and is predicted to grow at a CAGR of 7.4% from 2023 to 2030 to $68.7 Mn by 2030. The primary drivers of this market expansion encompass the growing incidence of gram-negative bacterial infections, the challenge of antimicrobial resistance, and collaborative efforts through partnerships. Major players in this sector in Egypt include Janssen Pharmaceuticals, Inc. and Bristol-Myers Squibb Company, among others.

Buy Now

Egypt Gram-Negative Infection Therapeutics Market Executive Summary

The Egypt Gram-Negative Infection Therapeutics Market was valued at $41.6 Mn in 2023 and is predicted to grow at a CAGR of 7.4% from 2023 to 2030 to $68.7 Mn by 2030.

Gram-negative bacterial infections remain a formidable challenge to global public health systems, exacerbated by the persistent threat of antimicrobial resistance (AMR), which complicates treatment efficacy. This diverse array of bacteria pervades healthcare settings worldwide, spanning Escherichia coli, Klebsiella pneumoniae, Acinetobacter baumannii, and Pseudomonas aeruginosa. From hospitals to long-term care facilities and community environments, these infections contribute to various illnesses, spanning urinary tract infections to bloodstream infections and pneumonia. Addressing this pressing public health issue demands a collaborative approach, integrating enhanced surveillance, antimicrobial stewardship programs, and fortified infection prevention and control measures. Key stakeholders, including healthcare sectors and policymakers, must synergize efforts to develop and implement effective strategies against gram-negative bacterial infections and AMR.

In Egypt, there's a significant disease burden with high prevalence rates of extended-spectrum β-lactamase (ESBL)-producing Enterobacteriaceae and carbapenem-resistant Enterobacteriaceae. Market growth is propelled by increasing prevalence, antimicrobial resistance, collaborations, and partnerships, while factors such as limited diagnostic access, lack of antimicrobial stewardship, and healthcare infrastructure challenges restrain the market.

Market Dynamics

Market Growth Drivers

Increasing prevalence: In Egypt, there is a high prevalence of extended-spectrum β-lactamase (ESBL)-producing Enterobacteriaceae (19–85.24% of E. coli, and 10–87% of K. pneumoniae), carbapenem-resistant Enterobacteriaceae (35–100% of K. pneumoniae and 13.8–100% of E. coli), carbapenem-resistant Acinetobacter baumannii (10–100%), and carbapenem-resistant Pseudomonas aeruginosa (15–70%) in Egypt. The high prevalence of antibiotic-resistant bacteria in Egypt creates a growing demand for effective therapeutics, thus driving market growth.

Antimicrobial resistance: The rise of antimicrobial resistance, especially among gram-negative bacteria, is a significant concern in Egypt, driving the need for effective therapeutics to combat resistant infections. Risk factors for MDR gram-negative infections were ventilated patients (67.4%), prolonged hospitalization (53.5%), and chronic disease (34.9%). The escalating rates of antimicrobial resistance and the demand for new therapeutics to combat resistant infections contribute to market growth.

Collaborations and partnerships: Collaborations between pharmaceutical companies and research institutions, such as Allergan and Teva Pharmaceutical Industries Ltd, are driving initiatives to combat antimicrobial resistance and promote the proper use of antibiotics in Egypt. These initiatives drive innovation and development in the market, further fuelling its growth.

Market Restraints

Limited Diagnostic Access: In Egypt, the absence of rapid antimicrobial resistance diagnostics and molecular testing in many laboratories hampers the timely identification of AMR, complicating treatment strategies and limiting market growth.

Lack of Antimicrobial Stewardship: Egypt's inadequate AMS programs and lack of comprehensive guidelines and monitoring fuel antibiotic misuse and worsening antimicrobial resistance. This restraint impedes the market's ability to effectively address the growing threat of antibiotic resistance.

Healthcare Infrastructure Challenges: Egypt's fragmented healthcare system, with disparities in medical services and facilities, impedes effective infection control and prevention strategies. This limitation hampers market growth by hindering the efficient delivery of antimicrobial therapies and the management of resistant infections.

Regulatory Landscape and Reimbursement Scenario

The primary regulatory body responsible for drug approval in Egypt is the Egyptian Drug Authority (EDA), which operates under the Ministry of Health's (MoH) supervision. The EDA ensures the safety, efficacy, and quality of pharmaceutical products marketed in Egypt. The Central Administration for Pharmaceutical Affairs (CAPA) is responsible for registering and pricing medicines, inspecting pharmacies and manufacturing facilities, and ensuring compliance with regulatory requirements and the quality of pharmaceutical products.

The reimbursement scenario for gram-negative infection therapeutics in Egypt is complex and influenced by factors such as antimicrobial resistance (AMR). It also involves the Egyptian Medicines Authority (EMA) and the Ministry of Health and Population (MOHP). Companies must demonstrate the value proposition of their drugs, including improved patient outcomes, reduced hospital stays, and cost-effectiveness analyses, to secure reimbursement.

Competitive Landscape

Key Players

Here are some of the major key players in the Egypt Gram-Negative Infection Therapeutics Market:

- GlaxoSmithKline plc (GSK)

- Pfizer Inc.

- Sanofi-Aventis

- Takeda Pharmaceutical Company Limited

- Nektar Therapeutics

- Bristol-Myers Squibb Company

- Baxter

- Novartis

- Sumitomo

- Janssen Pharmaceuticals, Inc.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Egypt Gram-Negative Infection Therapeutics Market Segmentation

By Drug Types

- Antibiotics

- Combination Therapies

- Adjunctive Therapies

By Infection Types

- Urinary Tract Infections (UTIs)

- Pneumonia

- Bloodstream Infections (Bacteraemia)

- Wound/Surgical Site Infections

- Gastrointestinal Infections

- Meningitis

- Hospital-Acquired Infections (HAIs)

- Respiratory Tract Infections (RTIs)

- Other Infections

By Route of Administration

- Oral

- Parenteral (injections, intravenous)

- Topical

By Distribution Channel:

- Hospitals

- Clinics

- Ambulatory Surgical Centres

- Home Healthcare

- Long-term Care Facilities

- Community Health Centres

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.