Egypt ECG Equipments Market Analysis

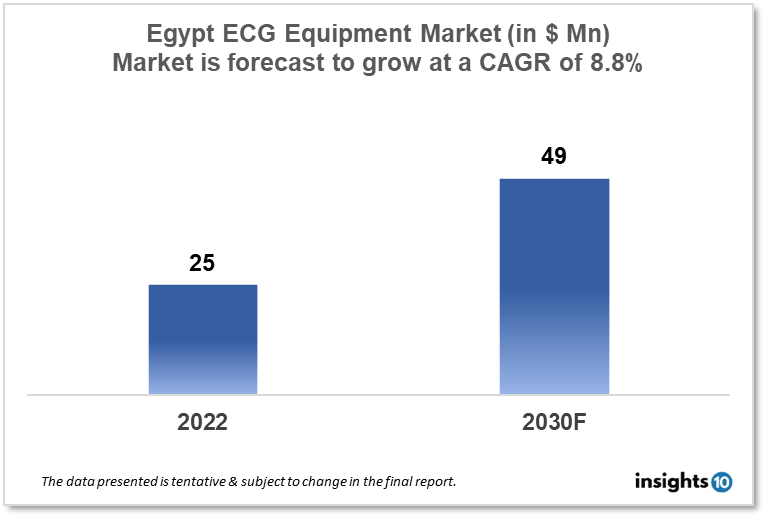

Egypt ECG Equipment Market is expected to witness growth from $25 Mn in 2022 to $49 Mn in 2030 with a CAGR of 8.80% for the forecasted year 2022-30. The Egyptian government has made significant investments in the healthcare industry, including the construction of brand-new hospitals and centres as well as the remodelling of already-existing ones. As a result, the demand for ECG equipment has grown. The market is segmented by product type and by the end user. Some key players in this market include Wassenburg Medical, EMG-EP Technologies, Johnson & Johnson, Philipps Healthcare, Medtronic and Dexcom.

Buy Now

Egypt ECG Equipment Healthcare Market Executive Analysis

Egypt ECG Equipment Market is expected to witness growth from $25 Mn in 2022 to $49 Mn in 2030 with a CAGR of 8.80% for the forecasted year 2022-30. Till 2021, only 5.2% of Egypt's overall budget, or 1.5% of GDP, went to the health sector. Healthcare expenses' proportion in the budget decreased, from 4.9% in 2019 to 4.2% in 2022, the lowest amount in the previous five years. 1.6% of GDP is a record level for government spending on health. In Egypt, spending on public health has grown to 3% of the GDP.

In Egypt, ECG equipment is frequently used to identify and track a variety of cardiac conditions. A variety of cardiac conditions, such as arrhythmias, myocardial infarction (heart attack), and coronary artery disease, are diagnosed using ECG equipment. The electrical activity of the heart can be continuously monitored with ECG equipment, which can be useful for identifying and treating cardiac conditions. Prior to surgery, an ECG can be used to assess a patient's heart health and help identify any possible risks. Population screening programmes can use ECG equipment to find people who may have cardiac conditions. During physical activity and athletic competition, players' heart rates and rhythms can be observed using ECG equipment. ECG equipment can be used to remotely observe patients with heart conditions, enabling medical professionals to keep an eye on the patient's heart health.

Market Dynamics

Market Growth Drivers

The Egyptian government has made significant investments in the healthcare industry, including the construction of brand-new hospitals and centres as well as the remodelling of already-existing ones. As a result, the demand for ECG equipment has grown. Due to Egypt's high cardiovascular illness prevalence, there is an increasing need for ECG equipment. Significant improvements in ECG technology have been made in Egypt, including the creation of wireless and portable ECG devices that have increased patient convenience and comfort. Market expansion is probable for producers who can provide cutting-edge technology and unique features.

Market Restraints

Competitors include inexpensive imports from other countries, especially China. In Egypt, these imports may be priced considerably lower than locally produced ECG equipment, which may make it challenging for local makers to compete on price. Operating ECG equipment can be challenging in some areas of Egypt where there is limited access to dependable power. Manufacturers who want to increase their customer base in these regions may find this to be a major challenge.

Competitive Landscape

Key Players

- Wassenburg Medical (EG)

- EMG-EP Technologies (EG)

- Johnson & Johnson

- Medtronic

- Philipps Healthcare

- Dexcom

Healthcare Policies and Regulatory Landscape

The control of Egypt's healthcare industry, including the purchase and selling of ECG equipment, falls under the purview of the Ministry of Health and Population (MOHP). Manufacturers, importers, and distributors of ECG devices are registered and licenced under the MOHP's supervision. ECG device standards in Egypt are established and upheld by the Egyptian Organization for Standardization and Quality Control (EOS). To make sure that ECG equipment complies with the required safety and quality standards, the EOS closely collaborates with the MOHP. In 2016, the Egyptian government imposed a Value Added Tax (VAT) of 14% on all products and services, including ECG equipment. All manufacturers and sellers of ECG equipment are vulnerable to this tax.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

ECG Equipment Market Segmentation

By Product Type (Revenue, USD Billion):

- Holter Monitors

- Resting ECG Machines

- Stress ECG Machines

- Event Monitoring Systems

- ECG Management Systems

- Cardiopulmonary Stress Testing Systems

By End User (Revenue, USD Billion):

- Hospitals and Clinics

- Diagnostic Centres

- Ambulatory Services

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

The market is segmented by type and by the end user.

The Egypt ECG Equipment Market is studied from 2022-2030.

Wassenburg Medical, EMG-EP Technologies, Johnson & Johnson, Philipps Healthcare, Medtronic and Dexcom are the major companies operating in Egypt's ECG Equipment market.