Egypt Diabetes Devices Market Analysis

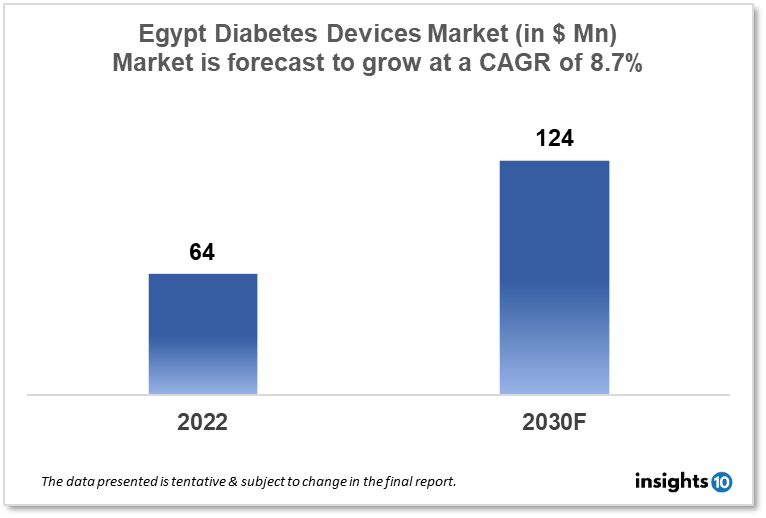

Egypt's Diabetes Devices Market is expected to witness growth from $64 Mn in 2022 to $124 Mn in 2030 with a CAGR of 8.70% for the forecasted year 2022-2030. As healthcare expenditures in Egypt increase, a greater focus is being placed on preventive care and the management of chronic diseases. The demand for healthcare goods in general, including diabetes management devices, ought to increase as a result. The market is segmented by type and by the end user. Some key players in this market include JK Medirise, EGMED, Johnson & Johnson, Medtronic, Roche, Ascensia Diabetes Care, and Dexcom.

Buy Now

Egypt Diabetes Devices Healthcare Market Executive Analysis

Egypt's Diabetes Devices Market is at around $64 Mn in 2022 and is projected to reach $124 Mn in 2030, exhibiting a CAGR of 8.70% during the forecast period. Till 2021, only 5.2% of Egypt's overall budget, or 1.5% of GDP, went to the health sector. Healthcare expenses' proportion in the budget decreased, from 4.9% in 2019 to 4.2% in 2022, the lowest amount in the previous five years. 1.6% of GDP is a record level for government spending on health. In Egypt, spending on public health has grown to 3% of the GDP.

Diabetes patients in Egypt may benefit from, use, and apply diabetes devices in an array of forms. Blood glucose levels are measured using blood glucose meters, which is a crucial part of managing diabetes. They make it possible for people with diabetes to regularly check their blood glucose levels, which enables them to make wise choices about their diet, exercise routine, and medication use. Blood glucose meters are commonly used in Egypt, and they are available at pharmacies and healthcare clinics throughout the country. For people with diabetes, insulin pens are a discreet and practical method to administer insulin. They are a common option for people who need to administer insulin injections frequently because they are portable and simple to use. In Egypt, insulin pens are generally accessible and can be obtained from pharmacies or on a doctor's prescription. Insulin is constantly delivered by small, portable devices called insulin pumps through a catheter inserted under the skin. Since they can be programmed to deliver basal rates and boluses in accordance with individual requirements, they offer a more accurate and versatile method of delivering insulin than insulin pens or injections. Due to cost and accessibility, insulin pumps are less frequently used in Egypt, but they have many advantages, including greater glycemic control, a lower chance of hypoglycemia, and a higher quality of life.

Market Dynamics

Market Growth Drivers

As healthcare expenditures in Egypt increase, a greater focus is being placed on preventive care and the management of chronic diseases. The demand for healthcare goods in general, including diabetes management devices, ought to increase as a result. As more people in Australia become conscious of the significance of proper diabetes management, the demand for diabetes devices that allow users to monitor their blood glucose levels and successfully manage their condition is increasing. The market for diabetes devices is continuously changing as new and creative tools are developed to improve diabetes management. New, more advanced technologies are expected to be introduced, which will fuel market growth.

Market Restraints

In Egypt, people with diabetes may choose traditional or complementary therapies, which could lower the demand for diabetes devices. Diabetes sufferers in Egypt might not be aware of or lack access to knowledge about the benefits of diabetes gadgets. This might make consumers less interested in diabetes devices.

Competitive Landscape

Key Players

- JK Medirise (EG)

- EGMED (EG)

- Johnson & Johnson

- Medtronic

- Roche

- Dexcom

- Ascensia Diabetes Care

Healthcare Policies and Regulatory Landscape

The Egyptian Drug Authority (EDA), which is in charge of governing the safety, effectiveness, and calibre of diabetes devices in Egypt, is in charge of overseeing the regulatory environment for diabetes devices in Egypt. The EDA works closely with other governmental organizations to guarantee adherence to regional laws and regulations while operating under the direction of the Ministry of Health and Population. Based on their degree of risk, medical devices are divided into four categories in Egypt. In order to be marketed and sold in the nation, diabetes devices like blood glucose meters, insulin pens, and insulin pumps must be registered with the EDA as Class II medical devices. In order to register a device, the EDA must receive paperwork proving its quality, safety, and efficacy in addition to proof that it complies with regional labelling and packaging laws.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Diabetes Devices Market Segmentation

By Type (Revenue, USD Billion):

The market is divided into blood glucose monitoring systems, insulin delivery systems, and mobile applications for managing diabetes within the type segment. Due to its convenience, ease of use, and usefulness in providing patients and healthcare professionals with real-time insights regarding diabetic conditions for integrated diabetes management, the segment for diabetes management mobile applications is anticipated to grow at the highest rate during the forecast period. Bare-metal Stents

- Blood glucose monitoring systems

- Self-monitoring blood glucose monitoring systems

- Continuous glucose monitoring systems

- Test strips/Test papers

- Lancets/Lancing Devices

- Insulin delivery Devices

- Insulin pumps

- Insulin pens

- Insulin syringes and needles

- Diabetes management mobile applications

By End User (Revenue, USD Billion):

The diabetes market is divided into hospitals & specialty clinics and self & home care, based on the end user.

- Hospitals & Specialty Clinics

- Self & Home Care

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.