Egypt Conjunctivitis Therapeutics Market Analysis

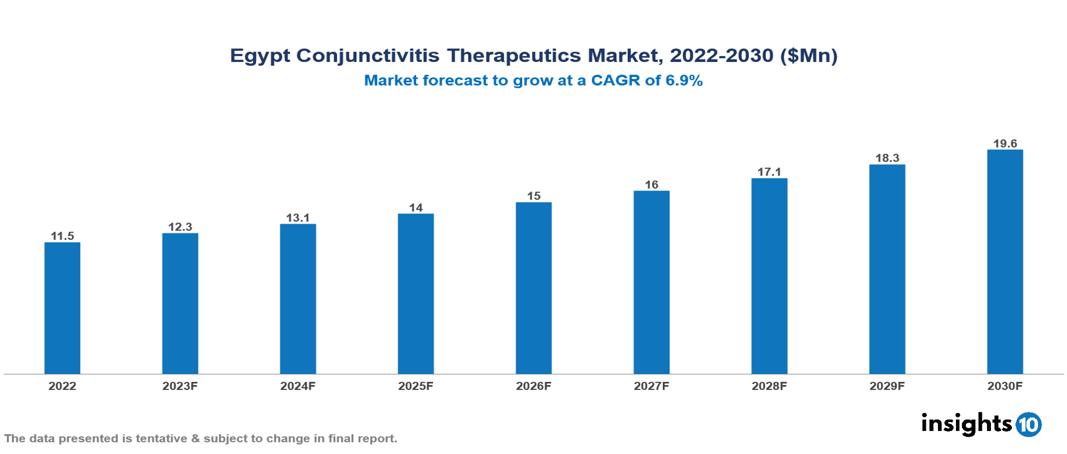

The Egypt Conjunctivitis Therapeutics Market was valued at $11 Mn in 2022 and is predicted to grow at a CAGR of 6.9% from 2023 to 2030, to $20 Mn by 2030. The key drivers of this industry include the rising prevalence of conjunctivitis, expanding healthcare infrastructure, and the evolving treatment landscape. The industry is primarily dominated by players such as Allergan, Sun Pharma, Novartis, Sirion, Boehringer Ingelheim, Pfizer, and Auven among others.

Buy Now

Egypt Conjunctivitis Therapeutics Market Analysis Executive Summary

The Egypt Conjunctivitis Therapeutics Market is at around $11 Mn in 2022 and is projected to reach $20 Mn in 2030, exhibiting a CAGR of 6.9% during the forecast period.

Conjunctivitis, commonly referred to as pink eye, is the inflammation of the conjunctiva, a clear membrane covering the white part of the eye and lining the inner surface of the eyelid. It can result from diverse sources, including viral or bacterial infections, exposure to allergens, or irritation caused by specific substances. Viral conjunctivitis is often associated with respiratory infections, while bacterial conjunctivitis can be caused by bacteria such as Staphylococcus or Streptococcus. Allergic conjunctivitis is triggered by allergens like pollen or pet dander, provoking an immune response in the eyes. Additionally, irritants such as smoke, dust, or exposure to chemicals can also induce conjunctivitis. Common symptoms of conjunctivitis include redness, itching, tearing, and a discharge that may cause the eyelids to stick together. While viral conjunctivitis typically resolves on its own, bacterial conjunctivitis may require the use of antibiotic eye drops or ointments for treatment. Allergic conjunctivitis can be managed with antihistamines or anti-inflammatory eye drops. Over-the-counter artificial tears may provide relief in certain cases. Several pharmaceutical companies, including Novartis, Alcon, Allergan, and Bausch + Lomb, produce medications for treating conjunctivitis, offering a variety of prescription and over-the-counter options to address different causes and severity levels of the condition.

Egypt faces a considerable burden of viral conjunctivitis which affects more than 34% of the adult population. The market growth is fuelled by major contributors such as the surge in the burden of conjunctivitis, expanding healthcare infrastructure, and the evolving treatment landscape. However, conditions such as health system challenges, dominance of generic medications, and insufficient coverage limit the growth and potential of the market.

Market Dynamics

Market Growth Drivers

Increasing burden of conjunctivitis: The hot and arid climate in Egypt, coupled with frequent dust and sandstorms, provides favorable conditions for the growth of bacteria and viruses responsible for causing conjunctivitis. The estimated prevalence of viral conjunctivitis is above 34% in Egypt. Elevated exposure to allergens such as pollen and dust mites contributes to a rise in cases of allergic conjunctivitis.

Expanding healthcare infrastructure: Enhanced investments in healthcare infrastructure and insurance programs have the potential to enhance accessibility to diagnosis and treatment for conjunctivitis, especially in rural regions. The growth of private clinics and hospitals is anticipated to offer additional treatment choices and increased convenience for individuals seeking care for conjunctivitis.

Evolving treatment landscape: Pharmaceutical firms are consistently creating novel medications, encompassing targeted therapies and combination drugs, to address various forms of conjunctivitis. Progress in drug delivery mechanisms, like nanoparticles and liposomes, has the potential to enhance the effectiveness and adherence of conjunctivitis treatments.

Market Restraints

Health system challenges: Disparities in healthcare facility distribution, especially in rural regions, limit the accessibility of diagnosis and treatment for conjunctivitis. Financial challenges experienced by a considerable segment of the population may constrain their capacity to afford essential medications and consultations. Insufficient awareness regarding conjunctivitis and available treatment options among the general public can additionally hinder timely intervention.

Insufficient coverage: A considerable segment of the Egyptian population does not have access to health insurance, rendering crucial conjunctivitis medications financially out of reach for many. This circumstance may result in delayed or overlooked treatment, potentially exacerbating the condition and heightening the risk of complications.

Dominance of generics: Generic conjunctivitis medications prevail in the Egyptian market, offering a more economical option compared to branded alternatives. While this affordability enhances accessibility to treatment for a broader patient base, it may constrain market expansion for pharmaceutical companies aiming for increased profit margins through branded drugs.

Healthcare Policies and Regulatory Landscape

The main regulatory body overseeing drugs and pharmaceuticals in Egypt is the Egyptian Drug Authority (EDA), which operates under the Ministry of Health and Population. The EDA is responsible for regulating and supervising the registration, manufacturing, importation, distribution, and marketing of pharmaceutical products to ensure their safety, efficacy, and quality.

The process of obtaining licensure for drugs involves the submission of a comprehensive dossier containing detailed information on the drug's composition, manufacturing process, preclinical and clinical data, and quality control measures. The EDA conducts a thorough review of the submitted data to assess the product's safety and efficacy before granting approval for market entry.

For new entrants into the pharmaceutical market in Egypt, the regulatory environment involves adherence to stringent requirements set by the EDA. New companies must submit applications for product registration, and the approval process may involve inspections of manufacturing facilities to ensure compliance with GMP standards. The regulatory landscape in Egypt aims to strike a balance between facilitating market entry for new pharmaceutical products and safeguarding public health through rigorous evaluation and oversight by the EDA.

Competitive Landscape

Key Players

- Alcon

- Sirion Therapeutics

- Sun Pharma

- Auven Therapeutics

- Boeringer Ingelheim

- Sanofi

- Pfizer

- Atopix Therapeutics

- Allergan

- Novartis

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Conjunctivitis Therapeutics Market Segmentation

By Drug Class

- Antibiotics

- Antiviral

- Antiallergic

- Others

By Treatment

- Mast Cell Stabilizers

- Decongestant

- Immunotherapy

- Antihistamines

- Non-steroidal anti-inflammatory drugs

- Olopatadine

- Epinastine

- Others

By Disease Type

- Bacterial

- Chemical

- Viral

- Allergic

By Formulation

- Ointment

- Drops

- Drugs

By End Users

- Hospitals and clinics

- Online Pharmacies

- Retail Pharmacies

- Drug Stores

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.