Egypt Clinical Diagnostics Market Analysis

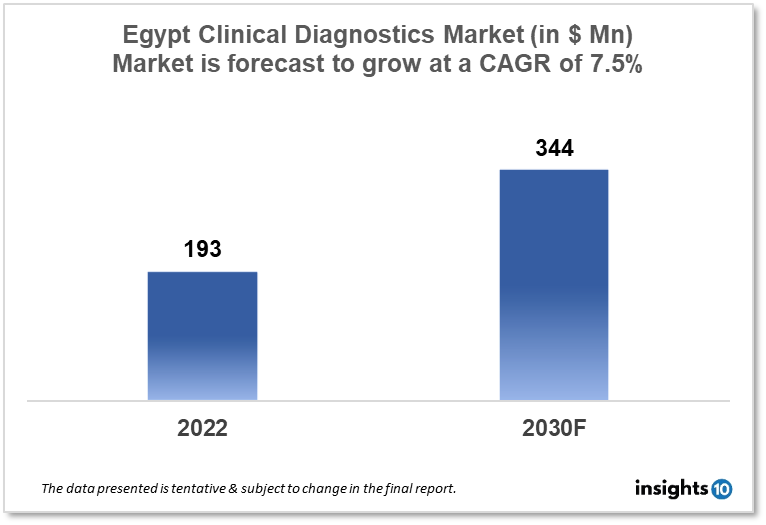

Egypt's clinical diagnostic market was valued at $193 Mn in 2022 and is estimated to expand at a CAGR of 7.5% from 2022-30 and will reach $344 Mn in 2030. One of the main reasons propelling the growth of this market is an increase in chronic disease and the aging population. The market is segmented by type, drug, and distribution channel. Some key players in this market are Biomedica Egypt, Al Borg Laboratories, NileDiagnostic, Delta Medical, Abbott, BioMérieux, Danaher Corporation, Roche, Siemens Healthineers, Beckman Coulter, and others.

Buy Now

Egypt Clinical Diagnostic Market Executive Summary

Egypt's clinical diagnostic market was valued at $193 Mn in 2022 and is estimated to expand at a CAGR of 7.5% from 2022-30 and will reach $344 Mn in 2030. Clinical diagnostics is the process of identifying and diagnosing diseases or ailments using biological samples such as blood, urine, or tissue tested in a laboratory. Diagnostic tests can assist healthcare providers in determining the source of symptoms, tracking illness development, and guiding treatment options. Diagnostic testing is an important component of modern healthcare, serving as a tool for illness prevention, diagnosis, and treatment. Technological and scientific advances have resulted in the creation of more complex and accurate diagnostic tests, increasing patient outcomes and lowering total healthcare costs.

The COVID-19 pandemic has also impacted Egypt's clinical diagnostics business, with increased demand for diagnostic tests and equipment to diagnose and monitor COVID-19 cases. As a result, there has been an increase in demand for goods such as PCR tests, antigen tests, and antibody tests. Overall, the clinical diagnostics market in Egypt is likely to expand in the coming years, owing to factors such as rising healthcare expenditure, increased demand for improved diagnostic technologies, and a growing emphasis on preventative healthcare.

Market Dynamics

Market Growth Drivers

Despite increasing healthcare expenditure, the healthcare infrastructure in Egypt remains limited in many areas, which may affect the availability and accessibility of clinical diagnostics. Many people in Egypt, particularly in rural areas, have limited access to diagnostic services due to a lack of healthcare facilities, trained healthcare professionals, and diagnostic equipment. The high cost of diagnostic tests, particularly advanced technologies such as molecular diagnostics and next-generation sequencing, may limit their availability and accessibility to patients in Egypt. Lack of awareness about the importance of early diagnosis: Many people in Egypt are not aware of the importance of early diagnosis for preventing and managing chronic diseases, which may limit the demand for clinical diagnostics. The regulatory environment in Egypt can be challenging for companies operating in the clinical diagnostics market, with complex regulations and lengthy approval processes. Multinational companies dominate the clinical diagnostics market in Egypt, which can make it difficult for local companies to compete.

Market Restraints

Diagnostic tests can be expensive, particularly advanced tests and imaging procedures. This can limit access to these tests for some patients, particularly those in low-income countries or those without adequate health insurance coverage. The interpretation of diagnostic test results requires specialized knowledge and skills, which can be in short supply in some regions. This can limit the availability and quality of diagnostic services. Clinical diagnostic products are subject to stringent regulatory requirements, particularly in developed countries. Meeting these requirements can be time-consuming and expensive, which can limit the ability of small and medium-sized companies to enter the market. The reimbursement for diagnostic tests can be limited in some countries, particularly for advanced tests and procedures. This can limit the demand for these tests and affect the financial viability of diagnostic companies. The lack of standardization in diagnostic tests can lead to variability in test results, making it difficult to compare results across laboratories or establish consistent treatment protocols. The clinical diagnostics market is subject to the threat of counterfeit products, which can pose a risk to patient safety and the reputation of legitimate diagnostic companies.

Competitive Landscape

Key Players

- Biomedica Egypt: A leading Egyptian company that provides a range of diagnostic tests and medical equipment, including clinical chemistry, hematology, and microbiology products

- Al Borg Laboratories: One of the largest medical laboratory chains in Egypt, with over 70 laboratories across the country offering a range of diagnostic services, including molecular diagnostics and next-generation sequencing

- Medico Laboratories: A leading provider of diagnostic laboratory services in Egypt, offering a range of diagnostic tests, including microbiology, hematology, and clinical chemistry

- NileDiagnostic

- Delta Medical

- Abbott

- BioMérieux

- Danaher Corporation

- Roche

- Siemens Healthineers

- Beckman Coulter

Healthcare Policies and Regulatory Landscape

Egypt's clinical diagnostics market is regulated by several government bodies, including the Ministry of Health and Population (MOHP), the Egyptian Drug Authority (EDA), and the Central Administration for Pharmaceutical Affairs (CAPA). The EDA is responsible for regulating the registration and marketing of medical devices and diagnostic tests, while the CAPA oversees the licensing of medical laboratories and the accreditation of healthcare professionals.

In 2018, the Egyptian government launched the Universal Health Insurance System (UHIS), aimed at providing comprehensive health coverage to all citizens. The UHIS is expected to drive demand for clinical diagnostics services and improve access to healthcare services across the country. Egypt is also a member of the World Health Organization (WHO) and follows its guidelines and recommendations for the regulation of clinical diagnostics products and services. The Egyptian Ministry of Health and Population (MOHP) is responsible for overseeing the healthcare sector in Egypt and is responsible for regulating medical devices and diagnostic tests. The Egyptian Drug Authority (EDA) is responsible for the registration and regulation of pharmaceuticals and medical devices, including clinical diagnostics.

The regulatory landscape for clinical diagnostics in Egypt can be complex, with lengthy approval processes and a lack of clarity in some areas. For example, the classification of diagnostic tests and the requirements for clinical data may not be clear, leading to uncertainty for companies seeking to register and market their products in Egypt. In recent years, the Egyptian government has taken steps to streamline the regulatory process for medical devices, including clinical diagnostics. For example, in 2020, the EDA announced new guidelines for the registration of IVDs, which are intended to simplify and accelerate the approval process for these products.

Reimbursement Scenario

the reimbursement scenario for clinical diagnostics in Egypt is still developing, and the majority of diagnostic tests are paid for out-of-pocket by patients. However, there have been some recent initiatives to improve the reimbursement of clinical diagnostics in Egypt. For example, the Universal Health Insurance System (UHIS) launched in 2018 aims to provide comprehensive health coverage to all citizens, which may include coverage for diagnostic tests.

In addition, some private health insurance companies in Egypt offer coverage for diagnostic tests as part of their health insurance plans. However, the availability and coverage of diagnostic tests can vary widely depending on the specific health insurance plan. The Egyptian government has also implemented several initiatives aimed at improving access to healthcare services, including diagnostic tests, for low-income families and those living in rural areas.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Egypt Clinical Diagnostics Market Segmentation

By Test

- Lab Test

- Imaging Test

- Other Tests

By Product

- Instruments

- Reagents

- Other Products

By End User (Revenue, USD Bn)

- Hospital Laboratory

- Diagnostic Laboratory

- Point-of-care Testing

- Other End Users

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.