Egypt Breastfeeding Accessories Market Analysis

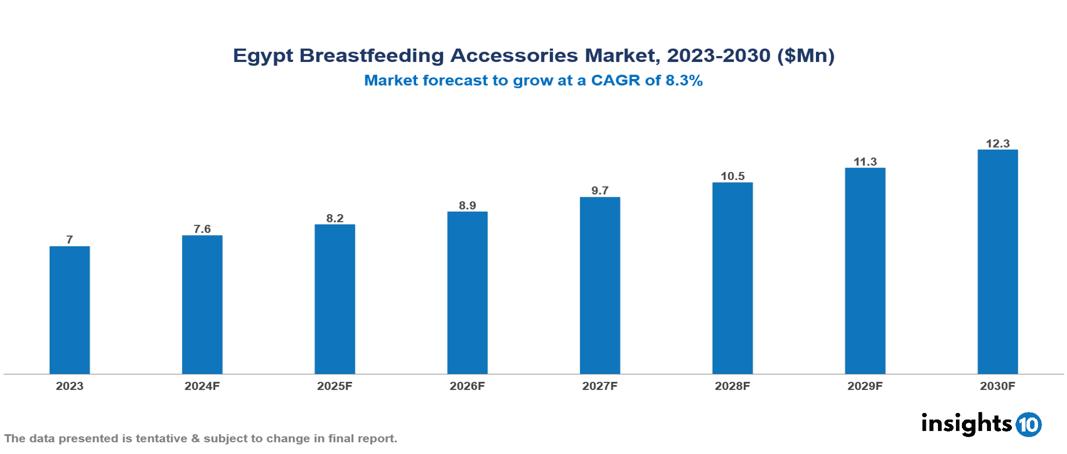

Egypt Breastfeeding Accessories Market was valued at $7.03 Mn in 2023 and is predicted to grow at a CAGR of 8.30% from 2023 to 2030, to $12.28 Mn by 2030. The key drivers of this industry include increasing awareness of breastfeeding benefits, a rising middle-class population, and improved healthcare infrastructure. The industry is primarily dominated by Medala, Elvie, Willow Innovations, and Koninklijke Philips among others.

Buy Now

Egypt Breastfeeding Accessories Market Executive Summary

Egypt Breastfeeding Accessories Market was valued at $7.03 Mn in 2023 and is predicted to grow at a CAGR of 8.30% from 2023 to 2030, to $12.28 Mn by 2030.

Breastfeeding accessories are essential tools that aim to improve the overall breastfeeding experience for both mothers and babies, addressing various needs from comfort to convenience. Key categories include manual, electric, and hospital-grade breast pumps, which cater to different pumping needs and frequencies, while nursing pads and nipple shields provide comfort by managing milk leaks and protecting sore nipples. Breast shells help collect excess milk and shield sensitive areas, and milk storage containers ensure the safe storage of expressed milk. Nursing bras and covers offer support and discreet breastfeeding options, and breastfeeding pillows provide ergonomic support to both mother and baby during feeds. Additionally, nipple creams soothe and protect against irritation. These accessories not only enhance comfort and ease for mothers but also support health by preventing infections and maintaining milk quality, ultimately contributing to a more positive, manageable, and flexible breastfeeding experience.

In Egypt, exclusive breastfeeding (EBF) rates have been consistently low, with only 13% of infants under six months exclusively breastfed according to studies from 2018 and a 2014 demographic survey. Although general breastfeeding rates are high, at 97% as of a 2012 study, exclusive breastfeeding prevalence among mothers in Cairo was only 51%. A meta-analysis from 2008 to 2022 indicates increased awareness and knowledge about EBF but highlights a lack of significant improvement in its practice, along with a decline in early breastfeeding initiation.

The market is therefore driven by significant factors like increasing awareness of breastfeeding benefits, rising middle-class population, and improved healthcare infrastructure. However, limited distribution in rural areas, cultural resistance to modern accessories, and inadequate support from healthcare providers restrict the growth and potential of the market.

A prominent player in this field is Medala, in 2024, Medela AG launched a new line of breast pumps with smart technology for real-time tracking and personalized support, enhancing milk production and breastfeeding practices. Similarly, Elvie introduced an updated wearable breast pump featuring improved suction technology and longer battery life, offering greater comfort and efficiency based on user feedback. Other contributors include Willow Innovations, and Koninklijke Philips among others.

Market Dynamics

Market Growth Drivers

Increasing Awareness of Breastfeeding Benefits: Growing awareness of the health benefits of breastfeeding is driving the demand for breastfeeding accessories in Egypt. Recent surveys indicate that 93% of mothers understand the importance of breastfeeding for infant health in 2022. This awareness is leading to increased adoption of breastfeeding accessories, such as breast pumps and nursing pads, to support breastfeeding practices.

Rising Middle-Class Population: The growing middle-class population in Egypt is expanding the market for breastfeeding accessories. With increasing disposable incomes, more families can afford breastfeeding products. According to the World Bank, Egypt's middle class grew by 8% annually over the past five years, boosting the demand for high-quality breastfeeding accessories.

Improved Healthcare Infrastructure: The enhancement of healthcare infrastructure in Egypt supports the market for breastfeeding accessories. The increase in the number of maternity hospitals and clinics with breastfeeding support programs provides better access to these products. As of 2022, the number of maternity hospitals in Egypt rose by 15%, improving accessibility to breastfeeding accessories.

Market Restraints

Limited Distribution in Rural Areas: Limited distribution of breastfeeding accessories in rural areas restricts market expansion. Rural regions in Egypt often lack access to specialized retail stores or online platforms, making it difficult for mothers to obtain these products.

Cultural Resistance to Modern Accessories: Cultural resistance to modern breastfeeding accessories can limit their acceptance in Egypt. Some mothers prefer traditional breastfeeding practices and view modern accessories as unnecessary.

Inadequate Support from Healthcare Providers: Inadequate support and guidance from healthcare providers hinder the use of breastfeeding accessories. Many healthcare providers do not offer sufficient information or recommendations about these products.

Regulatory Landscape and Reimbursement Scenario

In Egypt, the Ministry of Health is the primary regulatory body overseeing medical devices, including breastfeeding accessories. The regulatory framework focuses on ensuring the safety and efficacy of these products and align with international standards to facilitate trade and ensure product quality.

Regarding reimbursement, Egypt's public health insurance system covers some breastfeeding accessories, particularly for low-income families or specific medical conditions. Private health insurance plans may offer varying levels of coverage depending on the plan, but many consumers are expected to pay out-of-pocket for these products.

Competitive Landscape

Key Players

Here are some of the major key players in the Egypt Breastfeeding Accessories

- Medela AG

- Ameda, Inc.

- Willow Innovations, Inc.

- Koninklijke Philips N.V.

- Elvie (Chiaro Technology)

- Linco Baby

- Spectra Baby

- Hygeia Health

- NUK USA

- Mayborn Group (Tommee Tippee)

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Egypt Breastfeeding Accessories Market Segmentation

By Product Type

- Nipple Care Products

- Breast Pumps

- Breast Shells

- Breastmilk Storage & Feeding Products

- Others

By Distribution Channel

- Online retail

- Offline retail

- Hospital pharmacies

By End User

- Hospitals

- Clinics

- Homecare Settings

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.