Egypt Breast Pump Market Report

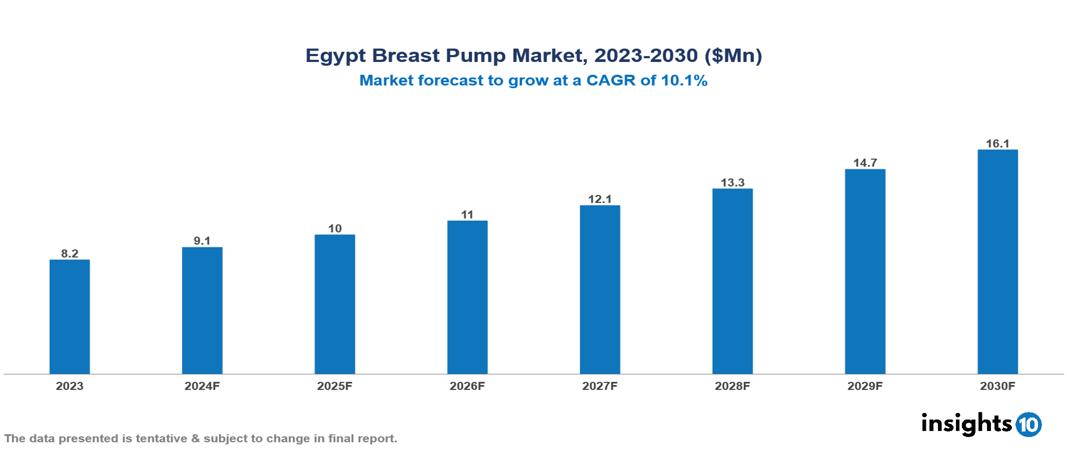

The Egypt Breast Pump Market was valued at $8.2 Mn in 2023 and is predicted to grow at a CAGR of 10.1% from 2023 to 2030, to $16.1 Mn by 2030. The key drivers of the market include improving healthcare infrastructure, growing consumer awareness, and rising disposable incomes. The prominent players in the Egypt Breast Pump Market are Bistos, Ameda, Avent, Evenflo, and Pigeon, among others.

Buy Now

Egypt Breast Pump Market Executive Summary

The Egypt Breast Pump Market is at around $8.2 Mn in 2023 and is projected to reach $16.1 Mn in 2030, exhibiting a CAGR of 10.1% during the forecast period.

A breast pump is a mechanical device that lactating women use to extract milk from their breasts. They are available in two forms; they can be manual devices powered by hand or foot movements or automatic devices powered by electricity. Breast pumps are available in a variety of styles to meet the demands of moms. Hand-operated manual pumps are lightweight and silent, making them ideal for sporadic usage. Electric pumps are often used on a regular basis because of their higher efficiency and ability to run on mains or batteries. There are several uses for breast pumps. Many parents use them to continue breastfeeding after they return to work. They express their milk at work, which is later bottle-fed to their child by a caregiver. A breast pump may be also used to address a range of challenges parents may encounter during breastfeeding, including difficulties latching, separation from an infant in intensive care, feeding an infant who cannot extract sufficient milk itself from the breast, to avoid passing medication through breast milk to the baby, or to relieve engorgement, which is a painful condition whereby the breasts are overfull.

The Egypt Breast Pump Market is driven by significant factors such as the improving healthcare infrastructure, growing consumer awareness, and rising disposable incomes. However, high cost, lack of insurance coverage, and stigma and embarrassment restrict the growth and potential of the market.

The major players in the Egypt Breast Pump Market are Bistos, Ameda, Avent, Evenflo, and Pigeon, among others.

Market Dynamics

Market Growth Drivers

Improving healthcare infrastructure: Improving healthcare infrastructure significantly drives the breast pump market. Enhanced access to maternal healthcare services, including lactation consultants and breastfeeding support, encourages mothers to initiate and continue breastfeeding. Hospitals implementing baby-friendly initiatives and providing lactation support increase the likelihood of mothers using breast pumps. As healthcare systems improve, so does the demand for breast pumps, contributing to the overall market growth.

Growing consumer awareness: More mothers are being encouraged to use breast pumps because of more easily accessible information from healthcare professionals, websites, and social media on the advantages of nursing and the ease of using a breast pump. This knowledge is further raised by government initiatives and health groups that advocate for breastfeeding as a means of enhancing baby health. Furthermore, the current need for flexible parenting and workplace assistance for nursing moms has led to a rise in the usage of breast pumps, which in turn has propelled market development.

Rising disposable incomes: Growing disposable incomes are driving the breast pump market since they allow households to spend more on high-quality medical supplies. Families are becoming more able to afford more sophisticated breast pump devices that offer more comfort, convenience, and efficiency. This economic upturn not only increases affordability but also makes people more conscious of and prioritize their health and fitness. Because of this increasing demand, producers are compelled to develop and broaden their product offerings, which propels market expansion.

Market Restraints

High Cost: The elevated cost of sophisticated breast pumps poses a substantial barrier to market growth. Even though features like hands-free operation, advanced technology, and enhanced efficiency offer clear advantages, their high prices deter budget-conscious consumers. This issue is particularly pronounced in rural areas or where healthcare reimbursements for breastfeeding equipment are limited. Consequently, the market loses many potential buyers, thereby hindering its overall expansion.

Lack of Insurance Coverage: In Egypt, where most healthcare costs are out-of-pocket expenses by individuals, the lack of insurance for breast pumps restricts their accessibility and affordability for a large segment of the population. This financial obstacle often discourages potential buyers, especially those from lower-income families, from purchasing these crucial breastfeeding aids. Consequently, without widespread insurance coverage, the breast pump market in Egypt faces challenges in achieving its full growth potential.

Stigma and Embarrassment: The stigma and embarrassment linked to using breast pumps can hinder the growth of the breast pump market. Social and cultural attitudes towards breastfeeding and breast pump use discourage some women from using these devices, especially in public or workplace environments. Discomfort with the visibility of the pump, fear of judgment, and insufficient support from employers and society contribute to this reluctance. Such societal perceptions can obstruct wider acceptance and usage, potentially restricting market expansion.

Regulatory Landscape and Reimbursement Scenario

The Egyptian Drug Authority (EDA) is Egypt’s pharmaceutical regulatory body, overseen by the Ministry of Health. It plays a vital role in ensuring the efficacy, safety, and quality of medications that are made available in the nation. The comprehensive drug approval procedure that the EDA enforces helps guarantee that only safe and effective pharmaceuticals are supplied to the Egyptian market; innovative medications that have undergone adequate testing are beneficial to patients; and public health is protected by reducing the risks associated with potentially harmful or ineffective medications.

Before new pharmaceuticals are offered in Egypt, the EDA examines applications and authorizes their marketing. It also grants licenses to producers, distributors, and wholesalers of pharmaceuticals and medical equipment. The EDA ensures medications fulfill the criteria of quality necessary for the purposes for which they are intended. This entails conducting quality control procedures, keeping up a national drug control laboratory, and inspecting manufacturing sites. When evaluating novel drugs, the EDA examines and approves clinical trial applications to guarantee participant safety and ethical research procedures. After a drug is placed on the market, the EDA actively monitors its safety by gathering and evaluating information on side effects that patients and medical experts have reported.

Egypt’s health insurance landscape includes the Universal Health Insurance (UHI) program. The UHI Law was passed in 2017 and replaced the previously fragmented insurance system of Egypt. The law aimed to provide comprehensive health insurance coverage to all Egyptian citizens. The goal of the UHI program is to provide a uniform benefits package that includes services for preventive care (checkups, screenings), services for both inpatient and outpatient care, necessary prescription drugs, maternity care, and emergency medical attention.

Competitive Landscape

Key Players

Here are some of the major key players in the Egypt Breast Pump Market:

- Bistos

- Ameda

- Avent

- Evenflo

- Pigeon

- Playtex

- Perifit

- Kimetech GmbH

- Medela AG

- Philips Avent

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Egypt Breast Pump Market Segmentation

By Product Type

- Manual pumps

- Battery-powered pumps

- Electric pumps

By Pump System

- Open System

- Closed System

By Pumping Type

- Single

- Double

By Distribution Channel

- Hospital Pharmacies

- Retail Stores

- Online Stores

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.