Egypt Antifungal Drugs Market Analysis

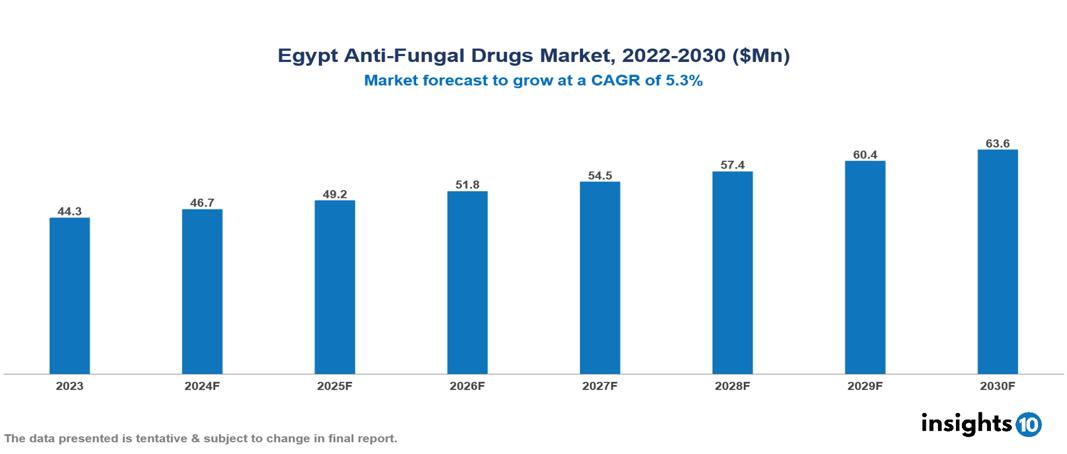

Egypt Antifungal Drugs Market is at around $0.04 Bn in 2023 and is projected to reach $0.06 Bn in 2030, exhibiting a CAGR of 5.3% during the forecast period. The market is driven by rising rates of fungal infections, the growth of the pharmaceutical industry, and government initiatives and policies. The market is dominated by key players like GlaxoSmithKline plc, Pfizer Inc., Merck & Co., Novartis AG, Abbott Laboratories, Astellas Pharma Inc., Sanofi S.A., Bayer AG, Glenmark Pharmaceuticals Limited, and Gilead Sciences Inc.

Buy Now

Egypt Antifungal Drugs Market Executive Summary

Egypt Antifungal Drugs Market is at around $0.04 Bn in 2023 and is projected to reach $0.06 Bn in 2030, exhibiting a CAGR of 5.3% during the forecast period.

Egypt's Antifungal drugs market aims to supply drugs that are intended to fight fungal infections in the nation. This market is dynamic, with changing treatment approaches and advances in medication research in response to rising healthcare knowledge and increased concerns about fungal-related disorders. Egyptian market dynamics are significantly shaped by variables such as population demography, the frequency of fungal infections, legal frameworks, and technical advancements.

The market for antifungal drugs in Egypt is expanding steadily, propelled by greater treatment awareness and an increase in the number of fungal illnesses. To take advantage of new prospects, major firms are concentrating on growing their product portfolios and improving their distribution networks. Government programs to enhance the availability of pharmaceuticals and the infrastructure supporting healthcare further support market expansion.

Revenue from sales of antifungal drugs reached $15.8 Bn worldwide in 2023, and both the stability and efficacy of these drugs have increased. Significant investment has also been made in the antifungal drug sector, which has been essential to the sector's steady growth trend. Antifungal drugs are in high demand due to improved industrial innovation, productivity, and profitability.

With about 10% market share, GSK is among the top companies in Egypt's antifungal industry. GSK provides a large selection of injectable, topical, and oral antifungal medications in Egypt. Canesten (clotrimazole), Fungarest (ketoconazole), and Lamisil (terbinafine) are a few of their well-known products. GSK introduced Locamax, a novel antifungal medication (clotrimazole and gentamicin), in Egypt in 2023. GSK additionally invests money in the study and creation of novel antifungal medications.

Market Dynamics

Market Growth Drivers:

Growing Prevalence of Fungal Infections: The need for Antifungal medications is driven by a spike in the frequency of fungal infections brought on by immunocompromised populations, aging populations, and the proliferation of drug-resistant strains.

Expansion of the Pharmaceutical Industry: As the pharmaceutical industry grows, new pharmaceuticals and treatment alternatives may be introduced, which will drive market expansion. Research and development efforts centered on antifungal medications may also contribute to this growth.

Government Initiatives and Policies: Market expansion can be aided by supportive government programs like drug cost and accessibility regulations, campaigns to prevent contagious diseases, and subsidies for necessary pharmaceuticals.

Market Restraints:

High Treatment Cost: Antifungal medications, especially the more recent or potent forms, can be costly. The high expense of therapy can discourage individuals from getting the right care or from following recommended treatment plans in a nation where funding for healthcare is scarce.

Preference for Traditional Remedies: People sometimes favor traditional or alternative treatments over prescription Antifungal medications due to cultural beliefs and preferences. This could affect the need for pharmacological treatments and restrict market expansion.

Competition from Generics: Branded pharmaceuticals may face price pressure due to the availability of generic copies of some Antifungal medications, especially those that have been on the market for a while. The revenue potential of pharmaceutical businesses operating in the Egyptian market may be impacted by this.

Healthcare Policies and Regulatory Landscape

To safeguard public health, the Egyptian Drug Authority (EDA), a pharmaceutical regulatory body within the Egyptian Ministry of Health (MOH), is in charge of making sure pharmaceutical products are safe and of high quality. Applicants must provide the Egyptian Drug Authority with adequate information from each part demonstrating the product's safety and efficacy for the uses listed in the recommended labeling to be permitted to lawfully market pharmaceutical products in Egypt. The intricate web of documents, departments, and processes involved may ensnare applicants in red tape and ambiguity. Navigating this bureaucratic labyrinth frequently necessitates the expertise of local specialists who are familiar with the peculiarities and protocols of the nation.

Competitive Landscape

Key Players:

- GlaxoSmithKline plc

- Pfizer Inc.

- Merck & Co., Inc.

- Novartis AG

- Abbott Laboratories

- Astellas Pharma Inc.

- Sanofi S.A.

- Bayer AG

- Glenmark Pharmaceuticals Limited

- Gilead Sciences Inc.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Egypt Antifungal Drugs Market Segmentation

By Drug Class

- Azoles

- Echinocandins

- Polyenes

- Allylamines

- Others

By Drug Indication

- Dermatophytosis

- Aspergillosis

- Candidiasis

- Others

By Drug Dosage

- Oral drugs

- Ointments

- Powders

- Others

By Infection

- Systemic Antifungal Infections

- Superficial Antifungal Infections

By Drug Distribution

- Hospital Pharmacies

- Retail Pharmacies

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.