Egypt Anemia Therapeutics Market Analysis

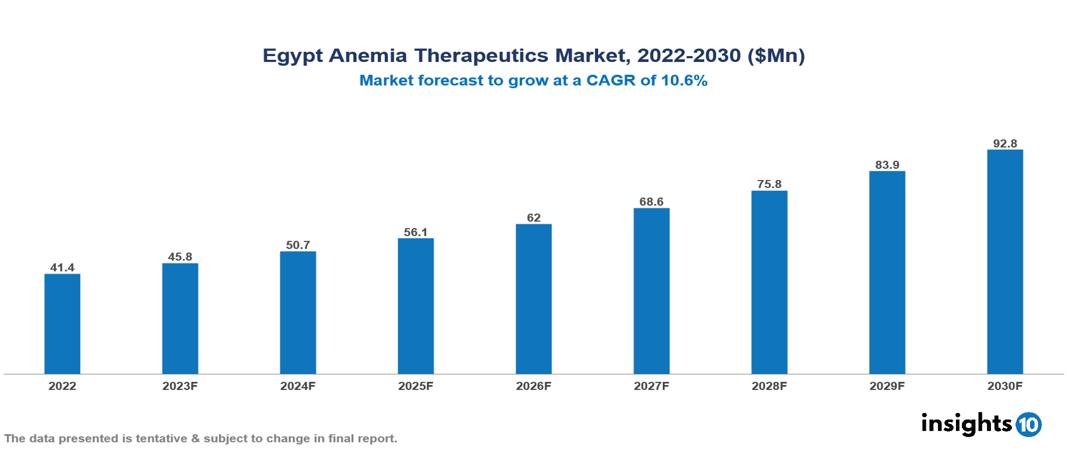

The Egypt Anemia Therapeutics Market is anticipated to experience a growth from $41 Mn in 2022 to $93 Mn by 2030, with a CAGR of 10.6% during the forecast period of 2022-2030. The key drivers for the growth of the Egypt Anemia Therapeutics Market include continuous advancements in pharmaceuticals for enhanced treatment options, a high prevalence of anemia types, particularly IDA, thalassemia, and SCA, necessitating diverse and specific therapies, and growing government initiatives focused on improving healthcare accessibility. The Egypt Anemia Therapeutics Market encompasses various players across different segments, including Novartis, Pfizer, Sanofi, Abbott Laboratories, Teva Pharmaceuticals, Foresee Pharmaceuticals, Jasper Therapeutics, Amoun Pharmaceutical Company, Pharco Pharmaceuticals, Hikma Pharmaceuticals, etc, among various others.

Buy Now

Egypt Anemia Therapeutics Market Analysis Executive Summary

The Egypt Anemia Therapeutics Market is anticipated to experience a growth from $41 Mn in 2022 to $93 Mn by 2030, with a CAGR of 10.6% during the forecast period of 2022-2030.

Anemia is a blood condition in which the body does not create enough healthy red blood cells to give oxygen to its tissues. Among the several types of anemia are hemolytic anemia, sickle cell anemia, iron-deficiency anemia (IDA), and vitamin deficiency anemia. The therapeutic plan is determined by the underlying cause of anemia. For example, iron supplements and dietary changes are usually used to treat iron deficiency anemia (IDA), whereas vitamin deficiency anemia is usually treated with vitamin supplements. To hydrate the patient and reduce discomfort, treatment options for sickle cell anemia include oxygen therapy, analgesics, and intravenous fluids. Red blood cell counts may occasionally need to be raised by bone marrow transplants or blood transfusions. One of the more recent treatments for anemia is recombinant human erythropoietin, which can be used to treat anemia caused by chemotherapy or long-term renal illness.

In Egypt, anemia affects between 40% and 50% of the population. Regional differences exist in the prevalence, with Lower Egypt showing greater rates than Upper Egypt. The most common kind, IDA, makes a substantial contribution to the total statistics. More than 40% of kids under the age of five suffer with IDA. The key drivers for the growth of the Egypt Anemia Therapeutics Market include continuous advancements in pharmaceuticals for enhanced treatment options, a high prevalence of anemia types, particularly IDA, thalassemia, and SCA, necessitating diverse and specific therapies, and growing government initiatives focused on improving healthcare accessibility.

A substantial portion of the market is held by multinational pharmaceutical corporations like Novartis, Pfizer, and Sanofi because of their robust distribution networks and diverse portfolios that cover a range of anemia types. The most common kind of anemia in Egypt is IDA, and local businesses like Amoun and Pharco are well-represented in this market.

Market Dynamics

Market Growth Drivers

Technological Developments: The global pharmaceutical industry is always coming out with new treatments for anemia. This includes the creation of novel medications with enhanced effectiveness and reduced adverse effects, focused treatments for certain anemia types, and developments in gene therapy to treat hereditary anemias such as thalassemia and SCA. These developments provide fascinating prospects for market growth. Patients in Egypt will have more alternatives for treatment as new treatments become accessible, which will further propel market expansion.

High Anemia Prevalence: IDA is a major problem in Egypt, especially for expectant mothers and young children. This is linked to poor hygiene, parasite infections, and dietary deficits. A total of 29% of Egyptian children under five and 43% of pregnant women are estimated to have IDA. In addition to IDA, thalassemia and sickle cell anemia (SCA) are two more anemia types that support the market's expansion. With 2% of babies affected, Egypt has one of the highest incidence rates of SCA worldwide. The market is driven by the need for specific therapies such as bone marrow transplants, hydroxyurea, and blood transfusions, which are necessary for certain disorders.

Growing government initiatives: The Egyptian government is putting more and more effort into expanding access to necessary medications and enhancing the country's healthcare system. This entails investing in specialist anemia treatment facilities, developing anemic screening programs, and increasing the reach of health insurance. These programs increase the accessibility and cost-effectiveness of anemia treatments, driving the market's expansion.

Market Restraints

Restricted accessibility: Egypt still has disparities in access to high-quality healthcare, especially in rural regions. This means that a sizable section of the population has restricted access to anemia diagnosis and treatment. There can be worries about the market's accessibility to fake or inferior medications, which could endanger patient safety and treatment effectiveness. Egypt's convoluted and ineffective pharmaceutical distribution system causes shortages of necessary medications and postpones patient access to care.

Cost of Treatment: Certain medicines come with a hefty price tag, particularly cutting-edge procedures like gene therapy or bone marrow transplantation. For many patients, especially those with low incomes or insufficient insurance, this can be a significant obstacle.

Limited Knowledge: Underdiagnosis and postponed treatment seeking may result from the stigma attached to anemia in some cultures. Furthermore, adherence to recommended treatment regimens may be discouraged by traditional beliefs and behaviors. Sometimes medical professionals don't have the necessary skills or training to handle progressive anemia, which affects the standard of care.

Healthcare Policies and Regulatory Landscape

Egypt's healthcare regulations are governed by the Ministry of Health and Population, which is in charge of regulating the healthcare system and assuring the quality of services. The Egyptian Drug Authority (EDA) is the national regulatory authority for pharmaceuticals and medical devices, responsible for registration, quality control, and post-market surveillance. The EDA is also responsible for medication pricing and reimbursement, as well as inspecting pharmaceutical plants to guarantee compliance with good manufacturing standards. In recent years, Egypt has implemented healthcare reforms to improve the efficiency and quality of its healthcare system, with an emphasis on increasing access to healthcare services and guaranteeing patient safety. The country has also been attempting to enhance its regulatory system in accordance with international standards and best practices.

Competitive Landscape

Key Players:

- Novartis

- Pfizer

- Sanofi

- Abbott Laboratories

- Teva Pharmaceuticals

- Foresee Pharmaceuticals

- Jasper Therapeutics

- Amoun Pharmaceutical Company

- Pharco Pharmaceuticals

- Hikma Pharmaceuticals

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Egypt Anemia Therapeutics Market Segmentation

By Type of Disease

- Iron Deficiency Anemia

- Megaloblastic Anemia

- Pernicious Anemia

- Hemorrhagic Anemia

- Hemolytic Anemia

- Sickle Cell Anemia

By Population

- Pediatrics

- Adults

- Geriatrics

By Therapy Type

- Oral Iron Therapy

- Parenteral Iron Therapy

- Red Blood Cell Transplantation

- Others

By Distribution Channel

- Hospital Pharmacies

- Drug Stores & Retail Pharmacies

- Online Pharmacies

By End User

- In-Patient Centres

- Out-Patient Speciality Clinics

- Homecare

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.