Egypt Addiction Therapeutics Market Analysis

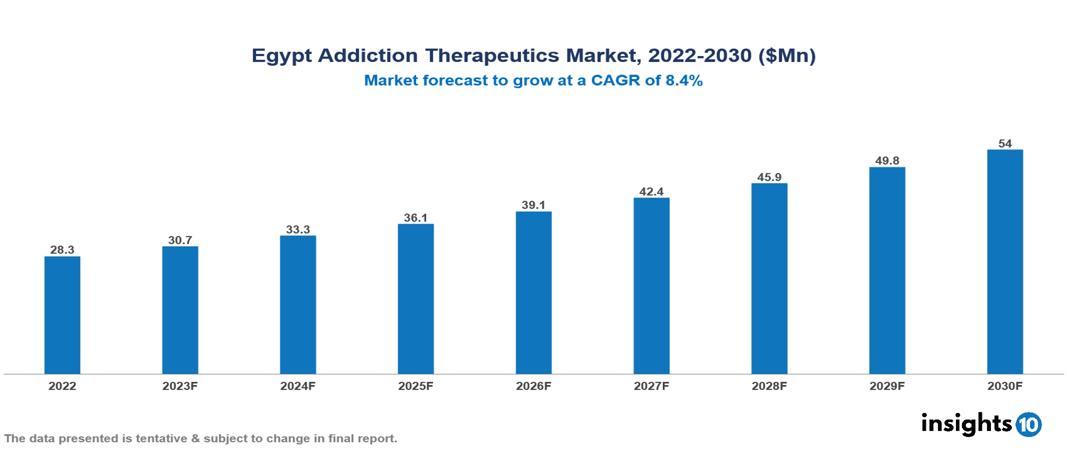

Egypt addiction therapeutics market was valued at $28 Mn in 2022 and is estimated to reach $54 Mn in 2030, exhibiting a CAGR of 8.4% during the forecast period. The industry for addiction treatment is expanding as a result of public awareness raised by anti-drug campaigns and supportive government initiatives. Dominant key players operating in the market include Indivior, Alkermes, Reckitt Benckiser, Otsuka Pharmaceutical Co., Pfizer, Mallinckrodt, Purdue Pharma L.P., GlaxoSmithKline, Teva Pharmaceutical and Novartis

Buy Now

Egypt Addiction Therapeutics Market Executive Summary

Egypt addiction therapeutics market was valued at $28 Mn in 2022 and is estimated to reach $54 Mn in 2030, exhibiting a CAGR of 8.4% during the forecast period.

Addiction is a medical condition that includes obsessive drug seeking and consumption behaviour despite its negative effects. Addiction therapeutics utilizes medications and psychological interventions that have been scientifically proven to help people stop using drugs and alcohol while also treating the underlying causes of their addiction. Personalized care in addiction treatment considers a range of variables, including the kind of addiction, the intensity of the drug use disorder, co-occurring mental health disorders, social support networks, personal preferences, and any underlying medical conditions. In order to assist long-term recovery, addiction therapies collaborate to develop a complete treatment plan that may incorporate behavioural therapy, medication, counselling, support groups, and other research-proven techniques.

Addiction is a major health concern in Egypt, affecting people of all ages and socioeconomic backgrounds. Addiction to nicotine, primarily from smoking, is still common in both adults and adolescents, with 90% of teenagers familiar with tobacco. The most popular illicit substance, hashish, has a varying prevalence of use. In 2022, 5.3% of secondary school students and 3.6% of university students were consuming illicit substances. Concerns are also raised by the growing abuse of opioids like tramadol and tranquilizers, which are abused by 4% of college students. When it comes to substance addiction, men typically show higher rates than women. Teenagers and young adults are more likely to abuse drugs, which is probably due to things like peer pressure, trying new things, and having fewer opportunities. Addiction impact varies geographically; it may be higher in urban locations like Cairo than in rural areas.

The market for addiction treatments has seen significant growth, led by Egyptian Pharma Holding Company (EPHC), which is developing local production of essential medications for addiction therapy such as buprenorphine and naltrexone in collaboration with foreign partners. This calculated action attempts to improve the price of these drugs and their accessibility for addicting patients. Furthermore, Pharco Pharmaceutical Industries has made noteworthy progress by opening a specialized facility dedicated to producing drugs for the treatment of addiction and chronic pain, strengthening Egypt's domestic supply chain for these vital therapeutics.

Market Dynamics

Market Growth Drivers

Changing Societal Attitudes and Reduced Stigma: As a result of a gradual shift in society's perceptions of addiction as a medical condition rather than a moral failing, stigma has diminished. This change makes people more likely to seek treatment, which raises the demand for comprehensive, easily available addiction therapy and fuels the market's growth.

High Burden of Addiction: There is a significant demand for effective and accessible treatment options due to the large number of people who suffer from addiction. Addiction treatment services see a corresponding boom in growth and expansion at the same time that addiction rates continue to rise sharply. More inventive, comprehensive, and easily available therapeutic solutions are required as a result of the growing market need for efficient therapies that address the wide variety of chemicals that cause addiction. Due to the urgent need to address the rising prevalence of addiction, interventions, drugs, and holistic approaches are being developed and made available, which is propelling the expansion of the addiction treatment market in Egypt.

Increasing Awareness and Recognition: Due to rising attempts to address addiction and growing awareness of substance abuse as a severe public health concern, there is a growing need for new addiction therapy medications and therapies. The growing awareness of addiction as a significant public health concern will lead to an expansion in the market for addiction therapy.

Market Restraints

Regulatory Challenges: The Egyptian Drug Authority (EDA) and other regulatory agencies have strict compliance standards and regulatory processes that could make it difficult to introduce novel drugs for addiction treatment onto the market. Complicated registration processes, strict quality standards, and lengthy approval processes could make it more difficult for new drugs to reach the market on time.

Stigma and Perception: The social stigma associated with addiction may prevent some people from getting the help they need. Addicts may be hindered from seeking treatment by societal attitudes and false beliefs that view addiction as a moral failing rather than a medical illness, which could impact the market for medications used in addiction therapy.

Limited Public Awareness: The public may still be unaware of all the options for treatment, even in spite of government initiatives to increase public knowledge of addiction and available options. The demand for medications and other services for the treatment of addiction may be impacted by this ignorance, preventing the market's expansion.

Healthcare Policies and Regulatory Landscape

The Ministry of Health and Population (MoHP) in Egypt is an important entity in establishing healthcare policies and managing the regulatory environment for drugs utilized as addiction therapeutics. The MoHP works alongside organizations such as the Egyptian Drug Authority (EDA) to guarantee that these drugs meet strict safety, effectiveness, and labelling requirements prior to being put on the market. The Egypt Drug Authority (EDA) regulates import, distribution, and licensing requirements for medicines. Guidelines for treatment protocols are developed, with an emphasis on a multifaceted strategy that includes behavioural therapies, pharmaceuticals, and support services. The focus may be on increasing the availability and affordability of medications used in addiction treatment, and pharmacovigilance and quality control procedures guarantee continuous monitoring of the safety and effectiveness of drugs.

Competitive Landscape

Key Players

- Indivior

- Alkermes

- Reckitt Benckiser

- Otsuka Pharmaceutical Co.

- Pfizer

- Mallinckrodt

- Purdue Pharma L.P.

- GlaxoSmithKline

- Teva Pharmaceutical

- Novartis.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Egypt Addiction Therapeutics Market Segmentation

By Treatment Type

- Opioid Addiction Treatment

- Alcohol Addiction Treatment

- Nicotine Addiction Treatment

- Other Substance Addiction Treatment

By Drug Type

- Buprenorphine

- Naltrexone

- Bupropion

- Disulfiram

- Nicotine Replacement Products

- Varenicline

- Others

By Treatment Centre

- Inpatient Treatment Centre

- Residential Treatment Centre

- Outpatient Treatment Centre

By Distribution Channel

- Hospital Pharmacies

- Medical stores

- Online Pharmacies

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.