Egypt Acne Therapeutics Market Analysis

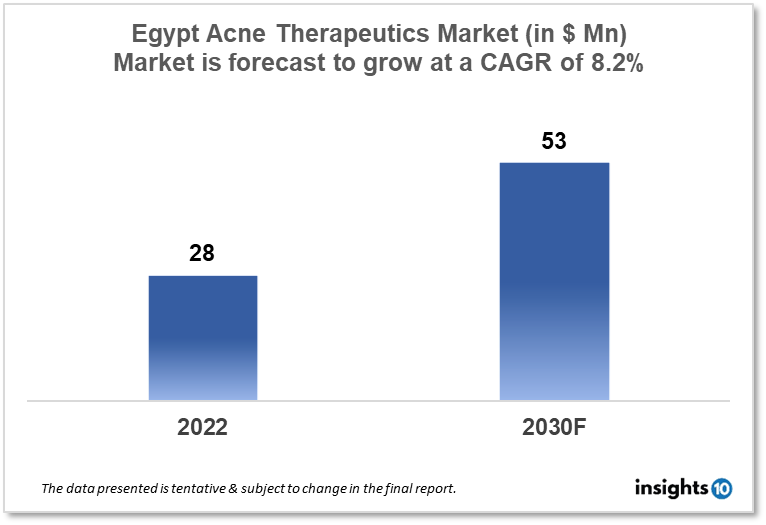

Egypt's acne therapeutics market is projected to grow from $28 Mn in 2022 to $53 Mn in 2030 with a CAGR of 8.2% for the year 2022-2030. Major market drivers include the growing prevalence of acne and the demand for novel therapeutics such as hormonal therapy for its treatment in Egypt. The Egypt acne therapeutics market is segmented by treatment, route of administration, age group, and by distribution channel. Copad Pharma, Delta Pharma, and Proactiv Company Sàrl are the key players in the market.

Buy Now

Egypt Acne Therapeutics Market Executive Analysis

The Egypt acne therapeutics market size is at around $28 Mn in 2022 and is projected to reach $53 Mn in 2030, exhibiting a CAGR of 8.2% during the forecast period. The new budget's overall spending is anticipated to reach $89 Bn. In addition to $0.62 Bn designated for the provision of medications and medical equipment, $0.36 Bn had been set aside for health insurance and the state-funded treatment of the deprived. Despite obstacles and financial constraints, the state budget allotted $10.13 Bn for health.

Acne is a long-lasting inflammatory condition that affects the pilosebaceous unit and is defined by seborrhea, comedones, papules, pustules, nodules, cysts, and, in some cases, scars and keloids. Egypt had a 34.7% self-reported acne prevalence. Significantly more women than men (39.1% vs. 30.3%) reported having acne breakouts. In Egypt, the prevalence of clinically confirmed acne was 24.4%, with females experiencing higher rates (28.6%) than males (20.25%). Acne is frequently noticeable on the face, exacerbating issues of body image and socialization. It is therefore not surprising that someone with facial acne may experience serious psychosocial disability. Teenagers are preoccupied with idealized versions of beauty all the time.

Acne treatment in Egypt seeks to manage current lesions, avoid permanent scarring as much as possible, shorten the duration of the condition, reduce morbidity, and prevent the development of new lesions. Anti-acne medications may work by restoring normal follicle keratinization, so reducing the production of sebum. Others reduce inflammation and Cutibacterium acnes growth-promoting sebum oxidation by acting as antibacterial agents against the bacteria and decreasing C. acnes growth.

In Egypt, topical therapies alone or in combination with systemic therapies in severe cases are used to tackle acne. Comedolytic agents, antibiotics, and different anti-inflammatory medications are examples of agents used topically. Agents that are administered systemically include hormones, antibiotics, zinc, and retinoids. Herbal therapy for acne has been promoted due to the benefits of improved patient tolerance, a lengthy history of use, fewer side effects, and is less expensive.

Market Dynamics

Market Growth Drivers

The high prevalence of skin disorders, rising health awareness, and increased healthcare spending are the main factors propelling the growth of Egypt's acne therapeutics market. The market is also expanding as a result of the rising demand for hormonal therapy for the treatment of acne.

Market Restraints

It may be challenging for patients to obtain effective acne treatment in some parts of Egypt due to the lack of access to healthcare. Consequently, there may be a reduction in the need for acne therapeutics due to underdiagnosis or undertreatment of acne. The regulatory environment in Egypt can be difficult to understand and navigate, especially for pharmaceutical firms seeking to market novel acne treatments. This might reduce the number of novel acne therapeutics on the market in the nation, which might limit the Egypt acne therapeutics market expansion.

Competitive Landscape

Key Players

- Ateco Pharma (EGY)

- Eva Pharma Haram Facility (EGY)

- Liptis (EGY)

- Copad Pharma (EGY)

- Delta Pharma (EGY)

- Proactiv Company Sàrl

- Vichy Laboratories

- La Roche-Posay

- L’OREAL

- Xieon Life Sciences

- Urban Skin Rx

Healthcare Policies and Regulatory Landscape

The regulatory organization in charge of regulating the development, production, distribution, and marketing of pharmaceuticals in Egypt is called the Egyptian Drug Authority (EDA). It is an agency under the Egyptian Ministry of Health and Population, and one of its main responsibilities is to guarantee the efficacy, safety, and calibre of pharmaceutical goods sold in the nation. The EDA is in charge of overseeing the safety and effectiveness of medicines that are already on the market as well as examining and approving applications for the registration of new drugs. Furthermore, it performs manufacturing facility inspections and enforces adherence to good manufacturing practices (GMPs) and other pertinent laws. In addition to performing regulation duties, the EDA also helps to advance R&D in Egypt's pharmaceutical sector. It works to foster industry-academia collaboration in order to progress scientific understanding and foster innovation in the pharmaceutical industry. It also offers advice and support to businesses seeking to develop new drugs.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Acne Therapeutics Market Segmentation

By Treatment (Revenue, USD Billion):

- Therapeutics

- Retinoid

- Antibiotics

- Hormonal Agents

- Anti-Inflammatory

- Other Agents

- Other Treatments

By Route of Administration (Revenue, USD Billion):

- Oral

- Topical

- Injectable

By Age Group (Revenue, USD Billion):

- 10 to 17

- 18 to 44

- 45 to 64

- 65 and above

By Distribution Channel (Revenue, USD Billion):

- Hospital Pharmacies

- Retail and Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.