China Pharmacy Automation Device Market Analysis

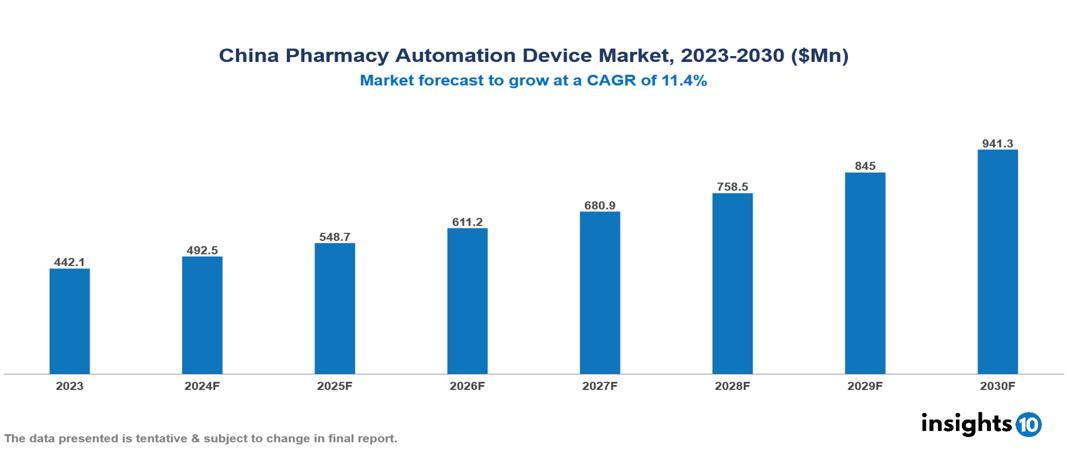

The China Pharmacy Automation Device Market was valued at $442.1 Mn in 2023 and is predicted to grow at a CAGR of 11.4% from 2023 to 2030, to $941.3 Mn by 2030. China Pharmacy Automation Device Market is growing due to Reducing Human Errors, Increasing adoption among end-users and Rising Demand for Pharmaceuticals. The market is primarily dominated by players such as Shanghai Fosun Pharmaceutical, WuXi AppTec Co, Amerisource Bergen Corporation, Omnicell, Inc., McKesson Corporation; Pearson Medical Technologies, Baxter; Talyst, LLC, Scriptpro LLC.

Buy Now

China Pharmacy Automation Device Market Executive Summary

China Pharmacy Automation Device Market is at around $442.1 Mn in 2023 and is projected to reach $941.3 Mn in 2030, exhibiting a CAGR of 11.4% during the forecast period.

Pharmacy automation, which enables prescription medications to be easily supplied and delivered in both hospital and retail settings, is extremely beneficial to modern healthcare. When a pharmacy is automated, medication errors are reduced. Errors that may arise in the manual process are prevented, such as those pertaining to prescription errors, patient data missing, medication information, formulation dispensing, therapy monitoring, and more. In order to improve healthcare facilities and services, ensure patient safety, and save costs, prescription errors must be reduced. Because of this, the pharmacy automation system is essential in minimizing errors pertaining to inventory, usage, storage, and retrieval. Increasing the precision and effectiveness of pharmacies through pharmacy automation is a very reasonable and beneficial solution.

Pharmacy automation devices in China have been increasing steadily, driven by healthcare modernization efforts and rising demand for improved patient safety. These devices have shown to increase efficiency by up to 30% in medication dispensing processes and significantly enhance effectiveness by reducing medication errors by approximately 90%. Several companies and startups are actively involved in this sector in China, including established players like BD, Omnicell, and Yuyama, alongside emerging startups focused on innovative robotics and AI technologies for pharmacy automation. This dynamic market growth reflects China's commitment to enhancing healthcare delivery through technological advancements. The market, therefore, is driven by significant factors like Reducing Human Errors, Increasing adoption among end-users and Rising Demand for Pharmaceuticals. However, High Costs, Regulatory and Compliance Challenges ,Security Concerns restrict the growth and potential of the market.

Healthmark Services Ltd., a division of Richards Packaging Inc., is partnering with JFCRx as the exclusive supplier of adherence pouch packaging, inspection, and semi-automated vial filling pharmacy automation equipment.

Market Dynamics

Market Growth Drivers

Reducing Human Errors: By reducing human error and raising efficiency, automation technologies have the potential to significantly boost production and scalability in pharmacies. Automation can, according to studies, cut down on dispensing errors by up to 85%, improving patient outcomes through expedited prescription fulfillment and inventory level monitoring. The potential for precise dose distribution and task simplification to propel the global acceptance and commercial expansion of these systems bodes well for their future.

Increasing adoption among end-users: Pharmacy automation systems are integral to hospitals aiming to improve patient care and reduce overall costs. With automation, hospitals can eliminate the need for pharmacy staff to manually count medications in the basement. Currently, 78% of hospitals in china have adopted some form of pharmacy automation to streamline operations. Hospitals are adapting by retrofitting or designing new floors to accommodate these advanced systems, optimizing space with innovative dispensing cabinets tailored to fit various floor plans. Over the past 10 years, significant advancements have been made in developing more effective and versatile drug-dispensing cabinets. These cabinets feature high-capacity drawers that can be configured in flexible ways to meet the specific needs of each facility, enhancing pharmacy automation capabilities.

Rising Demand for Pharmaceuticals: The need for drugs is rising globally due to the rising prevalence of chronic disorders like cancer, diabetes, obesity, and asthma. Approximately 60% of Chinese suffer from at least one chronic condition at the moment. Individuals suffering from these ailments are dependent on the drugs that their physicians prescribe. The world's population is also aging as more sophisticated healthcare services become accessible. Increased research and development has led to the creation of novel and effective medications aimed at certain conditions, which in turn has increased demand for pharmaceuticals.

Market Restraints

High Cost: The initial outlay for pharmacy automation devices is high and includes equipment, installation, and training costs. For instance, installing a pharmacy automation system typically costs between $200,000 and $800,000. Particularly small and medium-sized pharmacies may find it difficult to justify the expense because of their constrained funding. The cost of ownership extends beyond the acquisition price to encompass upkeep and prospective improvements. The adoption rate may be significantly slowed by this high initial cost, which acts as a disincentive. Furthermore, in areas with smaller healthcare budgets or financial limitations, the capital expenditure needed for automation might be unaffordable, which would slow down market penetration.

Regulatory and Compliance Challenges: Health authorities have set strict regulations and rules that pharmacy automation technologies must follow. The security, effectiveness, and safety of the devices are guaranteed by these rules. For manufacturers, meeting these standards may be a difficult and expensive procedure that calls for a lot of testing and paperwork. Violations may lead to harsh fines, product recalls, or prohibitions. The regulatory environment is ever-changing, adding another degree of risk and expense that can stifle innovation and impede market expansion.

Security Concerns: Cyberattacks could target pharmacy automation devices because they manage sensitive patient data and drug information. At the moment, 45% of healthcare companies have dealt with a cybersecurity event involving medical equipment or systems. It is crucial to make sure these systems are secure in order to guard against data breaches and guarantee patient privacy. Pharmacies thinking about automating may be discouraged by the danger of cybersecurity attacks and the requirement for strong security measures. The expense and resource requirements associated with implementing and maintaining high-level security mechanisms contribute to the total load. Adoption of automation technology may be impeded by security concerns, particularly in settings with inadequate cybersecurity infrastructure.

Regulatory Landscape

The regulatory landscape governing pharmacy automation devices in China is characterized by stringent standards aimed at ensuring product safety, efficacy, and compliance with local laws. Devices must adhere to regulations set by the China Food and Drug Administration (CFDA), now known as the National Medical Products Administration (NMPA), which oversees registration, manufacturing standards, and importation requirements. Key considerations include conformity assessments, clinical evaluations, and post-market surveillance to guarantee ongoing safety and performance. The market demands robust documentation, including technical files and quality management systems, to navigate the regulatory approval process successfully. Adherence to these regulations is crucial for companies entering or operating within China's pharmacy automation device market, ensuring both regulatory compliance and market competitiveness.

Competitive Landscape

Key Players

Here are some of the major key players in China Pharmacy Automation Device Market:

- Shanghai Fosun Pharmaceutical

- WuXi AppTec Co

- Cerner Oracle

- ARxIUM

- Touchpoint Medical

- Swisslog Healthcare

- Omnicell, Inc.

- McKesson Corporation

- Pearson Medical Technologies

- Baxter

- Talyst, LLC

- Scriptpro LLC

- Becton Dickinson and Company

- Fulcrum Pharmacy Management, Inc.

- Medacist Solutions Group, LLC

- Aesynt, Inc

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

China Pharmacy Automation Device Market Segmentation

Based on Pharmacy Type

- Independent

- Chain

- Federal

Based on Pharmacy Size

- Large Size Pharmacy

- Medium Size Pharmacy

- Small Size Pharmacy

Based on Application

- Drug Dispensing and Packaging

- Drug Storage

- Inventory Management

Based on End-user

- Retail Pharmacy

- Inpatient Pharmacies

- Outpatient Pharmacies

- Online Pharmacy

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.