China Patient Adherence Programs Market Analysis

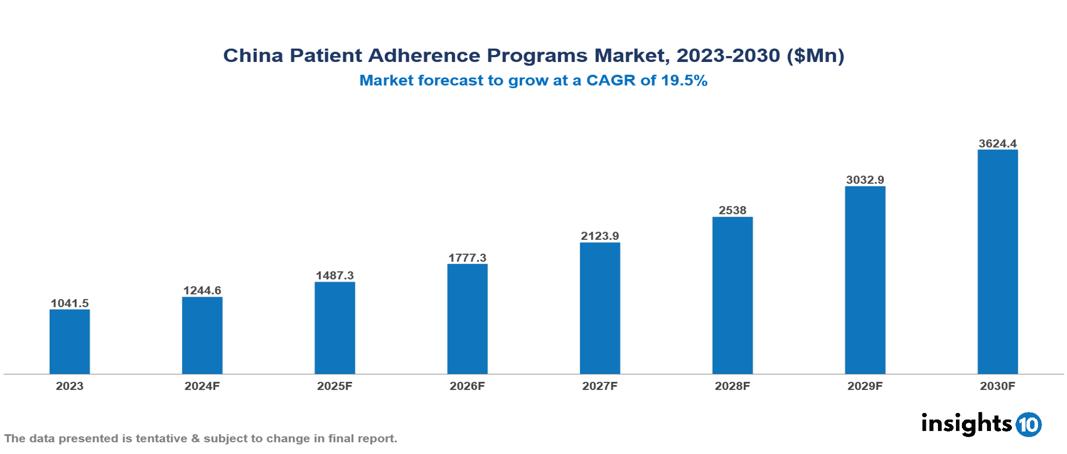

The China Patient Adherence Programs Market was valued at $1041.5 Mn in 2023 and is predicted to grow at a CAGR of 19.5% from 2023 to 2030, to $3624.4 Mn by 2030. The key drivers of the market include increasing non-adherence, rising chronic conditions, and an aging population. The prominent players of the China Patient Adherence Programs Market are, among others

Buy Now

China Patient Adherence Programs Market Executive Summary

The China Patient Adherence Programs market is at around $1,041.5 Mn in 2023 and is projected to reach $3,624.4 Mn in 2030, exhibiting a CAGR of 19.5% during the forecast period.

A patient adherence program aims to ensure that patients follow prescribed medication regimens to improve treatment outcomes, using both direct and indirect methods to assess adherence. Direct methods include monitoring therapy by measuring drug levels, metabolites, or biological markers in blood or urine, and confirming medication intake. Indirect methods, more commonly used, involve patient self-reports, pill counts, prescription refill rates, clinical response evaluations, and electronic medication monitors. Pill counts compare the number of pills taken between appointments with the prescribed dosage, while patient self-reports collect information through interviews, questionnaires, or diaries. Electronic devices such as pill bottles or blister packs track medication access to provide precise data. A widely used tool for assessing adherence is the Morisky Medication Adherence Scale (MMAS), a validated and reliable questionnaire suitable for clinical use. These approaches help healthcare providers ensure consistent medication use, ultimately enhancing patient health outcomes.

The burden of several chronic illnesses is significant, rising, and concerning among the older adult population. The China Patient Adherence Program Market is thus driven by significant factors such as increasing non-adherence, rising chronic disease prevalence, and an aging population. However, inadequate healthcare infrastructure, high implementation costs, and limited accessibility restrict the growth and potential of the market.

Market Dynamics

Market Growth Drivers

Increasing Non-Adherence: Non-adherence is a widespread problem in chronic conditions. The average medication non-adherence rates among patients with chronic conditions in China range from 22% to 57%. For hypertensive patients, the adherence to taking 2 or more medications (35.47%) was lower than that to taking one medication (58.33%). In a 2021 study conducted to evaluate medication adherence with type 2 diabetes mellitus, 62.50% of males and 37.50% of males were non-compliant with the medicines. To improve medication adherence in the country, patient adherence programs are being initiated which drive the overall market growth.

Rising Chronic Conditions: There is almost 70% of the total burden of diseases on the healthcare system and the well-being of its citizens. There is a high prevalence of chronic diseases such as diabetes, hypertension, and heart disease which require long-term therapy, which is more likely to lead to non-adherence from patients. Thus, a higher population suffering from chronic conditions translates to a larger potential pool of individuals who can benefit from the adherence programs. This directly expands the patient adherence programs market.

Aging Population: In China an estimated 402 Mn people (28% of the total population) will be over the age of 60 by 2040. The elderly population is more prone to risk from chronic diseases and multiple comorbidities, necessitating complex medication regimens that are difficult to manage without structured adherence programs. Patient adherence programs help with polypharmacy and provide monitoring and support, which raises its demand and increases the market growth.

Market Restraints

Inadequate healthcare infrastructure: It impedes the success of patient adherence programs by restricting access to vital services and resources. Inadequate facilities, a shortage of healthcare workers, and insufficient technological support prevent patients from consistently following treatment plans. Furthermore, without proper infrastructure, healthcare providers struggle to monitor and assist patient adherence, resulting in poor health outcomes and diminished trust in these programs. These issues discourage investment and limit the expansion and effectiveness of patient adherence initiatives, ultimately hindering market growth.

High Implementation Costs: Implementing cutting-edge technologies such as electronic health records (EHRs), mobile health apps, telemedicine services, and electronic monitoring tools requires substantial financial investments. Additionally, hiring specialized personnel like IT professionals, adherence counselors, and additional healthcare providers increases operational costs. Integrating these new adherence technologies with existing healthcare systems and EHRs is particularly challenging and costly. Consequently, these expenses associated with patient adherence programs can negatively impact the market.

Limited Accessibility: The growth of the patient adherence program market is significantly constrained by accessibility issues, particularly in areas with poor healthcare infrastructure. Patients may struggle with long distances to clinics, a shortage of healthcare providers, and a lack of affordable medication and support tools. Additionally, low income and lack of health insurance create further barriers, making it difficult for patients to engage in adherence programs. These challenges result in lower enrolment and participation, ultimately limiting the market's growth and effectiveness.

Regulatory Landscape and Reimbursement Scenario

China’s pharmaceutical regulatory authority was previously called China Food and Drug Administration (CFDA) which was renamed to National Medicinal Products Administration (NMPA) in 2018. The NMPA is the government agency which is responsible for regulating the pharmaceuticals, cosmetics, medical devices, and in-vitro diagnostics in the nation.

The effectiveness and safety of medications, medical equipment, and cosmetics sold in China are ensured by the NMPA. This entails checking applications, carrying out examinations, and monitoring post-market risks. Also, the whole medical product life cycle, from research and development to manufacture, marketing, and distribution, is governed by rules that are created and enforced by the NMPA. The Chinese Pharmacopoeia, which establishes quality standards for pharmaceuticals, is one of the requirements they set for the safety and quality of medicinal products. By expediting the approval procedures for cutting-edge medications and equipment, the NMPA promotes research and development of new and improved medical products.

The NRDL is the main pathway for pharmaceutical reimbursement in China, with the primary goal being to improve the affordability of drug treatments. The reimbursement landscape for pharmaceuticals in China is complex and prioritizes cost-effectiveness. Even though there are several advantages to being an NRDL member, there is competition in the process and significant cost savings. It is essential for pharmaceutical companies doing business in China to comprehend this framework.

Competitive Landscape

Key Players

Here are some of the major key players in the China Patient Adherence Programs Market:

- Takeda

- Sanofi

- Pfizer

- Novartis

- Astrazeneca

- Boehringer Ingelheim

- Amgen

- Adhere health

- Allazo Health

- Enliven Health

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

China Patient Adherence Programs Market Segmentation

By Type

- Hardware centric

- Software centric

By Medication

- Cardiovascular

- Nervous System

- Diabetes

- Gastrointestinal

- Oncology

- Rheumatology

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.