China Neurology Devices Market Analysis

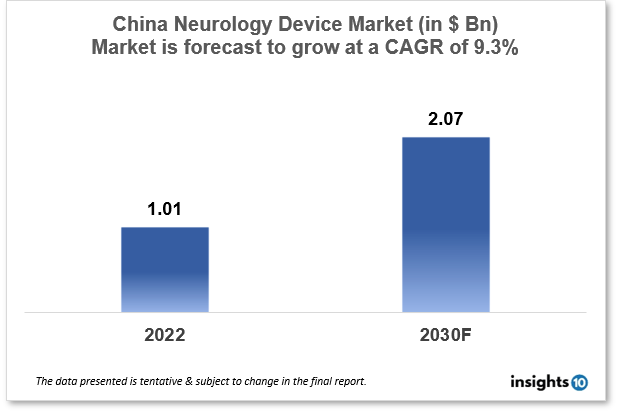

China's Neurology Device Market size is at around $1.01 Bn in 2022 and is projected to reach $2.07 Bn in 2030, exhibiting a CAGR of 9.3% during the forecast period (2022-2030). China is a leading manufacturer and simultaneous consumer of neuro devices attributed to its dominance in research and manufacturing excellence by major players like Mindray Medical International, Medtronic, JinkoSolar Holding, and Lepu Medical Technology. This report by Insights10 is segmented by product type like neurostimulation, interventional neurology, neurosurgery devices, and neuro-endoscopes, and by the end user.

Buy Now

China Neurology Device Market Executive Summary

The use of neurological devices such as Brain-Computer Interfaces (BCI) and deep brain stimulation devices is increasing in China. The Chinese government has been investing in the development and production of these devices, and there are several domestic companies producing and selling them. The healthcare system in China is also rapidly improving, which has created a growing market for these devices. However, there is a need for more regulation and standardization in the industry to ensure the safety and effectiveness of these devices. Products for cranial stabilization, tissue ablation, Cerebo-Spinal Fluid (CSF) management, neuro-critical care, duraplasty, and electrosurgery have become the forefront for neurology devices in China due to striving for clinical excellence and advanced quality care to individuals in China and increasing global demand.

Environmental factors such as pollution, lack of physical activity, and unhealthy diets contribute to the high prevalence of neurological disorders in China. The rapid pace of urbanization and changes in lifestyle have resulted in higher rates of stress, lack of sleep, and other factors that can increase the risk of neurological disorders. Many neurological disorders are underdiagnosed and undertreated in China due to a lack of awareness, resources, and access to healthcare. The incidence of stroke in China is increasing due to factors such as high blood pressure, diabetes, and unhealthy lifestyle.

China exports neurological devices to several countries globally, including - many countries in Asia, including India, Southeast Asian countries, and South Korea, import neurological devices from China. China exports neurological devices to several countries in Europe, including Germany, the United Kingdom, and France. China also exports these devices to countries in South America, including Brazil and Argentina. The United States and Canada also import neurological devices from China. China is a major producer of medical devices, including neurological devices, and exports a significant portion of its production to other countries. The demand for these devices is growing globally, and China is well-positioned to meet this demand with its competitive prices and growing manufacturing capabilities. The devices are widely used in China, and the demand for these devices is driven by the increasing prevalence of neurological disorders, the improving healthcare system in China, and the growing middle class, which is more aware of their health and willing to invest in medical devices like-

- Deep Brain Stimulation (DBS) Devices: DBS devices are used to treat Parkinson's disease and other movement disorders

- Electroencephalography (EEG) devices: EEG devices are used for diagnosing and monitoring a wide range of neurological conditions, including epilepsy, sleep disorders, and traumatic brain injury

- Transcranial Magnetic Stimulation (TMS) Devices: TMS devices are used for treating depression and other neurological conditions

- Brain-computer Interfaces (BCIs): BCIs are used to help people with disabilities control devices and perform other tasks using their brain signals

- Spinal Cord Stimulation (SCS) Devices: SCS devices are used to treat chronic pain, including back pain and neuropathic pain

Market Dynamics

Market Growth Drivers

The need for neurological devices in China is driven by several factors such as the population in China ages, and there is an increasing need for devices that can help manage age-related neurological conditions such as Parkinson's disease and Alzheimer's disease. There is a high prevalence of neurological disorders such as stroke, brain injury, and spinal cord injury in China, and these devices can help treat and manage these conditions. The Chinese government is investing heavily in improving the country's healthcare system, which has created a growing market for these devices. Advances in technology have made it possible to develop more effective and sophisticated neurological devices, which are in high demand in China. The growing middle class in China is more aware of their health and willing to invest in new and innovative medical devices, including neurological devices.

Market Restraints

The regulatory environment for medical devices in China is still developing, and there is a need for clearer and more consistent regulations to ensure the safety and efficacy of these devices due to stringent policies, the roll-out of neuro devices is a time-consuming and costly endeavor that pours onto the cost of treatment borne by the patients as well. The cost of these devices can be high, and many patients may not be able to afford them without adequate insurance coverage. Reimbursement policies for medical devices, including neurological devices, can be inconsistent and may limit their availability and affordability to patients. There is still a lack of awareness among the general public and healthcare professionals about the benefits and potential applications of neurological devices, which can limit their adoption and use, due to limited training access by neurologists the expansion of utilization of neurology devices is limited. Access to specialized care for neurological conditions is limited in many parts of China, and this can limit the availability and use of these devices.

Competitive Landscape

Key Players

- Neusoft Medical Systems

- Mindray Medical International

- Medtronic

- JinkoSolar Holding

- Lepu Medical Technology

Healthcare Policies and Regulatory Landscape

The regulatory body for medical devices in China is the National Medical Products Administration (NMPA). The NMPA, China's medical device regulatory organization, evaluates the safety, efficacy, and quality of medical devices before they are permitted for sale in China and establishes standards and rules for medical devices. It also inspects and monitors medical device manufacturing facilities, responds to adverse events and product recalls related to medical devices, provides information and guidance to industry and healthcare professionals, collaborates with international regulatory agencies to ensure that Chinese and international standards are aligned, and regulates medical device labeling, advertising, and promotion.

Reimbursement Scenario

Reimbursement for medical devices, including neurological devices, in China, is a complex issue and can vary depending on the specific device, the patient's condition, and the region. In general, reimbursement for medical devices in China is still limited and inconsistent, and patients are often required to pay for these devices out of pocket. However, the reimbursement situation is gradually improving, and the Chinese government is taking steps to increase access to medical devices for patients. The National Reimbursement Drug List (NRDL) and the Essential Drug List (EDL) include some medical devices, including some neurological devices, and these devices are eligible for reimbursement through the public healthcare system. However, the reimbursement coverage can vary widely depending on the specific device and the patient's condition, and patients may still face significant out-of-pocket expenses. Private insurance and out-of-pocket payments are also important sources of funding for medical devices in China, but they are still limited, particularly in rural areas and for people with lower incomes.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Neurology Device Market Segmentation

The Neurology Device Market is segmented as mentioned below:

By Product Type (Revenue, USD Billion):

- Neurostimulation

- ?Spinal Cord Stimulation Devices

- Deep Brain Stimulation Devices

- Sacral Nerve Stimulation

- Vagus Nerve Stimulation

- Gastric Electric Stimulation

- Interventional Neurology

- Aneurysm Coiling & Embolization

- Embolic Coils

- Flow Diversion Devices

- Liquid Embolic Agents

- Cerebral Balloon Angioplasty & Stenting

- Carotid Artery Stents

- Filter Devices

- Balloon Occlusion Devices

- Neurothrombectomy

- Clot Retriever

- Suction Aspiration Devices

- Snares

- CSF Management

- CSF Shunts

- CSF Drainage

- Neurosurgery Devices

- Ultrasonic Aspirators

- Stereotactic Systems

- Neuroendoscopes

- Aneurysm Clips

By End User (Revenue, USD Billion):

- ??Hospitals and Clinics

- Specialty Centres

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.