China Head and Neck Cancer Therapeutics Market Analysis

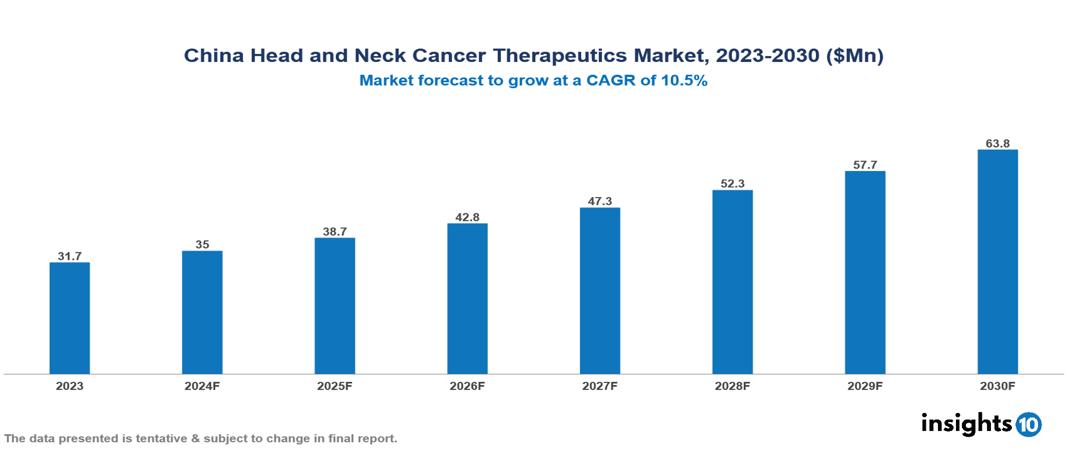

The China Head and Neck Cancer Therapeutics Market was valued at $31.72 Mn in 2023 and is predicted to grow at a CAGR of 10.50% from 2023 to 2030, to $63.81 Mn by 2030. The key drivers of this industry include an aging population, advancement in treatment, and growth in the healthcare sector. The industry is primarily dominated by players such as Bristol Myers Squibb, Merck, Roche, and Pfizer among others.

Buy Now

China Head and Neck Cancer Therapeutics Market Executive Summary

The China Head and Neck Cancer Therapeutics Market was valued at $31.72 Mn in 2023 and is predicted to grow at a CAGR of 10.50% from 2023 to 2030, to $63.81 Mn by 2030.

Head and neck cancer sites include the squamous cells lining the mucosal surfaces of the head and neck—such as those within the mouth, throat, and larynx (voice box). Head and neck cancers can also start in the salivary glands, sinuses, muscles, or nerves in these areas. Common risk factors include tobacco use, alcohol use, infection with Human Papilloma Virus (HPV), etc. The symptoms of head and neck cancer might include a painful lump in the neck, an ulcer in the mouth or throat that does not go away, trouble swallowing, and a change in voice that sounds hoarse.

In China, the age-standardized incidence rate of head and neck squamous cell carcinoma (HNSCC) is predicted to be 2.7 per 100,000, which is a comparatively low incidence. With alcohol and tobacco use being the two main risk factors for Head and Neck Cancer (HNC), there were an estimated 128,000 new instances of the disease in China, along with approximately 65,000 related deaths. The market is driven by significant factors like an aging population, advancement in treatment, and growth in the healthcare sector. However, late diagnosis, challenges in insurance and reimbursement, and side effects of treatment restrict the growth and potential of the market.

Prominent players in this field include Bristol Myers Squibb, Merck, Roche, and Pfizer among others.

Market Dynamics

Market Growth Drivers

Aging Population: The head and neck cancer therapeutics market is driven mostly by the growing number of elderly people in China, which is expected to reach 402 Mn by 2040. This change in the population highlights the growing need for efficient medicines that address age-related health problems, such as cancer, which is increasingly common among older people.

Advancement in Treatment: Among other recent advancements in the Head & Neck cancer therapeutic market, the introduction of targeted medicines, biological therapy, and immunotherapies has significantly increased the number of treatment options accessible. These advances have increased the demand for advanced therapies, which is driving the industry and giving pharmaceutical companies a significant opportunity to address the growing demand for suggested therapies.

Growth in Healthcare sector: China is currently seeing rapid growth in the healthcare sector, making it the second-largest industry globally. A favorable climate for significant expansion in healthcare is also created by improvements in medical technology, protection of intellectual property rights, and the application of long-term health initiatives like the Healthy China 2030 program. This advantageous environment also drives market dynamics in China and promotes innovation in the head and neck cancer therapeutics market.

Market Restraints

Late Diagnosis: Due to its impact on treatment effectiveness, late-stage diagnosis, which affects a large number of Chinese patients with head and neck cancer, represents a significant market restraint. Achieving successful treatment outcomes might be difficult when the diagnosis is made at an advanced illness stage (III or IV), as this generally restricts the number of therapeutic alternatives available. The head and neck cancer therapeutics market in China may face challenges due to delayed diagnosis, which may lead to more aggressive disease development, more complicated treatments, and lower overall survival rates.

Challenges in Insurance and Reimbursement: Due to poor control in managing the medical insurance fund, uneven insurance reimbursement regulations, a weak integrity system, and inadequate medical insurance fund, the Chinese market for head and neck cancer therapeutics faces significant challenges. All of these problems make it more difficult for patients to get effective therapies at reasonable prices, which limits market expansion.

Side effects of Treatment: Side effects from head and neck cancer treatments serve as a significant constraint on the market. These adverse effects can limit the use of certain therapies and reduce patient adherence, potentially impacting their overall effectiveness. The growth and innovation of the head and neck cancer therapeutics market are slowed by the hesitation of patients and healthcare providers to adopt new treatments due to concerns over severe side effects.

Regulatory Landscape and Reimbursement Scenario

The National Medical Products Administration (NMPA), previously known as the China Food and Drug Administration (CFDA), is the Chinese authority responsible for regulating drugs and medical devices. It oversees the evaluation and approval of drugs, medical devices, and cosmetics before they can be marketed in China, monitors the safety and efficacy of these products, etc. Mandatory personal accounts financed by employer and employee contributions are a part of China's health insurance program. The main services covered by these accounts are basic outpatient care. Employers also contribute to a pooled fund that is used to cover inpatient costs, critical illness outpatient expenditures, and chronic disease-related charges.

Competitive Landscape

Key Players

Here are some of the major key players in the China Head and Neck Cancer Therapeutic Market:

- Bristol Myers Squibb

- Merck

- Roche

- Pfizer

- Eli Lilly and Company

- AstraZeneca

- Novartis

- Amgen

- GlaxoSmithKline

- Sanofi

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

China Head and Neck Cancer Therapeutics Market Segmentation

By Treatment

- Targeted Therapy

- Immunotherapy

- Radiation Therapy

- Surgeries

By End Users

- Hospitals

- Specialty Centers

- Ambulatory Surgical Centers

By Distribution Channel

- Hospital-based pharmacies

- Retail pharmacies

- Online pharmacies

By Route of administration

- Injectable

- Oral

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.