China ENT Devices Market Analysis

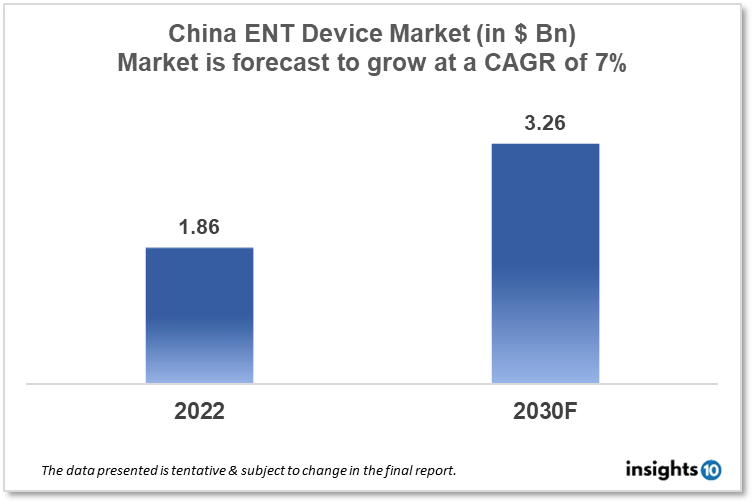

China's ENT Devices Market is projected to grow from $1.86 Bn in 2022 to $3.26 Bn by 2030, registering a CAGR of 7% during the forecast period of 2022-30. The rising prevalence of ENT disorders, such as hearing loss, sinusitis, and tonsillitis, is a major driver of the ENT device market. The market is highly competitive, with a large number of players operating in the space, ranging from small, specialized companies to large multinational corporations. The domestic key players in the China ENT devices market include Beijing Konted Medical Technology, Xuzhou Hengda Electronic, and Shenzhen.

Buy Now

China ENT Devices Market Analysis Summary

China's ENT Devices Market is projected to grow from $1.86 Bn in 2022 to $3.26 Bn by 2030, registering a CAGR of 7% during the forecast period of 2022-30.

China is an upper middle-income developing country in East Asia bordering the East China Sea, Korea Bay, and the South China Sea. In the Asia Pacific area, China is a major producer and consumer of ENT devices. ENT devices are mostly distributed through hospitals, clinics, and speciality medical equipment distributors. China has been gradually decreasing the market gap between itself and the United States. The Chinese market has grown significantly, with over 33 thousand hospitals to serve. Industry experts predicted an optimistic prognosis for the Chinese MedTech sector, driven by a growing middle class and an ageing population, as well as favourable legislation and technological improvements. China's government spent 5.6 % of its GDP on healthcare in 2020.

Market Dynamics

Market Growth Drivers Analysis

The recent flurry of Class III AI medical devices licenced for sale in China demonstrates that such goods have a significant business possibility. COVID-19 has advanced current digital healthcare trends in China, creating the market potential for global MedTech AI and software businesses. Many recent technological advancements in ENT devices have occurred, including 3D printing, robotics, and artificial intelligence. Chinese firms are investing in these technologies in order to remain competitive. These aspects could boost China's ENT Devices Market.

Market restrains.

There are strict criteria that must be followed in China. Traditional Chinese life sciences regulatory frameworks were designed with hardware in mind, therefore there is a regulatory lag as the frameworks catch up to the most recent medical technology breakthroughs. While the Chinese market for ENT devices is expanding, there are issues with cost, reimbursement, and access to healthcare in some areas of the country. These factors may deter new entrants into the China ENT Devices Market.

Competitive Landscape

Key Players

- Beijing Konted Medical Technology - Based in Beijing, China, this company produces a range of medical devices for use in ENT, including ear specula, nasal forceps, and suction tubes

- Xuzhou Hengda Electronic - Based in Xuzhou, China, this company produces a range of medical devices for use in ENT, including video laryngoscopes, endoscopes, and surgical navigation systems

- Tonglu Wanhe Medical Instrument - Based in Tonglu, China, this company produces a range of medical devices for use in ENT, including ear specula, forceps, and suction tubes

- Sino-Hero (Shenzhen) Bio-Medical Electronics - Based in Shenzhen, China, this company produces a range of medical devices for use in ENT, including endoscopes, light sources, and image processing systems

- Suzhou Tianyu Medical Equipment - Based in Suzhou, China, this company produces a range of medical devices for use in ENT, including laryngoscopes, endoscopes, and surgical instruments

Recent Notable Updates

November 2022: The NMPA initially approved the ENT active implants in June and July of 2022, with a clinical evaluation report (CER) that included Hainan real-world data to support the equivalency reasoning and offer safety and effectiveness outcomes in the Chinese population. BradyKnows offers complete regulatory and clinical solutions for such successful cases. It adheres to Hainan's urgent usage policy by collecting real-world data and incorporating it into the clinical evaluation report (CER) for NMPA approval. Five Class III imported medical devices with RWD have been approved by the NMPA, two of which are BradyKnows cases.

Healthcare Policies and Reimbursement Scenarios

In China, the regulation and reimbursement of ENT (Ear, Nose, and Throat) devices are overseen by various bodies, including the National Medical Products Administration (NMPA) and the National Healthcare Security Administration (NHSA). The NMPA is responsible for regulating medical devices in China, including ENT devices such as hearing aids, cochlear implants, and nasal dilators. The Chinese government establishes the reimbursement rates for medical devices in China, including ENT devices. The rates are based on the clinical and cost-effectiveness of the devices and are reviewed periodically.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

ENT Device Market Segmentation

The ENT Device Market is segmented as mentioned below:

By Product Type (Revenue, USD Billion):

- Diagnostic Devices

- Surgical Devices

- Hearing Aids

- Hearing Implants

- Co2 Lasers

- Image-Guided Surgery Systems

By Diagnostic Devices (Revenue, USD Billion):

- Endocsopes

- Hearing Screening Devices

By Surgical Device (Revenue, USD Billion):

- Powered Surgical Instruments

- Radiofrequency (RF) Handpieces

- Handheld Instruments

- Balloon Sinus Dilation Devices

- ENT Supplies

- Ear Tubes

- Voice Prosthesis Devices

By End Users (Revenue, USD Billion):

- Hospitals and Ambulatory Settings

- Home Use

- ENT Clinics

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.