China Diabetes Devices Market Analysis

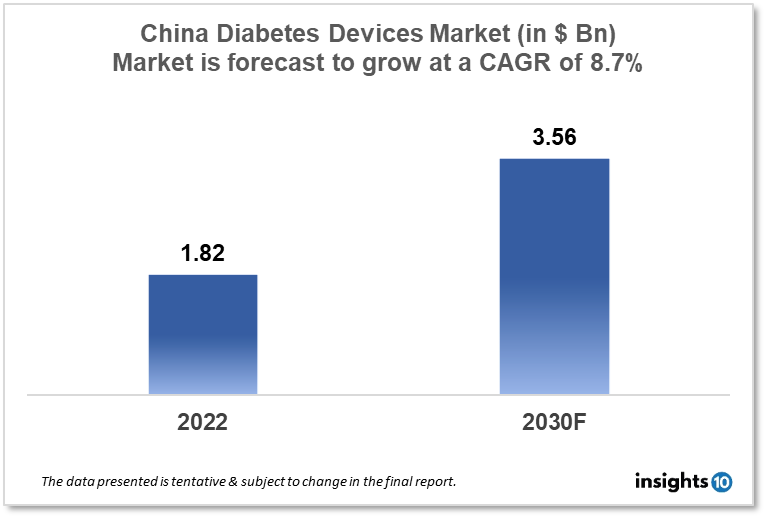

The China Diabetes Devices Market is expected to grow from $1.82 Bn in 2022 to $3.56 Bn in 2030 with a CAGR of 8.70% for the forecasted year 2022-2030. Diabetes is a common condition in China, where the demand for diabetes-related products and devices is rising. The prevalence of diabetes is anticipated to increase as the population ages and urbanizes, providing significant opportunities for diabetes device manufacturers. The market is segmented by type and by the end user. Some key players in this market include Lepu Medical Technology, MicroPort, Johnson & Johnson, Medtronic, Roche, Ascensia Diabetes Care and Dexcom.

Buy Now

China Diabetes Devices Healthcare Market Executive Analysis

The China Diabetes Devices Market is at around $1.82 Bn in 2022 and is projected to reach $3.56 Bn in 2030, exhibiting a CAGR of 8.70% during the forecast period. In China, health and family planning data reached a sum of $46.05 billion as of December 2022. Since the previous projection for November 2022 was $28.02 Bn, this might indicate an increase. The information reached a new low of $1.86 billion in January 2010 before hitting its peak of $46.05 billion in December 2022. In terms of GDP in 2022, China's health expenditures were 5.4%. Health expenditure in China increased as a percentage of GDP at an average annual rate of 1.00% from 4.5% of GDP in 2000 to 5.4% of GDP in 2022.

In China, diabetes is a serious health problem that affects a big and expanding population. In 2021, the prevalence of diabetes in China will be 12.8%, which is higher than the global average of 10.5%. In China, more than 116 million people have diabetes. Diabetes is more common in urban than rural regions in China, with an urban prevalence of 14.5% and a rural prevalence of 10.9%. Over 90% of all instances of diabetes in China are type 2, making it the most prevalent type of the disease. With a prevalence of 26.6% in individuals aged 70 and older, diabetes is more common in older age groups. With a prevalence of 13.5% in males and 12.2% in women, diabetes is more prevalent in men in China.

In China, where illness is extremely common, diabetes management tools are essential. In China, blood glucose monitors are a crucial part of the diabetes management arsenal. With the aid of these gadgets, patients can check their blood sugar levels at home and modify their lifestyle or medicine as necessary. Devices for continuous glucose monitoring (CGM), which provide real-time statistics and insights into blood glucose trends, are also gaining popularity in China. Diabetes patients can administer insulin with the help of insulin pumps. These gadgets can aid in enhancing glycemic control and lowering the danger of complications brought on by either elevated or low blood sugar levels. Insulin pumps are a common treatment for people with type 1 diabetes and poorly controlled type 2 diabetes in China. Diabetes patients can administer insulin with the help of insulin syringes, which are practical and simple to use. These devices, which come in disposable and reusable varieties, provide a more covert and practical substitute for conventional insulin shots. In order to offer patients a complete diabetes management solution, smart diabetes management systems combine a variety of diabetes devices, including blood glucose monitors, insulin pumps, and mobile applications. These tools can provide real-time information and insights into the management of diabetes, which can assist patients and healthcare professionals in making better treatment choices.

Market Dynamics

Market Growth Drivers

Diabetes is a common condition in China, where the demand for diabetes-related products and devices is rising. The prevalence of diabetes is anticipated to increase as the population ages and urbanizes, providing significant opportunities for diabetes device manufacturers. More patients are seeking a diagnosis and treatment for diabetes in China as knowledge of the illness and its complications rises. Demand for diabetes devices is being driven by this tendency as patients and healthcare professionals look for cutting-edge treatments for the condition. Diabetes devices are becoming more advanced and linked, providing patients and healthcare professionals with more information and insights into managing their diabetes. Manufacturers of diabetes devices who can offer cutting-edge and efficient solutions will be well-positioned to thrive in the China market as technology develops. China has recently made sizable investments in its healthcare system, with an emphasis on the management of chronic diseases. As the government and private payers work to better diabetes care and outcomes, this investment is anticipated to spur demand for diabetes devices.

Market Restraints

China's diabetes devices market is extremely valuable and domicile to many well-known companies. It might be challenging for new competitors to get a footing in the market and compete with these well-known names. Diabetes supplies need to meet stringent regulatory standards and qualify as medical devices before they can be sold in China. The possible expense and time commitment of this process may make it difficult for some producers to enter the market.

Competitive Landscape

Key Players

- Lepu Medical Technology (CN)

- MicroPort (CN)

- Johnson & Johnson

- Medtronic

- Roche

- Dexcom

- Ascensia Diabetes Care

Recent Notable Deals

2022: An agreement for distribution between Ascensia Diabetes Care and Sinocare Group allowed the worldwide provider of solutions for diabetes management to increase its presence in China. The distribution of Ascensia's blood glucose monitoring devices and test strips in China is covered by the deal.

Healthcare Policies and Regulatory Landscape

The National Essential Medicines List (NEML), created by the Chinese government, contains a list of essential medications that are deemed required and reasonably priced for basic healthcare. Several diabetes medications and tools, including insulin pens and glucometers, were added to the NEML in 2018, making them more broadly accessible and cost-effective for patients. China's new medical device regulations, which went into effect in 2020, have stricter criteria for product registration and clinical trials. The goal of the new rules is to increase the effectiveness and safety of diabetes devices in China. The Chinese government has been putting into effect a number of healthcare reforms meant to increase access and lower expenses. These changes include programs like the development of telemedicine services, the growth of public hospitals, and the creation of a national health insurance system, all of which could be advantageous for the market for diabetes devices.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Diabetes Devices Market Segmentation

By Type (Revenue, USD Billion):

The market is divided into blood glucose monitoring systems, insulin delivery systems, and mobile applications for managing diabetes within the type segment. Due to its convenience, ease of use, and usefulness in providing patients and healthcare professionals with real-time insights regarding diabetic conditions for integrated diabetes management, the segment for diabetes management mobile applications is anticipated to grow at the highest rate during the forecast period. Bare-metal Stents

- Blood glucose monitoring systems

- Self-monitoring blood glucose monitoring systems

- Continuous glucose monitoring systems

- Test strips/Test papers

- Lancets/Lancing Devices

- Insulin delivery Devices

- Insulin pumps

- Insulin pens

- Insulin syringes and needles

- Diabetes management mobile applications

By End User (Revenue, USD Billion):

The diabetes market is divided into hospitals & specialty clinics and self & home care, based on the end user.

- Hospitals & Specialty Clinics

- Self & Home Care

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.