China Dermatological Therapeutics Market Analysis

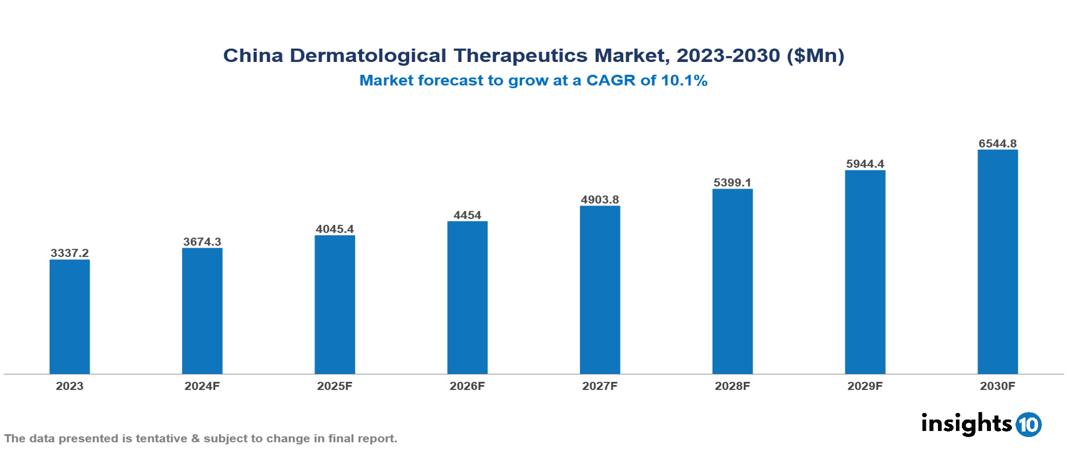

China Dermatological Therapeutics Market is at around $3.34 Bn in 2023 and is projected to reach $6.54 Bn in 2030, exhibiting a CAGR of 10.1% during the forecast period. The market is growing as a result of urbanization, increasing elderly population, and growing awareness. The market is dominated by key players like Fosun Pharma (CHN), Sinopharm (CHN), Jiangsu Hengrui Medicine (CHN), CSPC Pharmaceutical Group (CHN), Hualan Biological Engineering (CHN), Harbin Pharmaceutical Group (CHN), Yunna Baiyao Group (CHN), Sino Biopharmaceutical (CHN), Pfizer, Johnson & Johnson, Novartis AG, and GlaxoSmithKline PLC.

Buy Now

China Dermatological Therapeutics Market Executive Summary

China Dermatological Therapeutics Market is at around $3.34 Bn in 2023 and is projected to reach $6.54 Bn in 2030, exhibiting a CAGR of 10.1% during the forecast period.

Dermatological therapy includes a broad spectrum of medical and cosmetic procedures designed to treat different skin disorders that are common among Chinese people. Alongside contemporary Western medicine, dermatological therapies are frequently influenced by Traditional Chinese Medicine (TCM) techniques. The field consists of medications, topical therapies, and cutting-edge technology designed to enhance skin health and treat dermatological issues specific to the Chinese population. The field of dermatological treatments is constantly changing in China as a result of ongoing research and development.

Growing awareness of skincare and beauty is fueling the rapid expansion of the dermatological market in China. The market is expanding due to factors like an increase in dermatological problems, an older population, and rising disposable incomes. In an ever-changing industry, skincare brands from around the world and locally are aggressively competing by utilizing cutting-edge products and digital marketing techniques. Government programs and a greater emphasis on well-being and health are two other factors driving the expansion of the Chinese dermatological market.

In 2023, the global market for dermatological treatments brought in $40.94 Bn, a significant rise over the previous year. The industry is transforming, and this boom is being driven by efficient production techniques and revolutionary technologies. The market for dermatological treatments has been shaped into a thriving and expanding sector by the dynamic confluence of accessibility, innovation, and financial assistance.

Fosun Pharma has collaborated with other international businesses to create and market dermatological medications in China. They are working along with AstraZeneca to co-develop and market the biological treatment for psoriasis called brodalumab.

Market Dynamics

Market Growth Drivers:

Rapid Modifications to Lifestyle and Urbanization: Skin diseases including psoriasis, acne, and eczema are becoming more common in metropolitan areas due to increased sun exposure, stress, and pollution.

Aging Population: Chronic skin conditions including rosacea and seborrheic dermatitis are more common in China's aging population which is growing the market for dermatological therapeutics.

Growing Public Awareness: The importance of good skin care practices and the availability of efficient treatments among people is driving up demand for dermatological medicines.

Market Restraints:

Regulatory Environment: The market for dermatological medicines may be greatly impacted by modifications to regulatory laws and approval procedures.

Global Health Events: Circumstances like pandemics or infectious disease outbreaks might influence healthcare goals and systems, which could have an effect on the market for dermatological medicines.

Price controls: The government imposes price caps on several medications, which have an effect on pharmaceutical companies' profits and may deter investment in dermatological treatments R&D.

Healthcare Policies and Regulatory Landscape

National Medical Products Administration (NMPA) oversees the regulation of pharmaceuticals and medical devices in China. The approval procedure for drugs typically entails a New Drug Application (NDA) filed by the applicant with the NMPA. After reviewing the NDA, the NMPA visits the applicant's manufacturing facilities to do an on-site inspection. NMPA often has stricter data requirements for clinical studies than other countries, which can make the process more expensive and time-consuming.

Competitive Landscape

Key Players:

- Fosun Pharma (CHN)

- Sinopharm (CHN)

- Jiangsu Hengrui Medicine (CHN)

- CSPC Pharmaceutical Group (CHN)

- Hualan Biological Engineering (CHN)

- Harbin Pharmaceutical Group (CHN)

- Yunna Baiyao Group (CHN)

- Sino Biopharmaceutical (CHN)

- Pfizer

- Johnson & Johnson

- Novartis AG

- GlaxoSmithKline PLC

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

China Dermatological Therapeutics Market Segmentation

By Type

- Prescription-based Drugs

- Over-the-counter Drugs

By Disease

- Alopecia

- Herpes

- Psoriasis

- Rosacea

- Skin Cancer

- Acne

- Atopic Dermatitis

- Vitiligo

- Hidradenitis

- Other Applications

By Drug Class

- Anti-infectives

- Corticosteroids

- Anti-acne

- Calcineurin Inhibitors

- Retinoids

- Other Drug Classes

By Route of Administration

- Topical Administration

- Oral Administration

- Parenteral Administration

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.