China Dental Caries Detectors Market Analysis

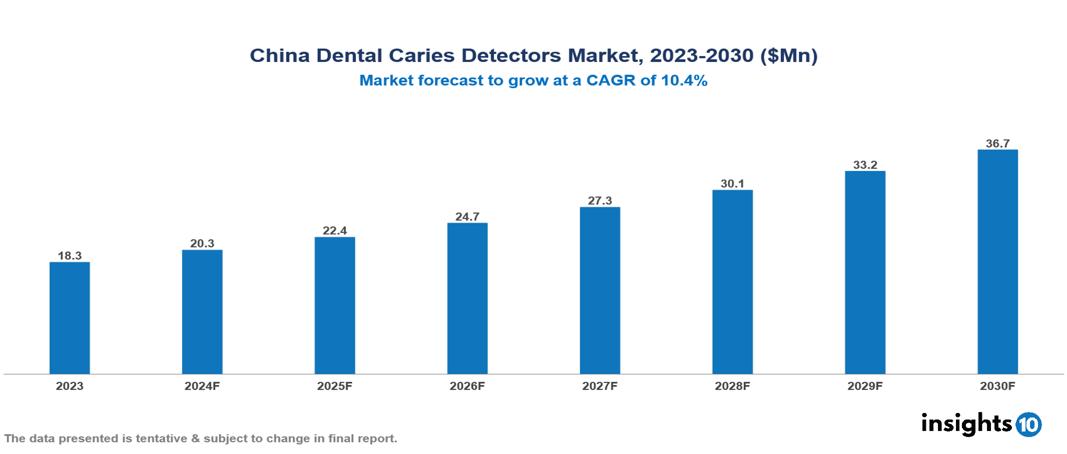

The China Dental Caries Detectors Market was valued at $18.3 Mn in 2023 and is predicted to grow at a CAGR of 10.4% from 2023 to 2030, to $36.7 Mn by 2030. China Dental Caries Detectors Market is growing due to the Rising prevalence of dental caries, Economic Growth, Increasing Disposable Income, and Advanced imaging and diagnostics. The market is primarily dominated by players such as Weizhou, Shanghai Jahwa, Smile 360, Pacific Dental Services, Dental Services Group, Sirona Dental Systems, Dentsply Sirona, KaVo Kerr, Ivoclar Vivadent, Planmeca Oy, Adec Technologies, 3M ESPE, Morita Corporation, Woodpecker Medical Instruments Co., Softdent.

Buy Now

China Dental Caries Detectors Market Executive Summary

China Dental Caries Detectors Market is at around $18.3 Mn in 2023 and is projected to reach $36.7 Mn in 2030, exhibiting a CAGR of 10.4% during the forecast period.

Dental caries, or tooth decay, is the most prevalent oral health condition. Cavities arise from the bacterial erosion of tooth enamel and dental health caused by a variety of factors, such as insufficient calcium or poor brushing technique. Using the caries detection method, holes in the proximities of teeth should be found as soon as possible. As a result, dental caries detectors are essential for identifying the location, size, and depth of carious interproximal lesions. Effective treatment plans can be implemented using less sophisticated technology by using dental X-rays, lasers, transillumination, revealing solutions, or other methods.

The third national epidemiological survey on oral diseases found that, while filling rates are low, persons in the 35-44 and 65-74 age groups also have poor filling rates, and children between the ages of 5-6 continue to have significant caries prevalence rates. Rising healthcare expenses, driven by economic growth and increasing demand for advanced dental care, further propel the market. Additionally, demographic factors such as urbanization and an aging population with greater susceptibility to dental issues contribute to market expansion. The market, therefore, is driven by significant factors like the Rising prevalence of dental caries, Economic Growth, Increasing Disposable Income, and Advanced imaging and diagnostics. However, High Cost and Economic Disparity, Regulatory hurdles, Cultural and Institutional Resistance restrict the growth and potential of the market.

Air Techniques Inc., an important producer, and leader of dental equipment, launched ScanX Classic View, a state-of-the-art digital radiography structure.

Market Dynamics

Market Growth Drivers

Rising Prevalence of Dental Caries: Dental caries remains a significant public health concern in China, with a high incidence rate, especially among children and the elderly. The increasing prevalence of caries drives the demand for effective diagnostic tools to detect and manage the condition early, propelling the market for dental caries detectors.

Economic Growth and Increasing Disposable Income: China rapid economic growth has resulted in increased disposable income among its population. In fact, disposable income per capita has risen by 8% annually over the past decade. As a result, more people are now willing to invest in their health, including dental care. This economic shift has heightened demand for advanced dental technologies and services, such as dental caries detectors, as patients increasingly prioritize better quality care and preventive measures.

Advanced imaging and diagnostic: Greater sophistication in caries detection tools is now available because to advancements in dental imaging and diagnostic technologies. Compared to methods using radiographic imaging, fluorescence, and transillumination, these instruments identify holes significantly more quickly. The need for advanced caries detectors is rising due to dental professionals' increasing need for more precise and effective diagnostic instruments.

Market Restraints

High Cost and Economic Disparity: Digital imaging tools and laser fluorescence are two examples of advanced dental caries diagnosis techniques that are frequently expensive. For instance, the average cost of a laser fluorescence apparatus might be more than $8,000, making it unaffordable for smaller clinics and dental offices. Since they can't afford to invest in new technologies due to their high cost, many practitioners still rely on outdated techniques. The total growth of the market is impacted by this resistance to implementing novel detection techniques. Particularly smaller clinics with little funding, the initial outlay and continuing maintenance expenses can be a substantial financial strain. This prevents potential market expansion by delaying the broad adoption of sophisticated caries detection technology.

Regulatory Hurdles: Regulatory agencies may have rigorous and drawn-out approval procedures for novel dental equipment. The market debut of novel caries detection instruments may be postponed while safety and effectiveness are ensured by this regulatory oversight. Manufacturers may encounter difficulties in adhering to regulatory standards due to the time and money involved, which could hinder the release of new technologies and hinder the expansion of the market.

Cultural and Institutional Resistance: Traditional practices and resistance to change can also impede the adoption of new technologies. Many dental practitioners in China are accustomed to conventional diagnostic methods and may be skeptical about the benefits of dental caries detectors. Overcoming this resistance requires targeted educational campaigns, demonstrations of the technology's effectiveness, and strong advocacy from influential figures in the dental community.

Regulatory Landscape and Reimbursement Scenario

Regulatory landscape for the dental caries detectors market is evolving, focusing on stringent quality and safety standards. The National Medical Products Administration (NMPA) oversees the approval and monitoring of dental devices, ensuring compliance with the latest technological and safety regulations. Companies must navigate complex approval processes, including rigorous clinical trials and testing. Recent regulations emphasize the need for innovative, non-invasive diagnostic tools, pushing manufacturers to invest in advanced technologies. Additionally, China is enhancing its intellectual property laws to protect medical device innovations, encouraging foreign investments. However, market entry remains challenging due to stringent regulatory requirements, necessitating thorough understanding and adherence to local regulations for successful market penetration.

In China's dental caries detectors market, reimbursement policies are evolving alongside the expanding healthcare system. Insurance coverage for dental services is limited, with many patients paying out-of-pocket, affecting the adoption of advanced detection technologies. Public health initiatives aim to improve access, yet reimbursement rates for diagnostic procedures remain low. Technological advancements, such as digital imaging and fluorescence-based detectors, are slowly being integrated, but their high costs and limited insurance coverage hinder widespread use. Efforts to enhance reimbursement policies and increase insurance coverage are crucial for boosting the adoption of advanced dental caries detection methods in China.

Competitive Landscape

Key Players

Here are some of the major key players in the China Dental Caries Detectors Market:

- Weizhou

- Shanghai Jahwa

- Smile 360

- Pacific Dental Services

- Dental Services Group

- Sirona Dental Systems

- Dentsply Sirona

- KaVo Kerr

- Ivoclar Vivadent

- Planmeca Oy

- Adec Technologies

- 3M ESPE

- Morita Corporation

- Woodpecker Medical Instruments Co.

- Softdent

- Elmeco

- Anthogyr

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

China Dental Caries Detectors Market Segmentation

Based on Type

- Laser Fluorescent caries detector

- Fiber Optic

- Trans-Illumination Caries Detector

- Others

Based on the Distribution Channel

- Online Platforms

- Offline Platforms

Based on End-user

- Hospitals

- Dental clinics

- Ambulatory Surgical Centres

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.