China Constipation Therapeutics Market Analysis

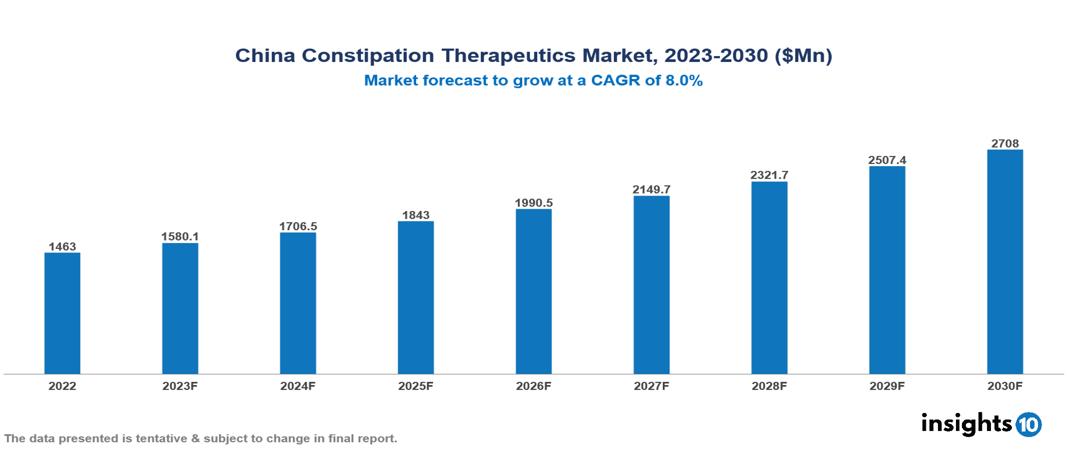

China Constipation Therapeutics Market was valued at $1463 Mn in 2022 and is estimated to reach $2708 Mn in 2030, exhibiting a CAGR of 8% during the forecast period. The constipation therapeutics market is experiencing growth driven by the rising prevalence of constipation worldwide, attributed to factors like aging, sedentary lifestyles, and unhealthy dietary habits, with the expanding elderly population, more prone to chronic conditions, further contributing to this market expansion. Notable participants in this industry include Pfizer, AstraZeneca, Johnson & Johnson, GlaxoSmithKline, Merck & Co., Novartis, Sanofi, Takeda, Shanghai Fosun Pharmaceutical, and Beijing Tongrentang.

Buy Now

China Constipation Therapeutics Market Executive Summary

China's Constipation Therapeutics Market was valued at $1463 Mn in 2022 and is estimated to reach $2708 Mn in 2030, exhibiting a CAGR of 8% during the forecast period.

Constipation is a digestive condition characterized by infrequent, difficult, or hard bowel movements due to slowed transit of stool through the colon, leading to increased water absorption and stool hardening. This condition results from a decrease in the speed at which feces pass through the large intestine. Common symptoms of constipation include straining during defecation, a sensation of incomplete evacuation, abdominal discomfort, and irregular or infrequent bowel habits. Various factors, such as a low-fiber diet, insufficient fluid intake, lack of physical activity, specific medications, and underlying medical issues, can contribute to constipation. Treating constipation often involves lifestyle modifications, dietary changes, increased physical activity, and, when necessary, the use of medications to manage and alleviate symptoms.

The prevalence of constipation in China is 3-17%. Compared to younger adults, constipation is more common in the elderly (13–32.6%), with women experiencing it more frequently than men. These are noteworthy demographic trends. Regional differences show that northern provinces such as Jilin and the Ningxia Hui Autonomous Region have the highest rates. Factors influencing prevalence include discrepancies in diagnostic criteria, emphasizing the need for standardization, as well as lifestyle factors such as diet, physical activity, and water intake. Additionally, underlying health conditions contribute significantly to constipation, emphasizing the importance of addressing overall health.

The increasing trend of utilizing mobile apps and devices for customized plans, dietary consultation, and biofeedback training is progressively prominent in managing constipation, offering patients convenient tools. The improving availability of telemedicine services boosts accessibility to healthcare professionals, improving diagnosis, treatment adherence, and remote monitoring for constipation, especially in remote areas with limited healthcare access. Wearables with integrated sensors can track gut activity, providing real-time feedback to both patients and healthcare providers, and offering valuable insights for a more comprehensive approach to constipation management.

Market Dynamics

Market Growth Drivers

Increasing Demand for Effective Treatments: The market for constipation therapeutics is expanding due to rising chronic illness rates, and dissatisfaction with conventional laxatives. The market for specialized therapies is being driven by patients with conditions like irritable bowel syndrome (IBS) who are looking for safer, more permanent solutions.

Lifestyle Factors Impacting Prevalence: Lifestyle factors, including sedentary habits and dietary choices, contribute significantly to the widespread occurrence of constipation, further boosting the demand for therapeutic interventions in the market.

Over-the-counter (OTC) Products: The presence of over-the-counter (OTC) constipation remedies and laxatives can stimulate growth in the constipation therapeutics market by offering individuals accessible self-treatment options, thereby enhancing market demand.

Market Restraints

Alternative Therapies: The availability and application of alternative therapies, such as changes in diet, herbal remedies, or lifestyle adjustments, may compete against conventional constipation treatments, impacting market demand.

Side Effects and Safety Concerns: Some constipation therapeutics may have side effects or safety concerns, leading to hesitancy among patients and healthcare providers in adopting certain treatments.

Patient Adherence: Compliance and adherence to prescribed constipation treatments can be challenging, affecting the overall effectiveness of the therapeutics and potentially limiting market growth.

Healthcare Policies and Regulatory Landscape

The National Medical Products Administration (NMPA), previously known as the China Food and Drug Administration (CFDA), is responsible for overseeing healthcare policies and regulations related to treatment drugs in China. The NMPA is primarily responsible for evaluating and approving pharmaceuticals for marketing, ensuring their safety, efficacy, and quality. The NMPA also regulates clinical trials, with a focus on maintaining ethical and safety standards. In addition, the NMPA enforces Good Manufacturing Practices (GMP) to ensure the quality and consistency of pharmaceutical manufacturing. The National Healthcare Security Administration (NHSA) influences the pricing and reimbursement of treatment drugs in China, reflecting the government's involvement in negotiating pricing and reimbursement policies.

Competitive Landscape

Key Players

- Pfizer

- AstraZeneca

- Johnson & Johnson

- GlaxoSmithKline

- Merck & Co.

- Novartis

- Sanofi

- Takeda

- Shanghai Fosun Pharmaceutical

- Beijing Tongrentang

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

China Constipation Therapeutics Market Segmentation

By Therapeutic

- Laxatives

- Chloride Channel Activators

- Peripherally Acting Mu-Opioid Receptor Antagonists

- GC-C Agonists

- 5-HT4 Receptor Agonists

By Disease

- Chronic Idiopathic Constipation

- Irritable Bowel Syndrome with Constipation

- Opioid-Induced Constipation

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.