China Chronic Cough Therapeutics Market Analysis

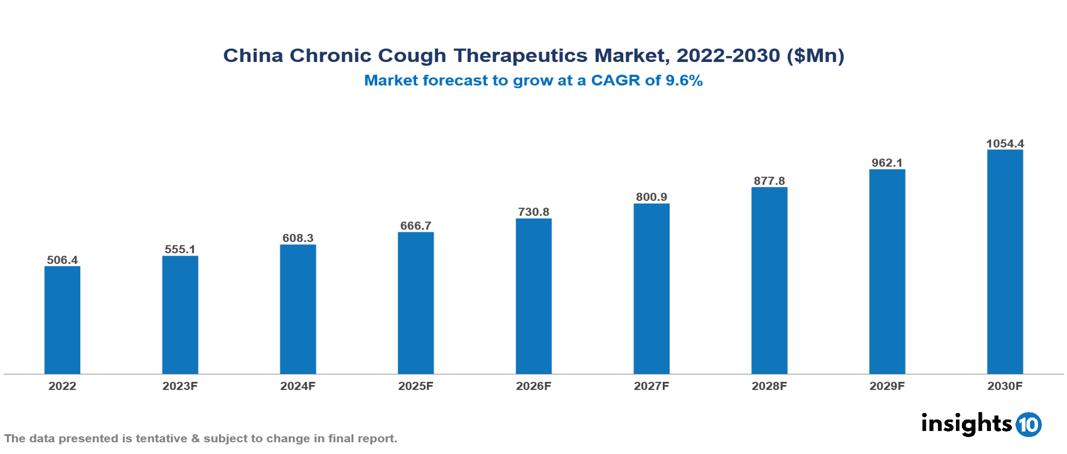

China Chronic Cough Therapeutics Market was valued at $506 Mn in 2022 and is estimated to reach $1054 Mn in 2030, exhibiting a CAGR of 9.6% during the forecast period. The key driver behind the growth of the chronic cough therapeutics market is the prevalent occurrence of chronic respiratory infections, often identified by persistent coughing. Leading participants in this market presently include Hengan Group, Guangzhou Pharmaceutical Holdings, Shanghai Fosun Pharmaceutical, Beijing Tongrentang Group, Merck, AstraZeneca, Boehringer Ingelheim, Chiesi, Novartis and GlaxoSmithKline.

Buy Now

China Chronic Cough Therapeutics Market Executive Summary

China's Chronic Cough Therapeutics Market was valued at $506 Mn in 2022 and is estimated to reach $1054 Mn in 2030, exhibiting a CAGR of 9.6% during the forecast period.

Chronic cough refers to a persistent cough lasting more than eight weeks, distinguishing it from acute coughs associated with short-term conditions. Unlike short-term coughs often linked to infections, chronic cough can indicate a more enduring underlying health problem. Respiratory conditions like asthma, chronic obstructive pulmonary disease (COPD), gastroesophageal reflux disease (GERD), postnasal drip, and certain medications commonly cause chronic cough. Identifying and addressing the root cause through a thorough medical assessment is essential for effective management. Chronic cough significantly impacts the quality of life, often requiring a comprehensive, multidisciplinary approach involving healthcare professionals such as pulmonologists, gastroenterologists, or ear, nose, and throat (ENT) specialists.

The prevalence of chronic cough in China is a matter of public health concern, with a reported rate of 7.11%, encompassing 6.22% in adults and 7.67% in children. According to this, more than 90 million people in China are suffering from a persistent cough. The prevalence of chronic cough appears to rise with age, according to an intriguing demographic trend. Among individuals aged 20–49 years, the prevalence is 2.4%, but it substantially rises to 6.0% in those aged 50 years or older. Furthermore, there are gender disparities, with men having a greater frequency of 4.6% compared to women's 2.6% prevalence in all age categories. China has a far lower prevalence of chronic cough than North America and Europe, where greater prevalence rates have been observed.

Chiesi China initiated Phase 3 clinical research with the objective of evaluating the safety and effectiveness of AF-059, a P2X3 receptor antagonist, which is specially designed to treat chronic cough in Chinese patients. The encouraging results of the Phase 2b study, which were released earlier this year, are being built upon by this critical trial. The Phase 3 trial's start demonstrates Chiesi China's dedication to developing possible treatments for chronic cough.

Market Dynamics

Market Growth Drivers

Increasing Prevalence of Chronic Cough: A persistent cough afflicts over 90 Mn individuals in China. The increasing prevalence of chronic cough in the country serves as a key catalyst for the expansion of the therapeutics market. The elevated occurrence of chronic cough is attributed to factors such as environmental pollution, smoking, and respiratory infections, generating a need for efficacious treatment solutions.

Aging Population: As of the year 2023, more than 260 Mn individuals, constituting 18.9% of the Chinese population, are aged 65 and above. Projections indicate that this percentage is expected to escalate to 32% by 2040 and further to 41.9% by the year 2060. The increasing proportion of elderly individuals in China augments the probability of people encountering chronic health ailments, such as respiratory issues. Chronic cough, frequently linked to age-related conditions, becomes a contributing factor to the expansion of the market.

Rising Awareness and Diagnosis: Growing awareness among both healthcare professionals and the general population regarding the impact of chronic cough on quality of life is leading to increased diagnosis. As awareness improves, more individuals seek medical attention for their chronic cough symptoms, driving the demand for therapeutic interventions.

Market Restraints

Regulatory Hurdles: Stringent regulatory requirements and approval processes in China can present difficulties for pharmaceutical companies aiming to introduce new treatments for chronic cough to the market. Navigating complex regulatory frameworks may result in delays in product approvals and market entry.

Healthcare Infrastructure Challenges: In certain regions of China, the healthcare infrastructure may have limitations, including access to specialized diagnostic facilities and healthcare professionals. This can impact the diagnosis and management of chronic cough, hindering the adoption of advanced therapeutics.

Affordability and Reimbursement Issues: Economic factors and varying levels of insurance coverage may affect the affordability of chronic cough therapeutics for some segments of the population. Limited reimbursement options could discourage patients from seeking or continuing treatment.

Healthcare Policies and Regulatory Landscape

In China, the oversight of healthcare policies and regulations pertaining to therapeutic drugs is primarily carried out by the National Medical Products Administration (NMPA), previously known as the China Food and Drug Administration (CFDA). The NMPA assumes a crucial role in the assessment and approval of pharmaceutical marketing, ensuring the safety, effectiveness, and quality of these products. Obtaining regulatory approval from the NMPA is also mandatory for conducting clinical trials, emphasizing adherence to ethical and safety standards. Furthermore, the NMPA is responsible for enforcing Good Manufacturing Practices (GMP) to uphold the quality and uniformity of pharmaceutical manufacturing. The pricing and reimbursement of therapeutic drugs in China are shaped by the National Healthcare Security Administration (NHSA), reflecting the government's active participation in negotiating and establishing pricing and reimbursement policies.

Competitive Landscape

Key Players

- Hengan Group

- Guangzhou Pharmaceutical Holdings

- Shanghai Fosun Pharmaceutical

- Beijing Tongrentang Group

- Merck

- AstraZeneca

- Boehringer Ingelheim

- Chiesi

- Novartis

- GlaxoSmithKline

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

China Chronic Cough Therapeutics Market Segmentation

By Drug Class

- Antihistamines

- Corticosteroids

- Decongestants

- Combination Drug

- Antibiotics

- Acid Blockers

- Others

By Route of Administration

- Oral

- Inhalational

- Injectable

- Others

By End-Users

- Hospitals

- Homecare

- Speciality Centres

- Others

By Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.