China Breast Pump Market Report

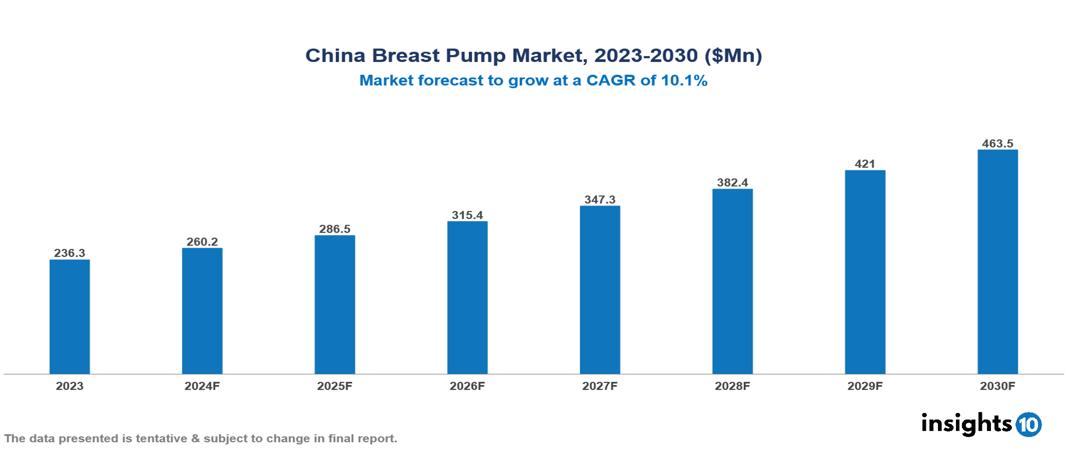

The China Breast Pump Market was valued at $236.3 Mn in 2023 and is predicted to grow at a CAGR of 10.1% from 2023 to 2030, to $463.5 Mn by 2030. The key drivers of the market include the rising female workforce, technological innovations, and growing consumer awareness. The prominent players in the China Breast Pump Market are Medela, Philips Avent, Ameda AG, Ardo Medical AG, Pigeon Corporation, Lansinoh Laboratories, Tommee Tippe.

Buy Now

China Breast Pump Market Executive Summary

The China Breast Pump Market is at around $236.3 Mn in 2023 and is projected to reach $463.5 Mn in 2030, exhibiting a CAGR of 10.1% during the forecast period.

A breast pump is a mechanical device that lactating women use to extract milk from their breasts. They are available in two forms; they can be manual devices powered by hand or foot movements or automatic devices powered by electricity. Breast pumps are available in a variety of styles to meet the demands of moms. Hand-operated manual pumps are lightweight and silent, making them ideal for sporadic usage. Electric pumps are often used on a regular basis because of their higher efficiency and ability to run on mains or batteries. There are several uses for breast pumps. Many parents use them to continue breastfeeding after they return to work. They express their milk at work, which is later bottle-fed to their child by a caregiver. A breast pump may be also used to address a range of challenges parents may encounter during breastfeeding, including difficulties latching, separation from an infant in intensive care, feeding an infant who cannot extract sufficient milk itself from the breast, to avoid passing medication through breast milk to the baby, or to relieve engorgement, which is a painful condition whereby the breasts are overfull.

The China Breast Pump Market is driven by significant factors such as the rising female workforce, technological innovations, and growing consumer awareness. However, stringent regulations, physical discomfort, stigma, and embarrassment restrict the growth and potential of the market.

The major players in the China Breast Pump Market are Medela, Ameda, Philips Avent, Evenflo, Pigeon, Playtex, and Hygeia, among others. Philips Avent, a division of Koninklijke Philips N.V., offers a range of breast pumps with innovative features such as massage cushions and multiple suction settings for personalized comfort.

Market Dynamics

Market Growth Drivers

Rising Female Workforce: Between 2010 and 2021, Brazil saw a 1.7% increase in the proportion of women in the workforce. This rise in female labor participation has played a significant role in driving the growth of the breast pump market. As more women join the professional sphere, the need for products that facilitate breastfeeding while maintaining their careers has grown. Breast pumps provide a practical solution for working mothers, allowing them to continue breastfeeding even when away from their babies. This shift of women into the workforce is a key factor in the expanding market for breast pumps.

Technological Innovations: Advancements in technology have led to the development of more efficient, comfortable, and portable pumps, catering to the evolving needs of modern mothers. Features like smart pumps with app integration, wearable designs, and improved suction technology are enhancing the user experience and encouraging more women to adopt breast pumping. Additionally, the focus on closed-system pumps and hygienic designs is boosting consumer confidence and expanding the market reach.

Growing consumer awareness: As healthcare professionals, online resources, and social media platforms disseminate more information about the benefits of breastfeeding and the convenience of using breast pumps, a growing number of mothers are choosing these devices. Support from health organizations and government initiatives promoting breastfeeding further elevates this awareness. Additionally, the need for flexible parenting solutions and workplace accommodations for breastfeeding mothers has driven higher adoption rates of breast pumps, thereby accelerating market growth.

Market Restraints

Stringent Regulations: Strict regulations governing medical devices, including breast pumps, can act as a significant market growth restraint. These regulations, designed to ensure product safety and efficacy, often involve rigorous testing, certification processes, and adherence to specific standards. While essential for consumer protection, these requirements can increase production costs, lengthen product development timelines, and limit market entry for smaller manufacturers. Additionally, navigating complex regulatory landscapes can be time-consuming and resource-intensive, hindering market expansion and innovation within the market.

Physical Discomfort: Painful suction, soreness, and overall bodily discomfort associated with pumping can deter mothers from utilizing breast pumps regularly. These issues can lead to reduced milk supply, decreased pumping frequency, and ultimately, early cessation of breastfeeding. Thus, physical discomfort remains a significant barrier to breast pump adoption and usage.

Stigma and Embarrassment: The stigma surrounding breastfeeding and feelings of embarrassment and discomfort pose a significant barrier to breast pump adoption. Many women are hesitant to use breast pumps due to societal pressures and the lack of supportive infrastructure. This reluctance to pump in public or even in private spaces hinders the normalization of breastfeeding and impacts the overall growth of the breast pump market.

Regulatory Landscape and Reimbursement Scenario

China’s pharmaceutical regulatory authority was previously called China Food and Drug Administration (CFDA) which was renamed to National Medicinal Products Administration (NMPA) in 2018. The NMPA is the government agency which is responsible for regulating the pharmaceuticals, cosmetics, medical devices, and in-vitro diagnostics in the nation.

The effectiveness and safety of medications, medical equipment, and cosmetics sold in China are ensured by the NMPA. This entails checking applications, carrying out examinations, and monitoring post-market risks. Also, the whole medical product life cycle, from research and development to manufacture, marketing, and distribution, is governed by rules that are created and enforced by the NMPA. The Chinese Pharmacopoeia, which establishes quality standards for pharmaceuticals, is one of the requirements they set for the safety and quality of medicinal products. By expediting the approval procedures for cutting-edge medications and equipment, the NMPA promotes research and development of new and improved medical products.

The NRDL is the main pathway for pharmaceutical reimbursement in China, with the primary goal being to improve the affordability of drug treatments. The reimbursement landscape for pharmaceuticals in China is complex and prioritizes cost-effectiveness. Even though there are several advantages to being an NRDL member, there is competition in the process and significant cost savings. It is essential for pharmaceutical companies doing business in China to comprehend this framework.

Competitive Landscape

Key Players

Here are some of the major key players in the China Breast Pump Market:

- Medela

- Philips Avent

- Ardo Medical AG

- Pigeon Corporation

- Lansinoh Laboratories

- Tommee Tippe

- Elvie

- Freemie

- Haakaa

- Bellababy

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

China Breast Pump Market Segmentation

By Product Type

- Manual pumps

- Battery-powered pumps

- Electric pumps

By Pump System

- Open System

- Closed System

By Pumping Type

- Single

- Double

By Distribution Channel

- Hospital Pharmacies

- Retail Stores

- Online Stores

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.