China Autosomal Dominant Polycystic Kidney Disease Therapeutics Market Analysis

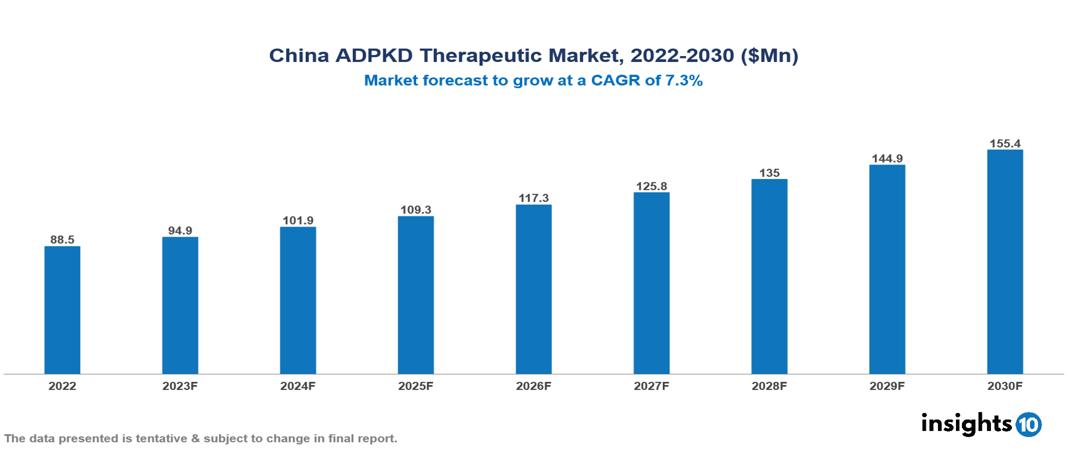

The China Autosomal Dominant Polycystic Kidney Disease Therapeutics Market was valued at US$88 Mn in 2022 and is predicted to grow at a CAGR of 7.3% from 2023 to 2030, to US$155 Mn by 2030. The key drivers of this industry include the upward trend in the prevalence of autosomal dominant polycystic kidney disease, healthcare infrastructure, economic growth, and other factors. The industry is primarily dominated by players such as Otsuka, AceLink, Palladio, Reata, Xortx, and Regulus, among others

Buy Now

China Autosomal Dominant Polycystic Kidney Disease Therapeutics Market Analysis

The China Autosomal Dominant Polycystic Kidney Disease Therapeutics Market is at around US $88 Mn in 2022 and is projected to reach US $155 Mn in 2030, exhibiting a CAGR of 7.3% during the forecast period.

Autosomal dominant polycystic kidney disease (ADPKD) is an inherited condition characterized by mutations in the PKD1 and PKD2 genes that affect various organs. This causes fluid-filled cysts to form in the kidneys, causing them to expand (renomegaly). In the majority of instances, ADPKD leads to kidney failure (ESKD). Pain, frequent infections, and fatigue are common symptoms. Although this rare condition has no cure, treatment focuses on preventing complications while managing symptoms. Otsuka Pharmaceuticals' tolvaptan (Jinarc) is the only licensed medication for ADPKD, working as a vasopressin blocker to reduce cyst formation in some patients. Other treatment options include pain management, lifestyle changes, and a variety of drugs to treat related problems such as high blood pressure, which can be controlled with medication.

China is a country situated in East Asia. Estimates suggest that the prevalence of ADPKD is around 1:2,500 to 1:1,000 individuals in China. There is an expected increase in the prevalence of ADPKD in UK due to advances in diagnostic modalities that reduce the chances of missed detections, a disproportionate increase in the geriatric population as compared to younger age groups, and an improving healthcare infrastructure. The market is therefore driven by major factors like increased prevalence, unexplored therapeutic market potential, rising disposable income of patients, and government initiatives in the industry. However, conditions such as high costs of treatment, limited treatment options, and others hinder the growth and potential of the market.

Market Dynamics

Market Growth Drivers

Surge in the prevalence of ADPKD: The prevalence of ADPKD is 1:2,500 to 1:1,000 individuals in China. It is estimated that there are around 1.5 million Chinese people surviving with this condition. These numbers are anticipated to result in patients requiring advanced treatments, resulting in the growth of the market.

Healthcare infrastructure: China's advancing healthcare infrastructure, characterized by enhanced specialized nephrology departments and advanced diagnostic capabilities, promotes improved diagnosis and treatment accessibility. Government-led healthcare reforms focused on enhancing treatment affordability and accessibility are additional drivers propelling market expansion.

Growing economy and disposable income: China's economic growth results in rising disposable income, empowering patients and families to afford costly ADPKD therapeutics. This creates opportunities for novel and innovative solutions, potentially stimulating market growth. In the year 2022, the annual per capita disposable income of a Chinese household was 36,883 yuan.

Unexplored market potential: Relative to developed markets, the ADPKD therapeutics market in China presents substantial untapped potential for new entrants and innovative technologies. Establishing an early presence and forming strategic partnerships with local entities and research institutions can lay the groundwork for sustained success in the long term.

Government initiatives: The Chinese government's emphasis on enhancing the management of chronic diseases and backing research on rare conditions sets a favourable stage for the development of ADPKD therapeutics and the expansion of the market. Several notable organizations, like the Chinese PKD Alliance, Chinese Society of Nephrology and others, play an active role in creating awareness, making policy decisions, and driving market growth

Market Restraints

High costs of treatment: Treatments for ADPKD, such as Tolvaptan, can be costly, causing a considerable financial burden on both patients and the healthcare system. Advanced treatments such as cell therapy or gene therapy and more recent targeted medications are often expensive, potentially surpassing the financial means of many patients and the limits of their healthcare coverage

Limited treatment options: While Tolvaptan is available, there is still an absence of definite cures or efficient treatments for all types and stages of ADPKD. This gap can create unfulfilled needs and non-compliance with treatments for numerous patients, impeding the expansion of the market.

Limited research and development: In contrast to other significant markets, China's involvement in ADPKD research might be relatively limited, which could slow down the development and accessibility of new treatment options for patients. This situation restricts market diversity and the potential for innovation.

Healthcare Policies and Regulatory Landscape

China's healthcare policy and regulatory framework involve various crucial authorities and agencies, with the National Health Commission (NHC) being the primary entity responsible for healthcare regulations and licensing in the country. The NHC oversees the development of national health policies, coordinates medical and healthcare reform, and supervises healthcare services across the country.

To gain registration and marketing authorization for pharmaceuticals and medical devices, companies must obtain approval from the National Medical Products Administration (NMPA). This process involves submitting technical and scientific data to validate the product's safety, quality, and effectiveness. China's healthcare policy and regulatory framework involve numerous authorities and agencies, with the NHC holding a pivotal role in healthcare product regulation. Both the public and private healthcare sectors in the country offer diverse opportunities for companies operating within the healthcare industry

Competitive Landscape

Key Players

- Otsuka Pharmaceutical Co., Ltd

- Regulus Therapeutics

- Palladio Biosciences

- Reata Pharmaceuticals

- Galapagos NV

- Exelixis Inc

- AceLink Therapeutics, Inc

- Sanofi

- Xortx Therapeutics

- Pano Therapeutics

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

China Autosomal Dominant Polycystic Kidney Disease Therapeutics Market Segmentation

By Treatment

- Pain & Inflammation Treatment

- Kidney Stone Treatment

- Urinary Tract Infection Treatment

- Kidney Failure Treatment

By Route of Administration

- Oral

- Parenteral

- Others

By End User

- Hospitals

- Speciality Clinics

- Surgical Centres

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.