China Atopic Dermatitis Therapeutics Market Analysis

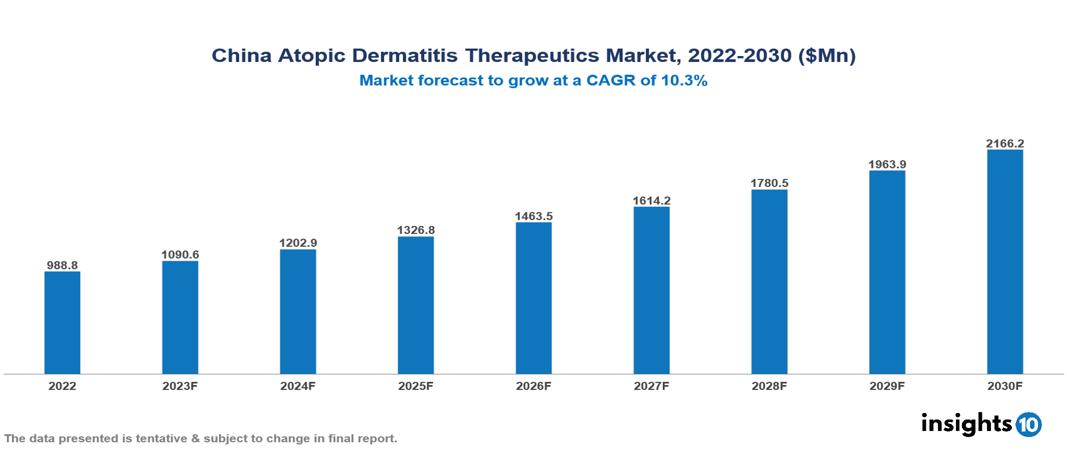

The China Atopic Dermatitis Therapeutics Market was valued at US $0.99 Bn in 2022, and is predicted to grow at (CAGR) of 10.3% from 2023 to 2030, to US $2.16 Bn by 2030. The key drivers of this industry include a surge in the prevalence of Atopic Dermatitis (AD), emerging innovative therapeutics and increased awareness. The industry is primarily dominated by players such as Pfizer, Sanofi, Novartis, Galderma, AbbVie, Viatris, Bayer, and AstraZeneca, among others.

Buy Now

China Atopic Dermatitis Therapeutics Market Analysis: Executive Summary

The China Atopic Dermatitis Therapeutics Market is at around US $0.99 Bn in 2022 and is projected to reach US $2.16 Bn in 2030, exhibiting a CAGR of 10.3% during the forecast period.

Atopic dermatitis, commonly known as eczema, is a persistent skin condition characterized by inflammation, redness, and irritation. It is non-contagious and can affect individuals of all age groups, with the onset often occurring during childhood. Key risk factors include a history of eczema, allergies, hay fever, or asthma, as well as a familial predisposition to these conditions. Common symptoms encompass intense itching, redness, swelling, cracking, clear fluid discharge, crusting, and scaling. Treatment strategies for atopic dermatitis may involve routine moisturizing and self-care practices, the application of medicated creams to manage itching and support skin repair, the use of topical or oral medications, and additional therapies like phototherapy or immunosuppressants. Several companies, including Sanofi, Pfizer, AbbVie, Leo Pharma, Eli Lilly, and Novartis, produce therapeutic options for atopic dermatitis. Their product portfolios include topical corticosteroids, calcineurin inhibitors, and other medications aimed at alleviating the symptoms of this skin condition.

Currently, more than 32 million individuals are living with AD in China. The estimated prevalence ranges from 10% to 30% for children and 12% for adults. The market is propelled by significant factors such as the rising prevalence of AD, improved awareness in the general population, and the evolving treatment landscape in the therapeutics market. However, conditions such as high cost of treatment, health system challenges, and competition from traditional medicines limit the growth and potential of the market.

Market Dynamics

Market Growth Drivers

Rising prevalence of AD: Approximately 35 million individuals are suffering from some form of AD in China. Estimates suggest that the prevalence of AD in children ranges from 10%–30% and approximately 12% in Chinese adults. The increase is attributable to factors such as urbanization, environmental pollution, and genetic susceptibility.

Improved awareness: Increasing public awareness and the availability of advanced diagnostic tools contribute to the early detection and treatment of atopic dermatitis, thereby contributing to the expansion of the market. Educational efforts and initiatives led by patient advocacy groups and healthcare professionals play a significant role in fostering this heightened awareness.

Emerging novel therapeutics: The introduction of innovative treatment alternatives, especially biologics with precise mechanisms of action, provides enhanced effectiveness and potentially more prolonged relief for patients when compared to conventional topical steroids. The prospect of personalized medicine approaches tailored to individual patient characteristics also heightens interest in the market.

Market Restraints

High cost of treatment: The significant expense associated with innovative biologic therapies poses a substantial obstacle for numerous Chinese patients, particularly those lacking sufficient health insurance coverage. This constrains the widespread adoption of these highly effective yet expensive treatments. Even conventional topical medications or moisturizers may be beyond the financial reach of some low-income households, resulting in suboptimal disease management.

Health system challenges: The healthcare system in China, continually undergoing changes, exhibits fragmentation and varying quality, especially in rural regions. Insufficient communication and coordination between primary care providers and dermatologists can hinder the effective management and accessibility of treatment options.

Traditional treatment preferences: In China, Traditional Chinese Medicine (TCM) has a significant cultural impact. While certain TCM practices can provide complementary relief for symptoms of atopic dermatitis, solely relying on these approaches may postpone or deter patients from seeking evidence-based medical treatment. Moreover, cultural stigma or misunderstandings related to chronic skin conditions dissuade individuals from seeking any medical assistance.

Notable Updates

December 2023, The Chinese biopharmaceutical firm Technoderma Medicines has successfully completed a Phase I clinical trial for the TDM-180935 topical ointment designed for treating atopic dermatitis. In this randomized, double-blind trial, the tolerability, safety, and pharmacokinetics of TDM-180935 were assessed in healthy male participants, who were divided into single-dose and multidose escalation cohorts.

June 2020, The National Medical Products Administration (NMPA) in China granted approval for Dupixent® (dupilumab) by Sanofi to be used in treating moderate-to-severe atopic dermatitis in adults when their condition is not effectively managed with topical prescription therapies or when the use of such therapies is not recommended.

Healthcare Policies and Regulatory Landscape

China's healthcare regulatory landscape is governed by various agencies and policies aimed at ensuring the safety, efficacy, and accessibility of medical products and services. The main regulatory body overseeing drugs and pharmaceuticals is the National Medical Products Administration (NMPA), formerly known as the China Food and Drug Administration (CFDA). NMPA plays a pivotal role in the approval and supervision of pharmaceuticals, medical devices, and healthcare products. The agency is responsible for setting standards, conducting inspections, and issuing licenses to ensure compliance with regulatory requirements. In recent years, China has undergone regulatory reforms to streamline and expedite the drug approval process, aligning its practices with international standards to encourage innovation and enhance the quality of healthcare products.

Obtaining licenses in the Chinese pharmaceutical market involves a rigorous process, requiring companies to submit comprehensive documentation and undergo thorough evaluations by the NMPA. The regulatory environment is evolving to support innovation, with a focus on expediting the approval of new drugs and encouraging research and development.

While the Chinese government has shown a commitment to opening up its healthcare sector, new entrants must navigate complex regulatory procedures, language barriers, and varying regional requirements. Collaborating with local partners, understanding cultural nuances, and staying abreast of evolving regulations are crucial for success in the dynamic and rapidly growing Chinese healthcare market. Despite the challenges, the vast opportunities presented by the sheer size of the population and the increasing demand for high-quality healthcare products make China an attractive market for pharmaceutical companies.

Competitive Landscape

Key Players

- Sanofi

- Leo Pharma

- Galderma

- Novartis

- AbbVie

- Almirall

- Pfizer

- Bayer

- Viatris

- AstraZeneca

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

China Atopic Dermatitis Therapeutics Market Segmentation

By Drug Class

- Corticosteroids

- Calcineurin Inhibitors

- Immunosuppressants

- Biologic Therapy

- PDE-4 Inhibitor

- Antibiotics

- Antihistamines

- Emollients

By Route of Administration

- Topic

- Oral

- Injectable

By Severity type

- Mild

- Moderate

- Severe

By Age Group

- 18 years and below

- 19 years and above

By Distribution channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Dermatology Clinics

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.