China Anti Aging Therapeutics Market Analysis

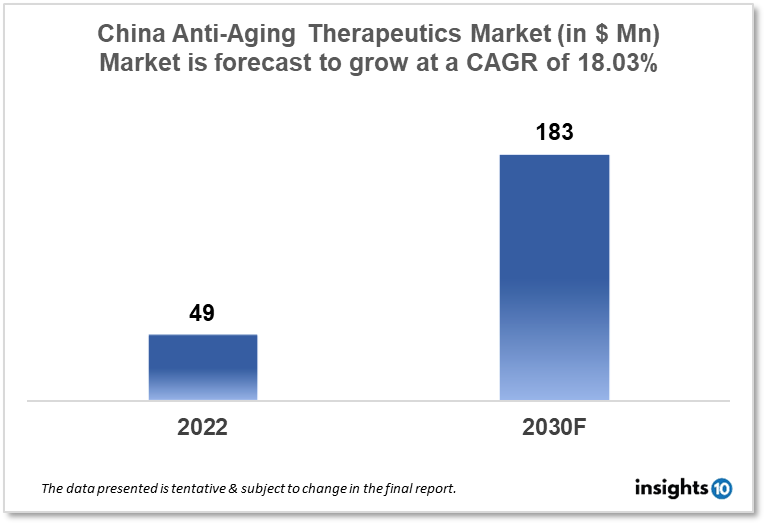

China's anti-aging therapeutics market is projected to grow from $49 Mn in 2022 to $183 Mn in 2030 with a CAGR of 18.03% for the year 2022-30. As China has the fastest-growing elderly population in the world, the market is projected to expand during the forecast period. Further, the concerns over the appearance of social media among the young Chinese population are also responsible for the growth of the market. The China anti-aging therapeutics market is segmented by product, treatment, target group, type of aging, type of molecules, mechanism of action, ingredient, and by distribution channel. Some of the top players in the market include Harbour BioMed, Hua Medicine, and Rejuvenate Bio.

Buy Now

China Anti-Aging Therapeutics Market Executive Summary

China's anti-aging therapeutics market size is at around $49 Mn in 2022 and is projected to reach $183 Mn in 2030, exhibiting a CAGR of 18.03% during the forecast period. According to the South China Morning Post's most recent healthcare report, China's combined pharmaceutical and biopharma R&D expenditure will increase at a compound annual rate of 23% until 2023, reaching $49 Bn. By then, 23% of the global total for drug finding and testing will be spent on pharmaceutical and biopharma R&D in China. By 2021, sales of biopharmaceuticals in China are expected to nearly double from their 2016 level to $50 Bn. Before 2030, the SCMP research found that China could be on par with America and Europe in terms of its ability to produce best-in-class medications. China's healthcare market was the second-largest in the world in 2018, spending $3.5 trillion in that sector.

Aging is the negative change in an organism's overall function that happens as it gets older. The theory of genetic mutation, telomere loss, somatic mutation, free radical damage, immune disorder, mitochondrial dysfunction, and autophagy dysfunction are some of the biological processes that contribute to the highly complex biological process of aging. Despite China's longstanding reputation as a nation that values and honors its elders, the country is currently experiencing a surge in anti-aging initiatives. All groups exhibit enthusiasm for anti-aging products, according to observers. For the first time, a novel cause of cellular senescence has been discovered using a genome-wide CRISPR-based screening technique. According to Chinese experts, it can be incorporated into novel ways to postpone aging and ward off diseases linked to it. The study team showed that knocking out, or disabling, some genes by CRISPR can prevent the aging of human mesenchymal precursor cells by screening and finding more than 100 genes responsible for the aging of human cells. (hMPCs). KAT7 (a histone acetyltransferase) is one of the senility-causing genes and a key factor in aging. The innovative gene therapy, which depends on turning off a specific gene or using KAT7 inhibitors, could potentially extend the lives of mammals. Furthermore, it might delay the deterioration of human liver cells. It implies a significant possibility for its use in translational medicine to combat human aging.

Market Dynamics

Market Growth Drivers Analysis

One factor influencing the market is the rising concern in China about how one appears on social media. China's aging population, which is one of the fastest-growing in the world, is one of the factors further igniting this anti-aging trend, according to WHO. Because of the differences in culture and society, these groups are more ready than their western counterparts to invest time, money, and effort into maintaining a youthful appearance. The China anti-aging therapeutics market's expansion is also due to social media and e-commerce. To capitalize on this generation's potential for online shopping, Alibaba launched its "Taobao for Elders" initiative at the beginning of 2018. The online lifestyle community Xiaohongshu, also known as "Little Red Book," is well-recognized and caters to young people in China. With the recent debut of Laohongshu (literally, "Old Red Book"), it began to include the elderly.

In the anti-aging market, personalized care-focused AI is commonly seen in technical R&D and client-focused marketing. Fermentation and synthetic biotechnology, in particular, are currently the China anti-aging therapeutics market's star components and are of natural or biotechnological origin.

Market Restraints

Companies seeking to market new anti-aging therapies in China may find the regulatory environment to be complicated and difficult. Delays and higher expenses for businesses may result from this, which may deter market innovation and investment. China has a long tradition of using traditional Chinese medicine, and it is still widely practiced today. Modern anti-aging treatments may not always be preferred by patients, which could impede the China anti-aging therapeutics market's expansion.

Competitive Landscape

Key Players

- BeiGene (CHN)

- Chi-Med (CHN)

- CStone Pharmaceuticals (CHN)

- Harbour BioMed (CHN)

- Hua Medicine (CHN)

- Rejuvenate Bio

- Rejenevie Therapeutics

- MyMD Pharmaceuticals

- Intervene Immune

- CohBar

Healthcare Policies and Regulatory Landscape

The National Medical Products Administration (NMPA), formerly known as the China Food and Drug Administration, is the regulatory body in charge of overseeing the licensing and control of anti-aging medications in China. (CFDA). In China, the NMPA is in charge of regulating all pharmaceutical goods, including anti-aging medications. Before pharmaceutical goods are permitted for sale in China, the agency is in charge of assessing their quality, safety, and efficacy. Clinical trial requirements, product registration requirements, and post-market surveillance requirements are all part of the complete regulatory framework for pharmaceutical products that the NMPA has put in place. Before their products can be sold in the Chinese market, businesses looking to develop and market anti-aging drugs in China must abide by these rules and receive approval from the NMPA. For patients in China, the NMPA has lately improved access to modern treatments by streamlining the drug approval procedure. These adjustments include accelerated review processes for specific drug classes as well as modifications to the clinical trial specifications for specific drugs.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Anti-Aging Therapeutics Market Segmentation

By Product (Revenue, USD Billion):

- Anti-Wrinkle

- Hair Color

- Ultraviolet (UV) Absorption

- Anti-Stretch Mark

- Others

By Treatment (Revenue, USD Billion):

- Hair Restoration

- Anti-Pigmentation

- Adult Acne Therapy

- Breast Augmentation

- Liposuction

- Chemical Peel

- Others

By Target Group (Revenue, USD Billion):

- Male

- Female

By Type of Aging (Revenue, USD Billion):

- Cellular Aging

- Immune Aging

- Metabolic Aging

- Others

By Type of Molecules (Revenue, USD Billion):

- Biologics

- Small Molecules

By Mechanism of Action (Revenue, USD Billion):

- Senolytic

- Cell Regeneration

- mTOR inhibitor/Modulator

- AMP-kinase/AMP Activator

- Mitochondria Inhibitor/Modulator

- Others

By Ingredient (Revenue, USD Billion):

- Retinoid

- Hyaluronic Acid

- Alpha Hydroxy Acid

- Others

By Distribution Channel (Revenue, USD Billion):

- Pharmacies

- Stores

- Online Stores

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.