China Alcohol Addiction Therapeutics Market Analysis

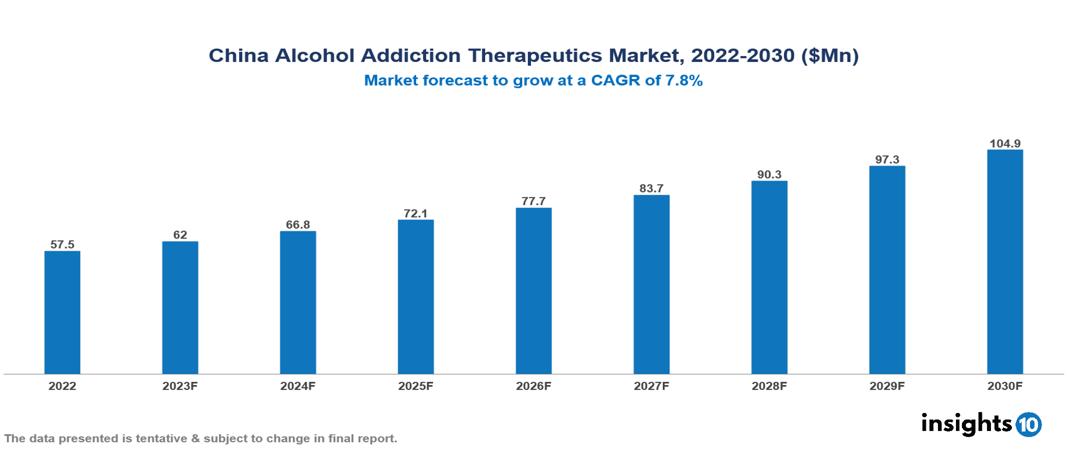

The China Alcohol Addiction Therapeutics Market is valued at around $58 Mn in 2022 and is projected to reach $105 Mn by 2030, exhibiting a CAGR of 7.8% during the forecast period. The primary growth drivers in the China Alcohol Addiction Therapeutic Market are the escalating prevalence of Alcohol Addiction due to rising disposable income and sociocultural shifts, expanding treatment options, and government initiatives recognizing AUD as a public health concern. The key players involved in the research, development, and distribution of Alcohol Addiction Therapeutics in China are Merck & Co., Alkermes, TEVA, Otsuka Pharmaceuticals, Adial Pharmaceuticals, Yabao Pharmaceutical, Tasly Pharmaceutical, China Meheco Corporation, Tonghua Dongbao, Harbin Pharm etc.

Buy Now

China Alcohol Addiction Therapeutics Market Executive Summary

The China Alcohol Addiction Therapeutics Market is valued at around $58 Mn in 2022 and is projected to reach $105 Mn by 2030, exhibiting a CAGR of 7.8% during the forecast period.

Alcohol dependency, commonly known as alcohol use disorder (AUD), is a chronic medical illness marked by an inability to limit alcohol use in the face of negative effects. People with alcoholism have a strong desire to drink, even if it causes issues in their personal, professional, and social lives. The specific reasons for alcohol dependency are complicated and differ from person to person. However, genetics, brain chemistry, mental health disorders, and environmental variables can all play a role in its development. Overcoming alcoholism demands a multifaceted strategy. Detoxification treats withdrawal symptoms, but behavioural treatments such as CBT target underlying thinking patterns and triggers. Medications like naltrexone can help with cravings and relapse prevention. Support groups, such as AA, provide a secure environment for encouragement and accountability.

Around 6% of China's adult population, those aged 18 and over, suffers from alcohol consumption disorder. This equates to around 70 million people. Regional differences are noticeable, with a higher incidence in metropolitan regions compared to rural settings. These discrepancies are influenced by socioeconomic variables as well as cultural attitudes toward alcohol. The key growth drivers in China Alcohol Addiction Therapeutic Market are the escalating prevalence of alcohol addiction due to rising disposable income and sociocultural shifts, expanding treatment options, and government initiatives recognizing AUD as a public health concern.

Yabao Pharmaceutical Group is the market leader, with a strong array of AUD drugs, mainly naltrexone. Tasly Pharmaceutical Group, a rising star, is carving out a niche with novel medicines such as naltrexone implants. Across the border, Alkermes (US) and Teva Pharmaceuticals (Israel) offer a varied range of AUD medications, including naltrexone and acamprosate, to the Chinese market.

Market Dynamics

Market Drivers

Rising Prevalence: China is the world's biggest drinking population, with over 800 Mn individuals. Increased disposable income and sociocultural changes contribute to increased alcohol intake, resulting in more cases of AUD. Growing recognition of AUD as a medical disease, rather than a moral flaw, helps people to seek help.

Expanding Treatment Options: The development of new drugs, such as longer-acting injectable naltrexone, is giving more effective choices for treating cravings and withdrawal symptoms. The increased availability of behavioural therapies, such as cognitive-behavioural therapy (CBT), combined with medication-assisted treatments (MAT), allows for more complete treatment approaches. Growing telemedicine and digital health solutions make addiction treatment more accessible in rural places or for people who are concerned about stigma.

Government Initiatives and Policy Support: The Chinese National Health Commission acknowledges AUD as a serious public health concern and has created measures to promote access to treatment. Increased financing for addiction treatment programs and awareness campaigns helps to drive market expansion. Policy improvements, such as reduced rules on MAT prescriptions, make medicine more accessible.

Market Restraints

Lack of Infrastructure: More than half of China's population lives in rural regions, yet healthcare resources are concentrated in busy cities. This limits millions of people's access to specialist addiction treatment centers and qualified professionals. China has a serious deficit of psychiatrists and addiction specialists, especially in rural regions. This results into long wait times, limited individual care, and insufficient treatment alternatives for rural patients.

Affordability: Medication, treatment, and possibly hospitalization can be excessively expensive, particularly for those on low incomes. The average yearly cost of AUD treatment in China is around $15,000, which exceeds the typical annual income in many rural communities. While China's healthcare system has improved, insurance coverage for addiction treatment remains restricted and frequently excludes medication-assisted therapy (MAT).

Regulatory Obstacles: New pharmaceuticals, particularly ones that are not yet widely used throughout the world, must go through lengthy and complex regulatory processes before they can reach patients. This slows access to potentially life-changing therapies. Even authorized drugs such as naltrexone may require prior permission from experts or particular conditions, limiting access for patients in resource-limited locations.

Healthcare Policies and Regulatory Landscape

China's healthcare policy is governed and monitored by the National Medical Products Administration (NMPA), which is in charge of drug monitoring under the State Council and is administered by the State Administration for Market Regulation. The NMPA also aims to ensure the safety, quality, and efficacy of medical goods by implementing faster approval procedures and other clinical trial improvements. In addition, the NMPA is in charge of registering and regulating medical equipment and medicines, which plays an important role in guaranteeing the quality and safety of healthcare goods in China. China has also implemented a drug marketing authorization holders (MAHs) system, which requires all entities or drug research institutions with drug marketing authorizations to be accountable for the effectiveness and quality control of the entire process of drug research and development, production, distribution, and use.

Competitive Landscape

Key Players

- Merck & Co.

- Alkermes

- TEVA

- Otsuka Pharmaceuticals

- Adial Pharmaceuticals

- Yabao Pharmaceutical

- Tasly Pharmaceutical

- China Meheco Corporation

- Tonghua Dongbao

- Harbin Pharm

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

China Alcohol Addiction Therapeutics Market Segmentation

By Therapy Type

- Pharmacological Therapy

- Behavioural Therapy

- Digital Health Interventions

- Others

By Disease Stage

- Mild Alcohol Dependence

- Moderate Alcohol Dependence

- Severe Alcohol Dependence

By Route of Administration

- Oral

- Parenteral

- Topical

- Others

By Distribution Channel

- Hospital Pharmacies

- Drug Stores & Retail Pharmacies

- Online Pharmacies

By End User

- In-Patient Centres

- Out-Patient Speciality Clinics

- Residential Treatment Centres

- Homecare

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.