Canada Radiotherapy Market Analysis

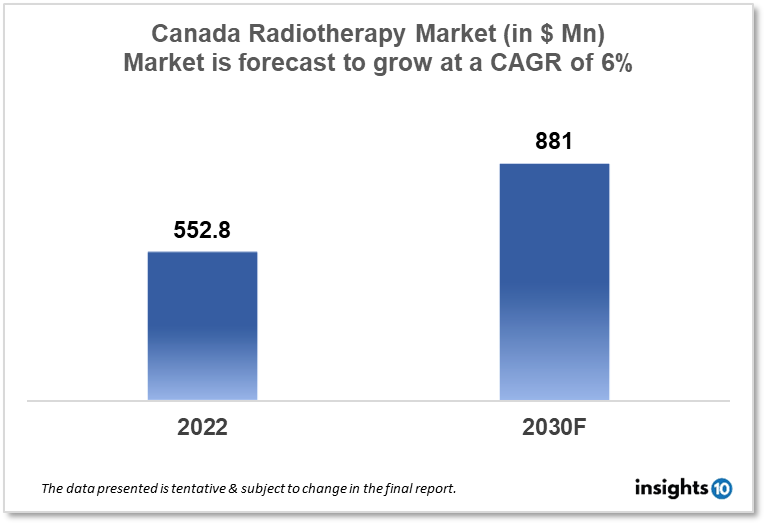

Canada radiotherapy market is likely to grow at a CAGR of 6% from a market size of $552.8 Mn in 2022 to $881 Mn in 2030. The rising incidence of cancer and the technological advancements in radiotherapy acts as a market growth driver. This report is segmented by type, technology, application, and by end user. Some key players in this market include Siemens Healthineers, Elekta Accuray Incorporated, Hitachi, IsoRay, Zeiss group, and others.

Buy Now

Canada Radiotherapy Market Executive Summary

Canada radiotherapy market size is at around $552.8 Mn in 2022 and is projected to reach $881 Mn in 2030, exhibiting a CAGR of 6% during the forecast period 2022-2030. One of the largest nations in the globe and the largest in the western hemisphere is Canada. With firms ranging from little owner-managed businesses to multinational corporations, it boasts a thriving free-market economy. In the past, the export of agricultural staples, primarily grain, as well as the production and sale of natural resource exports, such as minerals, oil and gas, and forest products, were the foundations of Canada's economy.

The public sector, which supports healthcare services, and the private sector, which provides these services, make up Canada's hybrid public-private healthcare system. There is currently no national procurement model that is uniform. Each province has its own set of regulations, which can vary significantly between regions or service providers. Provincial government agencies are implementing or looking at health care procurement reforms, including centralized approaches.

Radiotherapy, also known as radiation therapy and radiation treatment, is used almost exclusively to treat cancer and is employed in an estimated 50% of all cancer cases. In Canada, radiotherapy services are provided by both private healthcare facilities and the publicly funded healthcare system. The availability and accessibility of radiotherapy services may vary by province or territory, with some regions having more advanced or specialized facilities than others. Overall, the radiotherapy market in Canada is expected to continue to grow in the coming years, driven by the increasing demand for cancer treatment and the ongoing development of new radiotherapy technologies and techniques.

Market Dynamics

Market Growth Drivers

The radiotherapy market is expanding in Canada due to a number of factors, including:

1. Rising Cancer Prevalence: As was already said, one of the main factors propelling the radiotherapy market in Canada is the rising cancer prevalence. One in two Canadians, according to the Canadian Cancer Society, will have cancer at some point in their lives. One of the most popular forms of treatment for cancer patients, radiotherapy is a major market driver.

2. Technical Developments: The radiotherapy industry is expanding as a result of the quick advancements in technology. Innovative medical techniques like intensity-modulated radiation therapy (IMRT), image-guided radiation therapy (IGRT), and proton therapy are enhancing patient results and lowering adverse effects. As a result, there is a desire for more sophisticated and cutting-edge radiation equipment.

3. Demand for Non-Invasive Therapies is Growing: Patients who want to avoid invasive surgery or chemotherapy are increasingly choosing radiotherapy as a non-invasive treatment option. As a result, there is a rising need for radiotherapy treatment, which is propelling market expansion.

4. Government Support: The money and assistance provided by the Canadian government for cancer research and treatment are what spurs the market for radiotherapy's innovation and growth. Radiotherapy services are also provided by publicly funded healthcare institutions in Canada, making it available to a larger population.

Market Restraints

The radiotherapy market's expansion in Canada may be constrained by a number of factors, including the high cost of radiation equipment, access to treatment, and others. Certain healthcare facilities may find it difficult to implement radiotherapy because of the equipment's high cost. Access to radiation treatment may be hampered by high equipment costs, especially in rural or developing parts of the nation. Access to treatment may be restricted in some areas, even though radiation is provided through Canada's publicly financed healthcare systems. It may be necessary for certain patients to travel a great distance for treatment, which can be both expensive and difficult.

Radiation therapy is generally safe and effective, but it can also have side effects including exhaustion, rashes on the skin, and nausea. Radiotherapy occasionally also has more severe side effects, like harm to organs or healthy tissue. For some individuals and healthcare professionals, these safety worries may be a deterrent to adoption. Health Canada regulates the radiation market, which might make it difficult for new competitors to enter the market. Before items may be used in Canada, companies may need to go through a protracted regulatory process, which can impede market innovation and expansion.

Competitive Landscape

Key Players

- Siemens Healthineers

- Elekta Accuray Incorporated

- Hitachi

- IsoRay

- Zeiss group

- Optivus Proton Therapy

Healthcare Policies and Regulatory Landscape

Health Canada, the government agency in charge of national public health, will be in charge of regulating radiotherapy in Canada starting in September 2021. Health Canada monitors the safety and efficacy of all radiotherapy products and services, and it also grants permission for the use of novel radiotherapy approaches and procedures. The provision of radiotherapy services in Canada is governed not only by federal law but also by provincial and territorial laws. The healthcare systems in each province and territory may differ in terms of rules and guidelines for the use of radiation.

For cancer research and treatment, including radiotherapy, the Canadian government provides funds and support. Both privately owned healthcare facilities and the publically supported healthcare system offer radiotherapy services. The expense of radiation treatment is covered by the publicly financed healthcare system in Canada for qualified patients, while the accessibility and availability of treatment may differ depending on the region and kind of cancer. The goal of Canada's radiation health policy is to guarantee that patients receive efficient and safe care. Health Canada oversees the use of radiation products and services to make sure they adhere to high standards for safety and effectiveness as well as for the planning and management of patient care.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Canada Radiotherapy Market Segmentation

By Type (Revenue, USD Billion):

- External Beam Radiation Therapy

- Linear Accelerators

- Compact Advanced Radiotherapy Systems

- Cyberknife

- Gamma Knife

- Tomotherapy

- Proton Therapy

- Cyclotron

- Synchrotron

- Internal Beam Radiation Therapy

- Brachytherapy

- Seeds

- Applicators and Afterloaders

- Electronic Brachytherapy

- Systemic Radiation Therapy

- Others

By Technology (Revenue, USD Billion):

- External Beam Radiotherapy

- Intensity-Modulated Radiation Therapy (IMRT)

- Image-Guided Radiation Therapy (IGRT)

- Stereotactic Radiation Therapy (SRT)

- 3D Conformal Radiation Therapy (3D-CRT)

- Particle Therapy

- Internal Beam Radiotherapy

- Brachytherapy

- High-Dose Rate Brachytherapy

- Low-Dose Rate Brachytherapy

- Image-Guided Brachytherapy

- Pulse-Dose Rate Brachytherapy

- Systemic Radiation Therapy

- Intravenous Radiotherapy

- Oral Radiotherapy?

By Application (Revenue, USD Billion):

- Breast Cancer

- Cervical Cancer

- Colon and rectum Cancers

- Stomach Cancer

- Lung Cancer

- Prostate Cancer

- Skin Cancer

- Liver Cancer

- Other types of cancer

By End User (Revenue, USD Billion):

- Hospitals

- Radiotherapy Centers & Ambulatory Surgery Centers

- Cancer Research Institutes

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.