Canada Lung Cancer Therapeutics Market Analysis

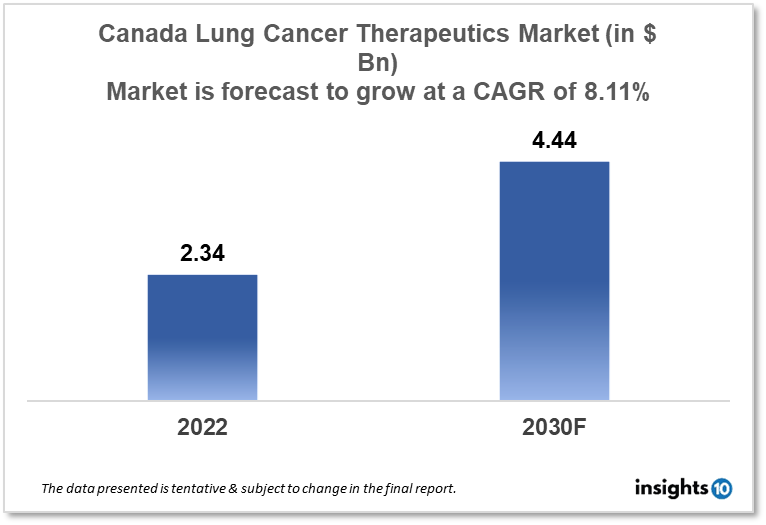

Canada's lung cancer therapeutics market is likely to grow at a CAGR of 8.11% from a market size of $2.34 Bn in 2022 to $4.44 Bn in 2030. One of the main factors propelling the growth of the lung cancer treatments market is the increase in the adoption of unhealthy lifestyles, such as smoking. Lung cancer is known to be frequently caused by cigarette smoking. This report is segmented by type, therapy, type of molecule, drug class, and distribution channel. Some key players in this market include Sanofi, Bristol-Myers & Squibb, Pfizer, AstraZeneca, Celgene Corporation, Boehringer Ingelheim, J&J, and others.

Buy Now

Canada Lung Cancer Therapeutics Market Executive Summary

Canada's lung cancer therapeutics market size is at around $2.34 Bn in 2022 and is projected to reach $4.44 Bn in 2030, exhibiting a CAGR of 8.11% during the forecast period 2022-2030. One of the largest nations in the globe and the largest in the western hemisphere is Canada. With firms ranging from little owner-managed businesses to multinational corporations, it boasts a thriving free-market economy. In the past, the export of agricultural staples, primarily grain, as well as the production and sale of natural resource exports, such as minerals, oil and gas, and forest products, were the foundations of Canada's economy.

Lung and bronchial cancer will be found in 30,000 Canadians. In 2022, this will account for 13% of all new cancer cases. Lung and bronchus cancer will claim the lives of 20,700 Canadians. In 2022, this will account for 24% of all cancer fatalities. 10,600 men will pass away from lung and bronchus cancer, which will affect 15,000 men. 10,100 women will pass away from lung and bronchus cancer, which will affect 15,000 of them. Every day, 82 Canadians will receive a lung and bronchus cancer diagnosis. Lung and bronchus cancer will claim the lives of 57 Canadians per day on average. New approvals of speciality and oncology drugs and generic formulations of the top 25 drugs may influence drug purchases from 2021 to 2023.

Market Dynamics

Market Growth Drivers

The rising incidence of lung cancer, increased investments in research & development for the creation of novel medicines, and government programmes to raise cancer awareness are the main drivers influencing the market growth. Out of all estimated new cancer cases in both sexes combined in 2022, lung cancer accounts for around 13% from it. Lung cancer's rising incidence is the biggest cause of cancer-related fatalities in Canada, and it also becomes more common. In Canada, there are expected to be approximately 31,000 new cases of lung cancer in 2021, according to the Canadian Cancer Society.

Another significant market driver for lung cancer is Canada's ageing population. The likelihood of having lung cancer rises with age. The most common cause of lung cancer is smoking, and Canada has one of the highest smoking rates in the world. In 2019, 16% of Canadians ages 15 and older reported smoking cigarettes. In recent years, there have been considerable improvements in the treatment of lung cancer, including the creation of targeted treatments and immunotherapies. Compared to conventional chemotherapy, these novel medicines are more efficient and have fewer adverse effects. To advance lung cancer detection, diagnosis, and care, the Canadian government has started a number of initiatives. To identify the disease early in high-risk individuals, the Canadian Alliance Against Cancer, for instance, has started a countrywide lung cancer screening programme.

Market Restraints

For optimal treatment outcomes, lung cancer early identification is sometimes essential. The absence of a national lung cancer screening programme in Canada, however, can lower detection rates and result in diagnoses at later stages. While there are several treatments for lung cancer, access to some of the more cutting-edge ones may be difficult in Canada. This may be because of a number of things, including accessibility, price, and legal limitations. The price of treating lung cancer can be extremely high, which might be a major market restraint. Patients might not be able to afford pricey therapies, which might reduce demand and impede market expansion.

Competitive Landscape

Key Players

- Sanofi

- Bristol-Myers & Squibb

- Pfizer

- AstraZeneca

- Celgene Corporation

- Boehringer Ingelheim

- J&J

Healthcare Policies and Regulatory Landscape

Lung cancer treatment reimbursement in Canada can be complicated and varies depending on the specific treatment, the province or territory, and the patient's health insurance coverage, among other things. In general, the pan-Canadian Oncology Drug Review (pCODR) evaluates cancer medications in Canada to assess their cost-effectiveness and clinical efficacy. Following the review, suggestions on whether or not to reimburse the medication are given to the provinces and territories. The medications and therapies covered by regional drug reimbursement programmes are determined by the provinces and territories. Even while some medications may be covered by insurance across the nation, there may be variations in the timing and terms of coverage. Private health insurance policies may also cover lung cancer treatments in addition to governmental drug programmes. The scope of coverage might vary greatly, and some plans might have restrictions or exclusions on particular medications or therapies. The Canadian Cancer Society's Cancer Connection programme, which provides financial support for costs connected to cancer, such as drugs, transportation, and lodging, may be available to patients who do not have public or private prescription coverage.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Canada Lung Cancer Therapeutics Segmentation

By Type (Revenue, USD Billion):

- Small Cell Lung Cancer

- Non-small Cell Lung Cancer

- Lung Carcinoid Tumor

By Therapy (Revenue, USD Billion):

- Radiation Therapy

- Targeted Therapy

- Immunotherapy

- Chemotherapy

- Others

By Type of Molecule (Revenue, USD Billion):

- Small Molecules

- Biologics

By Drug Class (Revenue, USD Billion):

- Alkylating Agents

- Antimetabolites

- Multikinase Inhibitors

- Mitotic Inhibitors

- EGFR Inhibitors

- Others

By Distribution Channel (Revenue, USD Billion):

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.