Canada Hemophilia B Therapeutics Market Analysis

Canada Hemophilia B Therapeutics Market is projected to grow from $xx Mn in 2023 to $xx Mn by 2030, registering a CAGR of xx% during the forecast period of 2023 - 2030. The rare genetic bleeding illness known as haemophilia B is brought on by a lack of or malfunction in the clotting factor IX. The increasing prevalence of haemophilia B, improvements in available treatments, and greater public knowledge of the condition have all contributed to the steady growth of the global market for therapies for the condition. However, because Hemophilia B is less common than Hemophilia A, the market for therapies for this condition is smaller than it is for Hemophilia A. Takeda Pharmaceutical Company Limited (previously Shire), Takeda Pharmaceutical Company Inc., Pfizer Inc., F. Hoffmann-La Roche Ltd., Novo Nordisk A/S, CSL Behring LLC, Sanofi S.A., Grifols S.A., Octapharma AG, and others are notable market participants.

Buy Now

Canada Hemophilia B Therapeutics Market Analysis Summary

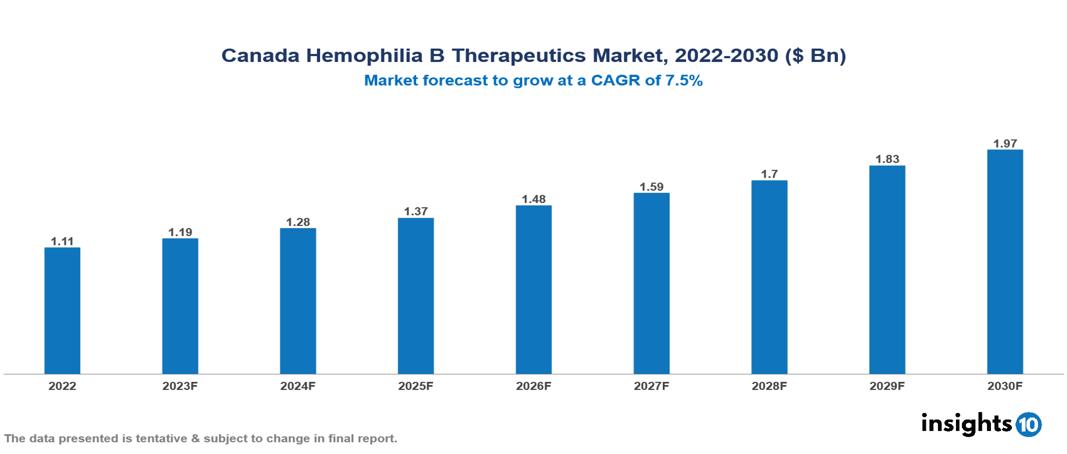

Canada Hemophilia B Therapeutics Market is valued at around $1.11 Bn in 2022 and is projected to reach $1.97 Bn by 2030, exhibiting a CAGR of 7.5% during the forecast period 2023-2030.

Clotting factor IX, often known as the Christmas factor, deficiency or dysfunction is the primary cause of the inherited bleeding condition haemophilia B. The World Federation of Hemophilia (WFH) has estimated that Hemophilia B affects roughly 1 in 25,000 male births worldwide. Hemophilia B's pathophysiology includes problems in the intrinsic pathway of the clotting cascade. Hemophilia B patients generally have prolonged Activated Partial Thromboplastin Time (aPTT), which is indicative of clotting factor IX deficiency. The factor IX assay test assesses the presence and activity of factor IX, a clotting agent, in the blood. When compared to healthy people, those with haemophilia B will have much lower levels of factor IX. Clotting factor IX, often known as the Christmas factor, deficiency or dysfunction is the primary cause of the inherited bleeding condition haemophilia B. The factor IX assay test determines whether factor IX, a clotting agent, is present and active in the blood. When compared to healthy people, those with haemophilia B will have much lower levels of factor IX. A thorough physical examination is performed to look for any bleeding indicators, such as joint swelling, bruising, or proof of prior bleeding episodes.

The increasing prevalence of haemophilia B, improvements in available treatments, and greater public knowledge of the condition have all contributed to the steady growth of the global market for therapies for the condition. Innovation in the haemophilia B industry is being driven by ongoing research and development projects concentrating on innovative therapeutics, such as gene therapy, bispecific antibodies, and non-replacement methods. The increase of treatment choices is aided by pharmaceutical companies and academic institutions' ongoing investments in R&D. A thorough physical examination is performed to look for any bleeding indicators, such as joint swelling, bruising, or proof of prior bleeding episodes.

Notable players in the market include BioMarin Pharmaceutical Inc., Pfizer Inc., F. Hoffmann-La Roche Ltd., Novo Nordisk A/S, CSL Behring LLC, Takeda Pharmaceutical Company Limited (formerly Shire), Sanofi S.A., Grifols S.A., and Octapharma AG, among others.

Market Dynamics

Market Drivers

The Hemophilia B market is influenced by several key drivers that shape its growth and development. These drivers include:

Increasing Awareness: The need for better diagnosis, treatment choices, and patient care is being driven by a rising awareness of Hemophilia B among medical professionals, patients, and the general public. For people with haemophilia B, more knowledge results in earlier discovery, proper management, and improved outcomes.

Advancements in Treatment: Gene therapy and the creation of extended half-life (EHL) factor IX concentrates are only two examples of the significant improvements made in Hemophilia B treatment options. These cutting-edge treatments boost patient convenience, decrease treatment frequency, and improve efficacy, spurring market expansion.

Rising Patient Population: Hemophilia B incidence and prevalence have a big impact on market dynamics. Even though Hemophilia B is a less common condition than Hemophilia A, rising awareness, better diagnostic tools, and greater access to healthcare have helped identify more instances, which has helped the market increase.

Government Support and Funding: The market is expanding as a result of government measures that support patients with haemophilia B through financial programmes, healthcare regulations, and advocacy efforts. Public financing can promote research and development, increase patient access to care, and improve overall Hemophilia B patient care. For Instance, In the United States, the Centers for Disease Control and Prevention (CDC) supports a network of Hemophilia Treatment Centers (HTCs) that provide comprehensive care for individuals with Hemophilia B.

Technological Advancements: Genetic testing and next-generation sequencing are two examples of cutting-edge technologies that have increased the precision and usability of diagnostic tools for haemophilia B. These developments have a favourable effect on the market since they support early diagnosis, genetic counselling, and individualised treatment plans.

Market Development

May 2023- The U.S. Food and Drug Administration (FDA) has granted fast-track designation to SerpinPC, Contessa Pharmaceuticals’ investigational treatment for people with haemophilia B. The drug is a novel inhibitor of activated protein C administered subcutaneously.

Key players

BioMarin Pharmaceutical Inc CSL Behring Grifols SA Kedrion Biopharma SpA Novo Nordisk A/S Pfizer Inc Roche Holding AG Sanofi Shire plc Takeda Pharmaceutical Co Ltd1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Market Segmentations For Canada Hemophilia B Therapeutics Market

By Drugs

- Plasma Derived Coagulation Factor Concentrate

- Recombinant Coagulation Factor Concentrates

- Desmopressin

- Others

By Route of Administration

- Oral

- Injectable

By End-Users

- Hospitals

- Homecare

- Specialty Clinics

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.