Canada Dental Caries Detectors Market Analysis

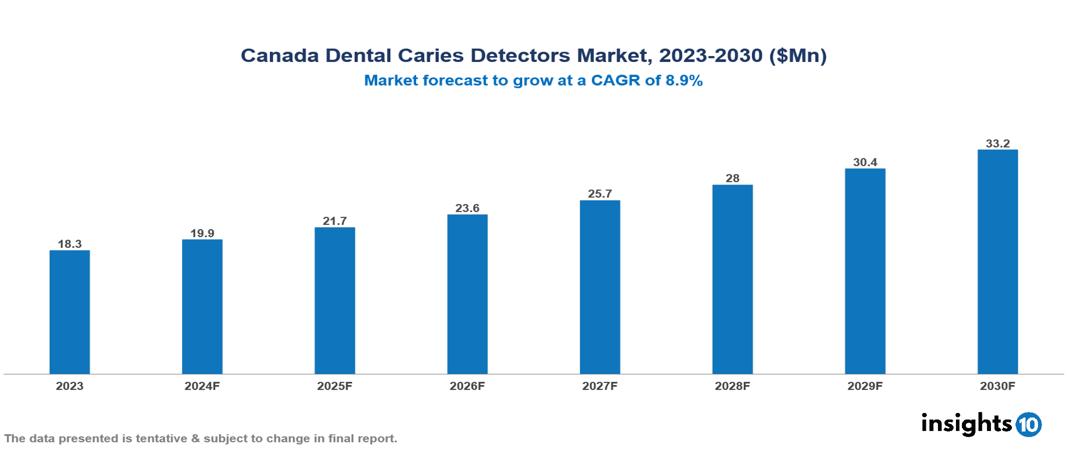

The Canada Dental Caries Detectors Market was valued at $18.3 Mn in 2023 and is predicted to grow at a CAGR of 8.9% from 2023 to 2030, to $33.2 Mn by 2030. Canada Dental Caries Detectors Market is growing due to Lifestyle changes, Rising awareness, and Advanced imaging and diagnostic. The market is primarily dominated by players such as Dentalcorp Holdings Ltd., 123Dentist, Altima Dental Canada Holdings Inc.Sirona Dental Systems, Dentsply Sirona, KaVo Kerr, Ivoclar Vivadent, Planmeca Oy, Adec Technologies, 3M ESPE, Morita Corporation.

Buy Now

Canada Dental Caries Detectors Market Executive Summary

Canada Dental Caries Detectors Market is at around $18.3 Mn in 2023 and is projected to reach $33.2 Mn in 2030, exhibiting a CAGR of 8.9% during the forecast period.

Dental caries detectors are tools or devices that dentists use to identify and cure dental caries, often known as cavities or tooth rot. These detectors employ a number of techniques, such as tactile examination, visual inspection, and the use of diagnostic instruments including caries detection dyes and dental probes. Additionally, the primary use of these tools is in the early detection of tooth decay, which enables prompt intervention and preventive measures to halt the development of cavities. Dental professionals can create more comprehensive treatment plans, such as fillings or root canal therapy, or less invasive procedures like fluoride treatments and dental sealants, with the use of dental caries detectors, which assist in assessing the degree and scope of decay.

75% of Canadians visit a dental clinic annually and 86% do so at least once every 2 years. The prevalence of dental caries, particularly among children and adolescents, drives the demand for advanced detection technologies. High healthcare expenses associated with dental treatments motivate practitioners to adopt efficient diagnostic tools that can prevent costly treatments later on. Demographic shifts, including an aging population and increasing urbanization, affect the demand for dental services and diagnostic technologies. The market, therefore, is driven by significant factors like Lifestyle changes, Rising awareness, and Advanced imaging and diagnostics. However, Regulatory and Approval Challenges, Limited Reimbursement Policies, High Cost of treatment restrict the growth and potential of the market.

Ortek Therapeutics, Inc. announced the official commercial launch of the Ortek-ECD, an electronic early cavity detection system certified for professional use by the Food and Drug Administration.

Market Dynamics

Market Growth Drivers

Lifestyle changes: Changes in lifestyle due to urbanization, high consumption of tobacco, and alcohol, an unhealthy diet, and a high intake of sugar are the leading causes of dental caries, which is the most common type of chronic disease experienced.

Rising awareness: There is a growing awareness among the general public in Canada about the importance of preventive care and oral health. This increasing awareness is driving the demand for routine dental examinations, which include the detection of dental caries. Early detection and treatment of dental caries can lead to significant cost savings in long-term healthcare and enhance patient outcomes by preventing more severe dental problems. This trend is prompting dental offices to adopt state-of-the-art caries detection equipment. For instance, recent surveys indicate that 65% of dental practices in urban areas have upgraded their equipment for better caries detection and treatment.

Advanced imaging and diagnostic: Better caries detection equipment is now available thanks to advancements in dental imaging and diagnostic technologies. Compared to methods that employ transillumination, fluorescence, and radiographic imaging, these instruments identify cavities significantly more quickly. Sophisticated caries detectors are becoming more and more necessary as dental professionals seek more precise and effective diagnostic instruments.

Market Restraints

Regulatory and Approval Challenges: Regulators can have a drawn-out and strict approval procedure for new dental equipment. Although this regulatory oversight guarantees efficacy and safety, it may cause a delay in the release of cutting-edge caries detection technologies. Manufacturers may find it difficult to comply with regulatory standards due to the time and money involved, which could hinder the release of innovative technology and impede market expansion.

Limited Reimbursement Policies: Advanced caries detection dental procedures frequently result in limited or no payment from insurance organizations. Only 40% of dental insurance policies in the country cover sophisticated diagnostic tools. The absence of coverage may deter patients and dentists from using these cutting-edge diagnostic instruments. The financial strain of upfront costs may cause people to favor more conventional, less costly techniques, which would prevent improved detecting technologies from becoming widely available in the market. As a result, the budgetary limitations brought about by inadequate insurance coverage impede the development and adoption of these cutting-edge technology in dental offices.

High Cost of treatment: Modern dental caries detection methods, such digital imaging equipment and laser fluorescence, are frequently expensive. For instance, a laser fluorescence system might cost upwards of $12,000 on average, making it unaffordable for smaller dental offices and clinics. Many practitioners continue to employ old approaches since the high cost prevents them from investing in modern technologies. This resistance to implementing novel detecting techniques hinders the expansion of the market as a whole. The initial outlay and continuing maintenance expenses can put a heavy financial strain on practices, especially those with limited funding. Thus, potential market expansion is hampered by the slow adoption of sophisticated caries detection technologies on a large scale.

Regulatory Landscape and Reimbursement Scenario

In Canada, the regulatory landscape for dental caries detectors ensures rigorous standards to guarantee safety and efficacy. These devices, ranging from traditional diagnostic tools to advanced imaging technologies, must comply with Health Canada's regulations, including licensing and quality control measures. The market for dental caries detectors in Canada reflects growing demand driven by increasing awareness of oral health and preventive care. Key players in the market offer a variety of products catering to both professional dental practices and consumer needs. The regulatory framework not only ensures patient safety but also fosters innovation in dental care technology, supporting the continuous evolution of diagnostic tools aimed at detecting and managing dental caries effectively.

In Canada's dental caries detectors market, reimbursement policies and coverage vary by province and insurance provider. Generally, basic diagnostic services like dental exams are covered under provincial health plans, but coverage specifics for advanced caries detection technologies such as fluorescence-based systems or digital imaging may vary. Dental professionals must navigate provincial fee schedules and billing codes to ensure proper reimbursement. Private insurance plans offer additional coverage options, influencing adoption rates of new technologies based on reimbursement levels. Challenges include disparities in coverage between provinces and the need for updated policies to accommodate evolving dental technologies, impacting widespread implementation in Canadian dental practices.

Competitive Landscape

Key Players

Here are some of the major key players in the Canada Dental Caries Detectors Market:

- Dentalcorp Holdings Ltd.

- 123Dentist

- Altima Dental Canada Holdings Inc

- Sirona Dental Systems

- Dentsply Sirona

- KaVo Kerr

- Ivoclar Vivadent

- Planmeca Oy

- Adec Technologies

- 3M ESPE

- Morita Corporation

- Woodpecker Medical Instruments Co.

- Softdent

- Elmeco

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Canada Dental Caries Detectors Market Segmentation

Based on Type

- Laser Fluorescent caries detector

- Fiber Optic

- Trans-Illumination Caries Detector

- Others

Based on the Distribution Channel

- Online Platforms

- Offline Platforms

Based on End-user

- Hospitals

- Dental clinics

- Ambulatory Surgical Centres

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.